Qual é o objetivo de Donald Trump?

Summary

TLDRThis transcript discusses the impact of tariff increases on the U.S. consumer and the broader economic implications. The speaker highlights that tariffs primarily affect U.S. consumers, not Brazilians, and elaborates on how these changes are part of a broader economic and tax restructuring plan by the Trump administration. The conversation touches on inflation, potential recession, the repatriation of businesses, and the tax reforms, including the elimination of income taxes. The speaker also speculates on the future consequences of these policies, stressing that while they may be economically beneficial in the long run, political challenges, particularly during midterm elections, pose significant risks to the plan's success.

Takeaways

- 😀 The tariff increase primarily impacts American consumers, not Brazilian ones, as some misinformation suggests.

- 😀 Importers, such as companies like BMW, are the ones who pay the tariffs, not consumers directly.

- 😀 The tariff hikes are part of a larger plan to restructure the U.S. economy, with a focus on eliminating income tax for both individuals and businesses.

- 😀 The goal of the economic reforms is to replace income tax with tariffs, where importers pay instead of citizens through traditional taxation.

- 😀 Inflation is one potential side effect of the tariff hikes, though it is only one of many contributing factors to rising prices, such as government spending and labor laws.

- 😀 In the short term, the U.S. could face inflation and reduced international trade as a result of higher tariffs.

- 😀 The long-term goal of these policies is to repatriate businesses and jobs back to the U.S., potentially boosting the domestic economy and job market.

- 😀 The U.S. economy grew wealthier after the 2016 tax reforms, including tax cuts for the wealthy and inheritance tax exemptions, leading to the repatriation of capital.

- 😀 By making the U.S. economy more attractive for investment, the government aims to increase domestic wealth, which would allow consumers to absorb the higher tariffs.

- 😀 The biggest political risk to these reforms is the upcoming midterm elections, which could shift political power and potentially disrupt the proposed economic changes.

Q & A

How does the tariff increase discussed in the transcript impact consumers?

-The tariff increase primarily affects American consumers, not Brazilian consumers. The increase in tariffs is directed at imports, with the importers being responsible for paying these tariffs, not the Brazilian manufacturers.

What is the broader economic plan that includes the tariff increases?

-The tariff increase is part of a larger economic restructuring plan proposed by Donald Trump, which includes eliminating income taxes for both individuals and corporations. This aims to reduce the tax burden on American workers and businesses.

How does the proposed elimination of income tax fit into the economic strategy?

-The elimination of income tax is a central part of Trump's economic strategy, designed to reduce the financial burden on American citizens and companies. The goal is to encourage economic growth by allowing individuals and businesses to keep more of their income.

What is the potential short-term effect of the tariff increase?

-In the short term, the tariff increase could lead to inflation, as higher tariffs would increase the cost of imported goods and production. This would result in higher prices for consumers and could create economic challenges.

What role does inflation play in this scenario, according to the transcript?

-Inflation is driven by various factors, including increased tariffs, higher production costs, and government spending. The speaker highlights that the tariff increase could contribute to inflation as part of a broader set of economic dynamics.

What are the potential long-term effects of the tariff increase?

-In the long term, the tariff increase could lead to a shift in economic dynamics, with companies potentially repatriating jobs and factories back to the U.S. This could create a positive multiplier effect, boosting employment and income in the country.

What historical example is used to support the potential success of the current economic strategy?

-The speaker references Donald Trump's actions in 2016, including lowering income taxes for the wealthy and eliminating inheritance taxes for large estates. These policies resulted in the repatriation of significant amounts of capital into the U.S. economy.

How does the U.S. income distribution compare to other regions, according to the speaker?

-The speaker notes that the U.S. has a more favorable environment for wealth accumulation compared to Europe, Latin America, and Asia. In the U.S., individuals are able to accumulate and grow their wealth more easily, contributing to a higher per capita income over time.

What risks are associated with the current economic plan, especially in the context of political events?

-The primary risk is political, particularly the upcoming midterm elections. If the plan leads to a recession or causes political backlash, the necessary support for Trump's economic policies could diminish, possibly preventing the successful implementation of his long-term economic strategy.

What does the speaker believe about the potential success of Trump's economic model?

-The speaker expresses confidence that Trump's economic model could succeed, particularly in enriching the U.S. and enabling it to handle higher tariffs. However, the speaker also acknowledges that there may be political challenges and short-term economic turbulence.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Pengakuan Sri Mulyani Depan Ekonom Soal Perang Trump, Seruangan Tertawa: Maaf Jadi Tak Berguna

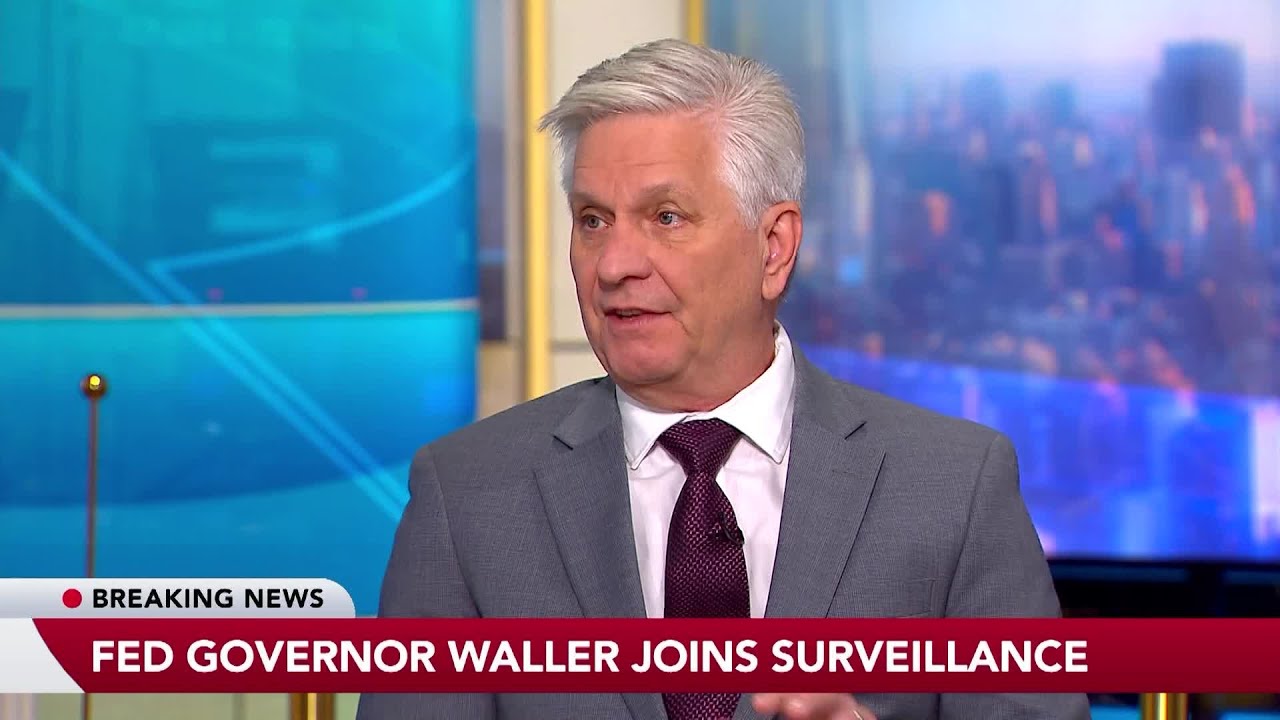

Fed’s Waller on Labor Market, Rate Cuts, Inflation, Fed Chair

Trump Tariffs in 2025: A Simple Explanation

US China Tariffs War Impact on UAE KSA E-Commerce 2025

SIMAK! Menkeu Sri Mulyani Blak-blakan soal Tarif Trump | AKIM tvOne

Trump Tunda Tarif Puluhan Negara Hingga Ramai Karyawan China Dilarang Kerja Gila-Gilaan

5.0 / 5 (0 votes)