5 Steps That Will Guarantee You Build Wealth from Scratch – Whatever Your Circumstances | Kiyosaki.R

Summary

TLDRThe video explores key financial concepts, focusing on the importance of leveraging resources, knowledge, and networks for financial success. It discusses the role of leverage in investments, the control needed for low-risk returns, and the value of improving one's financial IQ. Emphasizing continuous learning and staying updated with information, the content encourages a proactive approach to financial growth. The speaker highlights how leveraging other people’s time, expertise, and networks can significantly accelerate success, urging viewers to move beyond outdated information and embrace smarter, more strategic financial practices.

Takeaways

- 😀 Leverage is about doing more with less—it's a way to amplify your efforts and returns by using resources like money, time, and knowledge.

- 😀 Financial IQ is composed of five key factors, including understanding and applying leverage effectively to grow wealth.

- 😀 A strong financial foundation relies on controlling income, expenses, assets, and liabilities. Mastering these areas can lead to higher profits and lower risks.

- 😀 Banks are less likely to lend for stock market investments because they are considered high-risk and out of the borrower's control.

- 😀 Leverage isn’t limited to just money. Time, knowledge, networks, and products can all be leveraged to increase success in business and life.

- 😀 Information is a powerful tool. In the modern age, access to accurate and current information can make or break financial success.

- 😀 Using outdated knowledge, like relying on traditional job security, can be detrimental in today’s information-driven economy.

- 😀 The key to leveraging your time is outsourcing tasks that others can do more efficiently, freeing up your own time for higher-value work.

- 😀 Successful people leverage their networks to access new opportunities and solve problems faster. Networking can provide crucial support for growth.

- 😀 Continuous learning and staying updated with modern information is essential for maintaining financial health. Knowledge that’s outdated can be as harmful as expired food.

Q & A

What is the key to financial intelligence according to the script?

-The key to financial intelligence is learning how to make money work for you, rather than just focusing on earning more. This involves investing wisely, protecting your wealth, and continuously learning to adapt to changes in the financial landscape.

How does Kiyosaki define 'leverage' in financial terms?

-'Leverage' is described as doing more with less. It refers to using borrowed resources, such as money, time, knowledge, or other people's efforts, to maximize returns or increase efficiency. Proper leverage can significantly amplify financial success when applied in areas where one has control.

What does Kiyosaki mean by the statement 'Leverage is risky only when you invest in assets you have no control over'?

-Kiyosaki is emphasizing that leverage can be risky when you're investing in areas where you don’t have direct control. For example, investing in stocks without understanding the company or market risks makes it harder to manage leverage effectively. The key is control over your investments.

What is the relationship between financial IQ and making good investments?

-A high financial IQ helps individuals make smart investments by understanding how to use resources, manage risks, and adapt strategies to increase wealth. People with a strong financial IQ are more likely to make informed decisions that lead to successful investments.

What role does control play in the use of leverage?

-Control is essential for effectively using leverage. When you have control over an asset or situation, you can manage risks better and apply leverage in ways that are beneficial. Without control, leverage becomes much riskier and less effective.

How does the script suggest people can increase their income using leverage?

-People can increase their income by leveraging business strategies, such as better marketing, using systems to decrease labor costs, and negotiating lower interest rates on loans. By taking control of income, expenses, and liabilities, individuals can amplify their financial success.

What does Kiyosaki say about the importance of information in the modern world?

-Kiyosaki stresses that information is a key asset in today’s economy. Access to up-to-date information is crucial for making smart financial decisions. He highlights that, in the information age, using outdated knowledge is like consuming expired food, as information doubles rapidly every 18 months.

Why does Kiyosaki believe that financial advisors often warn against leverage?

-Kiyosaki believes that financial advisors warn against leverage because they typically deal with investments that offer little control over the assets. Since they cannot apply leverage effectively in these scenarios, they view it as risky, even though leverage can be safe when used in areas where you have control.

How does Kiyosaki view the role of network in leveraging financial success?

-Kiyosaki views a network as a critical form of leverage. Knowing the right people and having access to the right contacts can open doors to opportunities, such as collaborations or business partnerships, that would otherwise be inaccessible. A strong network can accelerate success.

What advice does the script give about using financial education to improve financial health?

-The script advises continuous self-education to improve financial health. Since the amount of available information doubles rapidly, staying updated with current financial knowledge is essential. Those who do not keep learning or adapt to new information may find themselves financially stuck.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

#7 Scope of finance function| Introduction to financial management | Financial management |B.Com/PU

15 Lessons Rich Parents Teach Their Kids

The Truth About The "New Rich"

Financial Knowledge and Decision-Making Skills - Building Blocks of Financial Capability

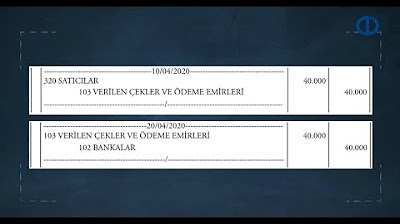

FİNANSAL MUHASEBE - Ünite 3 Konu Anlatımı 1

Financial Management Explained in 11 minutes

5.0 / 5 (0 votes)