Fair Value Gaps Explained in 22 Minutes

Summary

TLDRIn this video, the speaker shares their journey to becoming a consistently profitable trader, focusing on the importance of fair value gaps (FVG) in identifying market imbalances. FVGs indicate areas where prices rapidly move, creating opportunities for traders to capitalize on price corrections. The speaker outlines key trading strategies, emphasizing the significance of trading within discount and premium zones, understanding market context, and the need for patience as some trades require multiple attempts. By combining FVGs with a strong mindset and market context, traders can increase their chances of success and profitability.

Takeaways

- 😀 Fair Value Gaps (FVG) are imbalances in price, typically formed by sudden market moves that leave gaps which traders can exploit.

- 😀 The key to trading Fair Value Gaps is understanding when the market is 'out of balance' and spotting these imbalances early.

- 😀 Larger Fair Value Gaps tend to provide more profitable opportunities than smaller ones due to bigger imbalances.

- 😀 Trading FVGs effectively requires recognizing when the price is in a discount (for buys) or premium (for sells) zone.

- 😀 Bullish Fair Value Gaps formed in a discount zone generally provide better opportunities compared to those in a premium zone.

- 😀 Fair Value Gaps can often take multiple attempts to validate and profit from, requiring patience and persistence.

- 😀 Trading FVGs is more effective when combined with other concepts like liquidity, market trends, and context.

- 😀 The key to success lies in catching the ‘home run’ trade, which happens when a trade scales into a larger trend with significant profits.

- 😀 The proper mindset is crucial—staying calm and focused on market context, rather than just chasing short-term gains.

- 😀 Always ensure that your trading strategy aligns with the broader market context, like identifying liquidity draws and trend direction.

- 😀 Mastering the concept of Fair Value Gaps, along with proper risk management and mindset, is essential for becoming a consistently profitable trader.

Q & A

What is the main concept discussed in the video script?

-The main concept discussed is the use of 'fair value gaps' in trading, which are areas where the price has moved too quickly, creating imbalances that can be exploited for profit. These gaps, when identified correctly, present trading opportunities as they are often retested before price continues in the original direction.

What is the significance of identifying fair value gaps in trading?

-Identifying fair value gaps allows traders to spot potential opportunities where the price may return to fill these gaps. These gaps often represent areas of imbalance, and recognizing them can help traders predict potential market movements for profitable trades.

What factors should traders consider when evaluating a fair value gap?

-Traders should evaluate the size of the gap, its position in terms of price discount or premium, and the context of the overall market trend. A larger gap typically indicates a stronger imbalance, and traders should also assess the market’s liquidity and the presence of any significant liquidity draws.

Why is it important to combine the fair value gap strategy with market context?

-Combining the fair value gap strategy with the correct market context is crucial for success. Understanding the broader market trend, liquidity conditions, and other factors ensures that trades are aligned with the overall market sentiment, improving the chances of success.

How many attempts does it usually take before a fair value gap trade idea works out?

-A fair value gap trade idea may require one to three or more attempts before it works out. The gap could be retested multiple times, and patience is required before the market reacts as expected.

What is the 'Home Run trade' mentioned in the video?

-The 'Home Run trade' refers to a high-reward trade where a trader can scale into a position, allowing them to capture a large move in the market. This type of trade is significant because it can make up for smaller, less profitable trades and lead to a substantial profit.

What is the risk when targeting smaller fair value gaps?

-Smaller fair value gaps typically represent weaker imbalances and may not provide as much of a profitable move. Traders are advised to avoid these smaller gaps in favor of larger ones that present stronger potential for price movement.

What mindset is necessary to become a consistently profitable trader?

-A trader must develop the right mindset, which includes patience, discipline, and the ability to analyze the market context. A long-term view of trading success, focusing on high-reward opportunities like the 'Home Run trade,' is essential.

How does the video suggest a trader should handle sideway price action?

-When facing sideways price action, traders are encouraged to focus on higher-quality opportunities, such as larger fair value gaps. The video suggests that the true profitable trades often come after periods of consolidation or sideways movement.

What does the speaker mean by a 'draw on liquidity' in the context of trading?

-A 'draw on liquidity' refers to areas where liquidity is likely to be concentrated, such as price levels where large market orders could be triggered. Traders should consider these liquidity areas when identifying fair value gaps, as they may influence the price direction and present potential trading opportunities.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

FVG vs IMB - The Best Trading Strategy?!

The Only ICT FVG Video You'll Ever Need

Why FVGs Are All You Need to Become Profitable in 2024

Draw On Liquidity (only video you need)

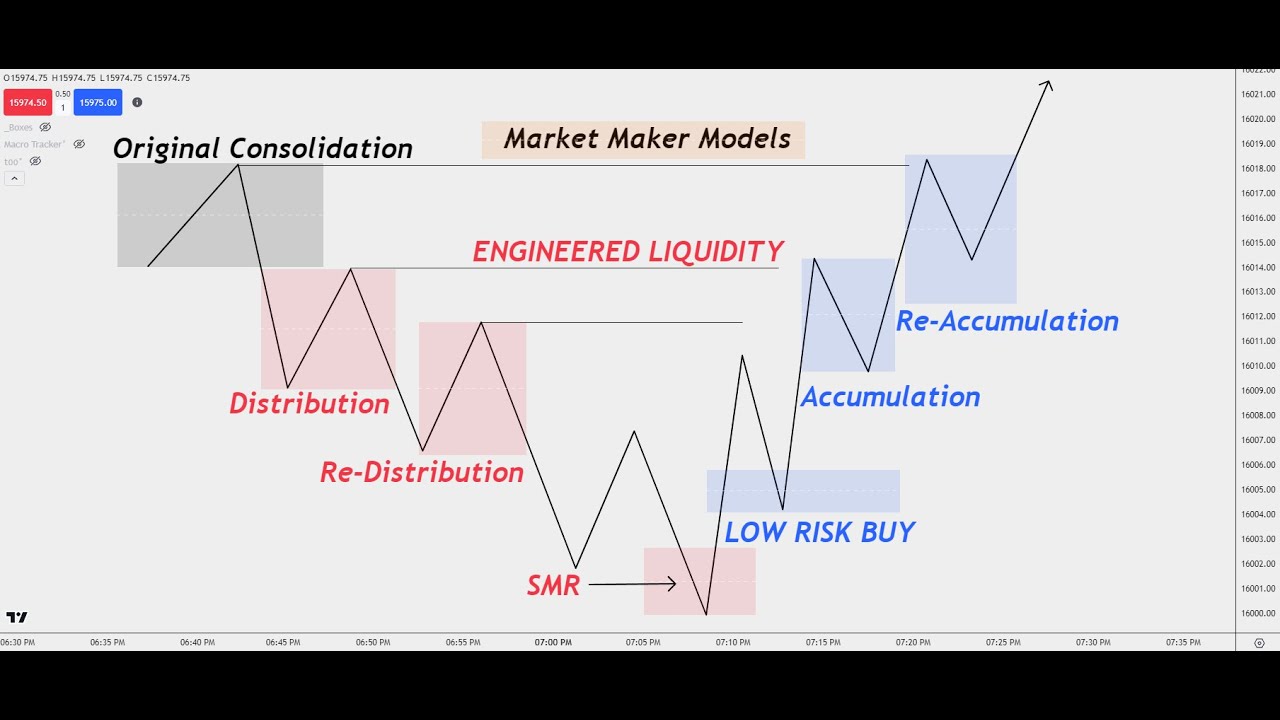

ICT Concepts: Understanding How To Trade ICT Market Maker Models!

20 PERFECT ICT FVG TIPS TO ELEVATE YOUR TRADING ! - ICT CONCEPTS

5.0 / 5 (0 votes)