ICT Mentorship - Core Content - Month 02 - How Traders Make 10% Per Month

Summary

TLDRThis trading strategy focuses on small, controlled risk, utilizing liquidity pools to identify profitable entry points. By framing trades based on institutional levels on higher timeframes, the trader emphasizes partial profit-taking at a 3:1 reward-to-risk ratio, while allowing the second portion of the trade to run for larger gains. The key is consistent profit accumulation through disciplined risk management and psychological control. The strategy offers the potential for impressive compounded returns, with the goal of achieving a 10% monthly return, which could lead to over 300% annual growth. Small, consistent profits are emphasized over trying to catch every pip.

Takeaways

- 😀 Focus on identifying liquidity pools and market levels where institutional orders are likely to drive price movement.

- 😀 Risk management is key: using a small stop loss (e.g., 10-20 pips) allows for a higher reward-to-risk ratio (3:1).

- 😀 Partial profit-taking is essential: take a portion of the position off at 3:1 risk-to-reward, securing profits early.

- 😀 Traders can achieve consistent profits with low-risk trades by focusing on higher time frame objectives (e.g., daily, weekly).

- 😀 Aiming for 10% monthly returns through consistent, low-risk trades can compound to significant annual profits (300% per year).

- 😀 Don’t aim to capture every pip in the market—focus on the range and liquidity pools rather than the absolute high or low.

- 😀 Avoid emotional frustration by taking partial profits and not forcing trades to hit your ultimate profit target.

- 😀 The key to long-term success is not having big risk, but rather framing trades with small risk and letting profits compound over time.

- 😀 Traders should not be upset with making smaller profits (e.g., 50 pips out of a potential 100) as it still leads to substantial gains.

- 😀 Consistent focus on well-framed trades with modest risk can yield a 10% return per month, leading to exponential growth over time.

Q & A

What is the primary focus of the case study in this script?

-The case study primarily focuses on trading the Australian Dollar (Aussie Dollar) and how to make 10% per month by using specific technical analysis methods such as identifying liquidity pools, buy stops, and framing trades with low risk on multiple time frames.

What is the significance of the 7512 level mentioned in the script?

-The 7512 level is a key reference point identified on the daily chart, where a bullish order block was found. It is used as a critical support level for potential buying opportunities in the trade setup.

How is the risk managed in the trading setup described?

-Risk is managed by framing trades on lower time frames (like the 5-minute or 15-minute charts) to reduce stop loss distances. A 2% risk is applied on the initial position, with partial profits taken at a 3:1 risk-to-reward ratio to lock in gains while leaving a portion of the position to potentially reach higher objectives.

What does 'liquidity pool' refer to in this context?

-A liquidity pool refers to a cluster of buy or sell orders resting above or below key levels, like the highs or lows of previous price action. In the case study, the buy stops above specific price levels are considered liquidity pools, which the market is expected to target.

What role does institutional involvement play in the trade setups?

-Institutional involvement is important because it drives the market towards key levels, such as daily or weekly order blocks, where large orders are placed. These levels are significant because they often result in substantial price movements as institutional players push price to fill these orders.

Why is taking partial profits at a 3:1 risk-to-reward ratio recommended?

-Taking partial profits at a 3:1 risk-to-reward ratio ensures that traders lock in profits early, reducing the emotional pressure of holding a full position. This allows for secure gains even if the market reverses and helps manage the risk of potential losses.

What is the impact of greed on trading decisions, according to the script?

-Greed can lead to poor trading decisions, such as insisting on holding a position for the absolute maximum potential profit. This can result in frustration or losses if the market reverses before the target is hit. The script advises traders to focus on consistent, smaller profits rather than trying to capture every single pip.

How does compounding returns play into the trading strategy described?

-Compounding returns is a key aspect of the strategy, as the script suggests that a 3% gain per trade can lead to over 10% returns in a month. By consistently achieving these gains and reinvesting profits, traders could potentially see significant growth in their accounts, with a projected annual return of over 300%.

What is the psychological benefit of taking partial profits during a trade?

-Taking partial profits helps reduce psychological pressure by ensuring that the trader is compensated for their time and effort, even if the market does not reach the ultimate profit target. It also provides a sense of security and confidence, making it easier to manage the remaining position.

What is the main takeaway about risk management in this trading strategy?

-The main takeaway is that small, calculated risk is the key to successful trading. By framing trades with low risk and focusing on key levels supported by institutional activity, traders can maximize their reward-to-risk ratios while minimizing potential losses.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Order Block Strategy Prints 1K/Week | Full SMC Trading Course

I Found a Secret To Orderblocks

ICT Standard Deviation Full Strategy With MMXM

Why Valid Order Blocks Fail in Forex Trading, Exploring the Order Flow Trading Strategy

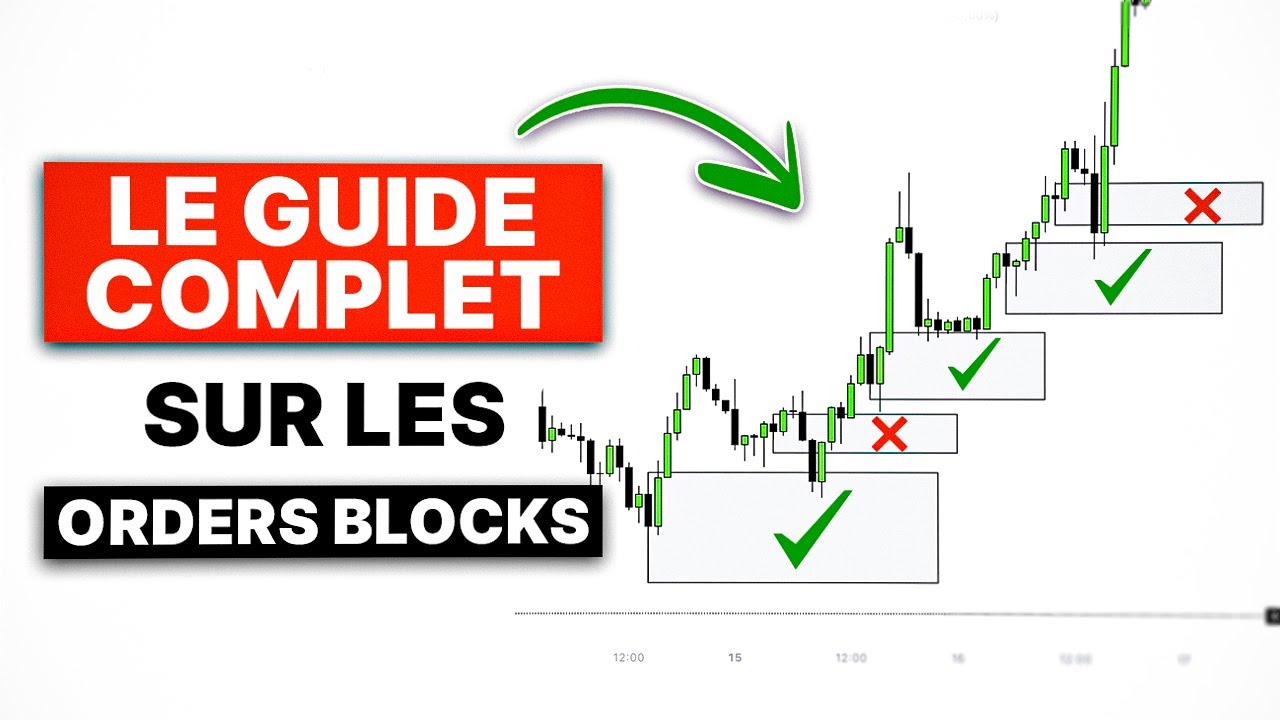

Voici Comment Identifier Facilement des Orders Blocks en Trading (Guide 2024)

ICT Power of 3 (PO3) Entry Model: Sniper Entries with DRT

5.0 / 5 (0 votes)