Yang Diajarkan Ayah Kaya dan Ayah Miskin | Ringkasan Buku Rich Dad Poor Dad

Summary

TLDRThis video emphasizes the importance of financial independence and wealth-building through proactive learning and action. It encourages viewers to educate themselves about investment opportunities like real estate and the stock market, track their income and expenses, and network with experienced individuals for guidance. The script also stresses the value of maintaining a mindset focused on long-term financial goals, regularly updating personal finances, and taking small steps towards achieving a greater income than expenses. The key message is to start now, stay engaged, and continually learn to achieve financial success.

Takeaways

- 😀 Financial independence requires taking action, not just having ambition.

- 📚 Start learning about your chosen field (e.g., real estate or stock market) by reading beginner-friendly books.

- 🌐 Use trusted resources like Investopedia for beginner investment information.

- 📊 Set up a financial tracking system using tools like Excel to monitor income, expenses, assets, and liabilities.

- 💡 Monitor your finances regularly to ensure your income exceeds your expenses and to identify areas where you can cut costs.

- 👥 Build relationships with more experienced individuals in your field to learn from their expertise.

- 🍽️ Offer to treat experienced mentors (e.g., tax office professionals) to lunch while gaining insights from them.

- 🎯 Be clear about your intention to learn, not just to ask for help to get rich.

- 📅 Create a financial plan and update it regularly to ensure continued progress towards your financial goals.

- 📝 Use a table or spreadsheet to compare your income with your expenses and evaluate the health of your financial situation.

- 📈 Always strive to increase the gap between income and expenses, making your financial growth sustainable.

Q & A

What is the main focus of the video script?

-The main focus of the video script is on achieving financial independence and wealth by taking actionable steps, including educating oneself, tracking finances, networking with experienced individuals, and managing both income and expenses.

Why is ambition not enough to achieve financial independence?

-Ambition alone is insufficient because without action, it remains just a desire. The script emphasizes that one must actively seek knowledge, take steps toward financial education, and implement practical strategies to achieve financial success.

What is suggested as the first step in becoming financially independent?

-The first step is to begin learning about areas of financial investment that interest you, such as real estate or the stock market. This can be done by reading books and researching online resources that are suitable for beginners.

What role do online resources like Investopedia play in financial education?

-Online resources like Investopedia provide accessible and reliable information for beginners looking to understand investing. They help individuals who are unsure where to start by offering educational content on financial concepts and investment strategies.

How can tracking finances help in achieving financial independence?

-Tracking finances is crucial because it allows individuals to compare income with expenses, monitor the performance of their assets, and identify unnecessary liabilities. This enables better control over finances and helps reduce expenses to increase savings and investments.

Why is it important to create a financial tracking table?

-A financial tracking table helps individuals clearly see their income, expenses, assets, and liabilities, providing insight into their financial health. Regularly updating the table ensures that one can make informed decisions to improve financial stability.

What is the purpose of reducing expenses in the process of achieving financial independence?

-Reducing expenses helps to increase the gap between income and spending, allowing more money to be saved or invested. By eliminating unnecessary costs, individuals can allocate more resources toward wealth-building activities.

How can networking with experienced individuals aid in financial success?

-Networking with experienced individuals provides valuable insights and knowledge from those who have already navigated the challenges of investing and financial management. Learning from their experiences can help avoid mistakes and accelerate one's learning process.

What should be the approach when seeking advice from experienced professionals?

-When seeking advice, it is important to be honest about your intentions and express a genuine desire to learn from their experience rather than seeking financial assistance. Building trust and showing a commitment to self-improvement encourages people to share their knowledge.

How does the video encourage ongoing learning and sharing?

-The video encourages ongoing learning by suggesting that viewers subscribe for more book summaries and share the information with others. It promotes a culture of mutual growth and knowledge-sharing, which can be beneficial for everyone involved.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

The 5 High Income Skills I Wish I Knew at 21

How Much MONEY You Should Have by Age 20, 30, 40 & 50 (Are You on Track?)

"Most People Have No Idea What's About To Happen" - Robert Kiyosaki's Last WARNING

Semakin MUDA lu paham ini, Semakin CEPAT lu KAYA.

前Banker真心話🙅🏻♀️成為有錢人不能靠投資, 不要再浪費時間了🫡[中文ENG]

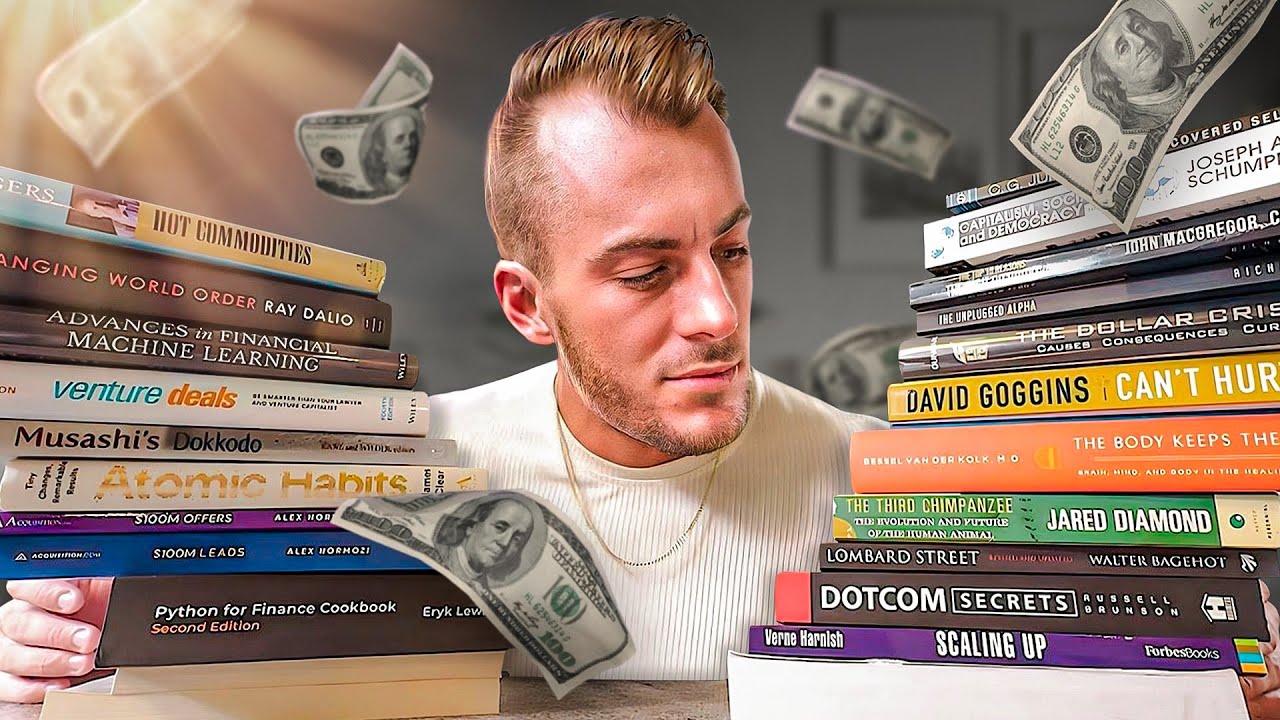

What I Learned Reading 50 Books on Money

5.0 / 5 (0 votes)