Weekly Recap - A Historic Trainwreck!

Summary

TLDRIn this video, the speaker delves into the tumultuous state of global markets, touching on the challenges faced due to tariffs, inflation concerns, and a significant market selloff. Despite these pressures, Bitcoin has shown resilience, sparking discussions around its potential as a 'risk-off' asset, similar to gold. The speaker highlights historical market events, investor sentiment, and the retail vs. hedge fund divide. With macroeconomic factors like interest rates and trade deficits influencing market dynamics, the speaker concludes with a message of hope, urging investors to maintain cash reserves and stay optimistic despite the volatility.

Takeaways

- 😀 The speaker thanks various groups, including people in Australia, the Philippines, and Canada, while acknowledging a tough week in the financial markets.

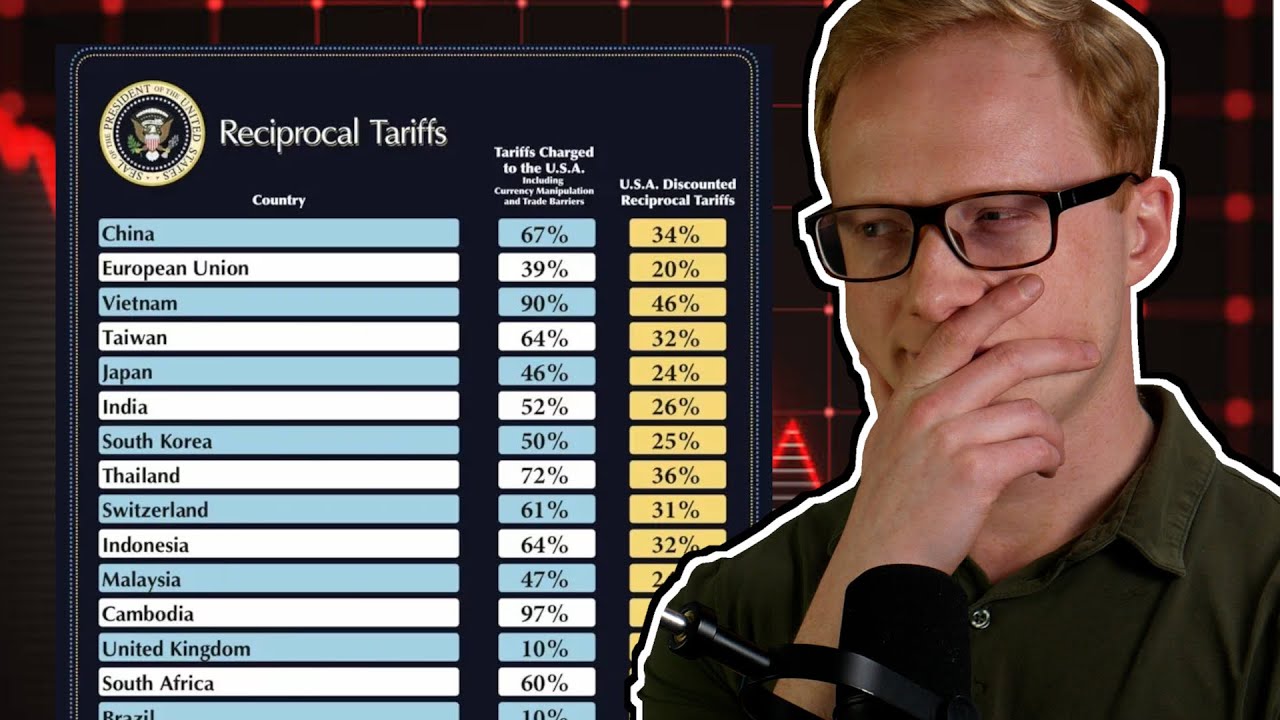

- 😀 The financial markets experienced a significant two-day wipeout, erasing $6.4 trillion in market value, driven by factors like tariffs and inflation concerns.

- 😀 Bitcoin performed relatively well amidst market sell-offs, only dropping 1.91%, suggesting that it may be becoming a 'risk-off' asset similar to gold.

- 😀 Despite a record market downturn, Bitcoin showed resilience and held up against other major assets, including stocks and ETFs.

- 😀 There is speculation about a potential shift from big tech into Bitcoin, with Bitcoin surpassing a historic milestone against the NASDAQ.

- 😀 April 3rd saw the largest one-day selloff in history for the S&P 500, marking a dramatic moment in the market.

- 😀 Retail investors were more proactive than institutional investors during the market crash, with retail buying $5 billion in stocks while hedge funds sold off $40 billion.

- 😀 The speaker emphasizes that when the market is in fear, it's often a good time to buy, especially when investor sentiment is at its lowest.

- 😀 There's a growing concern about the US trade deficit, which has reached a record $1.33 trillion, contributing to market instability.

- 😀 The probability of interest rate cuts in 2025 is increasing, which could bring more liquidity into the market and potentially boost risk assets like Bitcoin and stocks.

Q & A

What was the significance of the record two-day wipeout in the markets mentioned in the transcript?

-The record two-day wipeout, which erased $6.4 trillion in market value, highlights the severity of the market sell-off. Factors such as the tariffs imposed by China and concerns about inflation, alongside the broader global economic uncertainty, contributed to this dramatic market downturn.

How did Bitcoin perform compared to other assets during the market sell-off?

-Despite the widespread market decline across various sectors like the S&P 500, oil, copper, and international markets, Bitcoin held up relatively well. It only dropped by 1.91%, which was seen as a positive sign, indicating that Bitcoin might be evolving into a 'risk-off' asset similar to gold.

What role do retail investors play in the current market trends according to the transcript?

-Retail investors are seen as being increasingly proactive in the market, especially in buying during dips. They have been quick to act in contrast to traditional financial institutions, showing their ability to recognize market opportunities faster. This trend is seen as a shift in the power dynamics between retail investors and hedge funds.

What did Michael Saylor's interaction with the GameStop CEO signify in the context of Bitcoin?

-Michael Saylor's remark about a 'million-dollar made in USA Bitcoin' in response to the GameStop CEO’s statement about the $10,000 iPhone highlights the growing importance of Bitcoin. It suggests that Bitcoin is being positioned as a strategic reserve asset, particularly in the context of the U.S. economy's long-term future.

How did the U.S. trade deficit factor into the overall economic picture discussed in the transcript?

-The U.S. trade deficit, which reached a record $1.33 trillion, is seen as a contributing factor to the broader economic struggles. The ongoing trade imbalance poses a challenge, and the transcript suggests that resolving it may require tough measures, potentially influencing market dynamics and investor sentiment.

What historical context is provided regarding the market's volatility and investor sentiment?

-The transcript compares the current market volatility to past market crashes and recessions, noting that despite fears of a global recession, the market isn't officially in one. It emphasizes that significant market sell-offs often occur in uncertain times, but these moments also present opportunities for investors when sentiment is at its most bearish.

How do rate cuts impact the market according to the transcript?

-Rate cuts are seen as a potential catalyst for increasing liquidity in the market, which can drive buying and push asset prices higher. The transcript points out that if rate cuts occur in 2025, they could provide a significant boost to risk assets like Bitcoin, as lower interest rates encourage borrowing and investment.

What was the significance of Bitcoin's performance during the largest one-day sell-off in history?

-During the largest one-day sell-off, Bitcoin remained flat, which was noteworthy. This stability suggests that Bitcoin may be acting as a 'risk-off' asset, meaning it could provide stability during periods of financial turbulence, making it attractive to investors looking to hedge against traditional market risks.

What is the significance of the term 'risk-off asset' in the context of Bitcoin's behavior?

-The term 'risk-off asset' refers to assets that investors turn to during periods of financial uncertainty because they are perceived as safer. Bitcoin's behavior during the market downturn, where it performed better than other assets, suggests it may be becoming a risk-off asset, much like gold.

How did retail investors respond to the market conditions described in the transcript?

-Retail investors, despite the negative market conditions, have been buying stocks, including during significant sell-offs. They are portrayed as acting counter to hedge funds and large institutional investors, which further highlights the growing influence of retail investors in driving market trends.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)