JUNTE R$3.774,34 COMEÇANDO com R$5,00! QUALQUER UM PODE FAZER!

Summary

TLDRThis video provides a step-by-step guide on how to turn an initial investment of R$5 into R$3,774.34 in one year. The process involves placing the money in a bank account where it will earn interest, and gradually increasing the daily contribution. It explains how different banks and investment methods, like savings accounts and fixed-income investments, work to help the money grow. The video also touches on taxes, risks, and the benefits of regular investments, encouraging viewers to take control of their finances, build an emergency fund, and achieve financial freedom.

Takeaways

- 😀 Start with R$ 5 in your bank account and follow the step-by-step guide to potentially turn it into R$ 3,774.34 in one year.

- 😀 It is crucial to have your money in a bank account that offers some form of interest or returns, such as Nubank's 'Cofrinho' or 'Porquinho' feature.

- 😀 Avoid leaving money in physical cash, as it does not earn interest; using digital savings or investments allows your money to grow over time.

- 😀 The 'CDB' and other similar fixed-income options allow you to earn interest on your deposited funds, with 100% of the CDI return being a standard example.

- 😀 Be aware of taxes: If you withdraw funds before 30 days, the IOF tax can eat away a significant portion of your interest.

- 😀 The income tax for investments in fixed-income securities decreases the longer the money is invested, with rates starting at 22.5% for under 180 days and going down to 15% for over 720 days.

- 😀 Fixed-income investments like the RDB offer a safe return based on the CDI, and they are backed by the FGC (Financial Guarantee Fund) in case the bank fails, up to R$ 250,000 per institution.

- 😀 Monitor the financial health of the bank you’re investing in. You can research banks’ financial performance through resources like BancoData to ensure your investment is secure.

- 😀 Consistently investing small amounts (like R$ 5 a day) and letting it accumulate over time can lead to significant results due to compounding interest.

- 😀 By progressively increasing your daily contributions to R$ 10 and then R$ 15, you can accelerate your savings and reach your financial goals faster.

- 😀 Consider diversifying your investments in the long run with tools like Dini, which help track and manage investments in stocks and real estate funds, building wealth over time.

Q & A

What is the first step to turning R$ 5 into R$ 3,774.34 in one year?

-The first step is to have the R$ 5 in a bank account, as the money needs to be placed in a bank account to earn interest. Simply having cash in hand won’t help generate returns.

Why is it important to put money in a bank account rather than keeping it as physical cash?

-Physical cash does not earn interest, whereas money in a bank account can be invested in financial products that yield returns. For example, using savings products like 'cofrinhos' or CDBs can help the money grow.

What types of investments are mentioned in the script for growing money?

-The script mentions various options such as the 'porquinho' (savings) in banks like PicPay and Inter, or CDBs that yield 100% of the CDI, which is a form of fixed income investment.

What is the '100% CDI' mentioned in the script, and what does it mean?

-100% CDI refers to an investment that yields a return equal to the CDI rate, which is a benchmark for short-term interest rates in Brazil. The current CDI rate is slightly lower than the Selic rate, which is the Brazilian central bank's benchmark interest rate.

What are the key taxes associated with these types of investments?

-There are two key taxes: the IOF (Tax on Financial Transactions), which applies if money is withdrawn within 30 days, and the Income Tax, which is applied progressively based on how long the money is invested. The longer the money stays, the lower the tax rate.

How does the IOF tax work, and when does it stop affecting the investment?

-The IOF tax is a sliding scale that starts high when the money is withdrawn within the first 30 days, gradually decreasing until it is completely exempt after 30 days.

How does the Income Tax apply to investments, and how is it calculated?

-The Income Tax is a progressive tax that depends on how long the money stays invested. It ranges from 22.5% (for up to 180 days) to 15% (for investments held for over 720 days). The tax is only applied to the returns, not the principal amount.

What happens to the money if the interest rates (CDI or Selic) change?

-If the interest rates go up, the money in investments that track the CDI will yield more. Conversely, if rates go down, the returns on the invested money will decrease. However, the money already earned is not affected.

What are the risks of investing in these products, and how can investors assess them?

-The main risk is the possibility of the bank failing. To assess this risk, one can check the bank's financial health using tools like BancoData, which shows whether a bank is making a profit or loss. Additionally, there is a safety net provided by the FGC (Credit Guarantee Fund), which guarantees up to R$ 250,000 per bank in case of failure.

How can someone turn R$ 5 into R$ 3,774.34 in one year, according to the script?

-By consistently investing R$ 5 daily and allowing the money to accumulate with interest over the year. The script outlines a step-by-step process, gradually increasing the daily contribution from R$ 5 to R$ 15 as the individual’s financial situation improves, and leveraging the compound interest effect.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Otimizando parâmetros com Irace

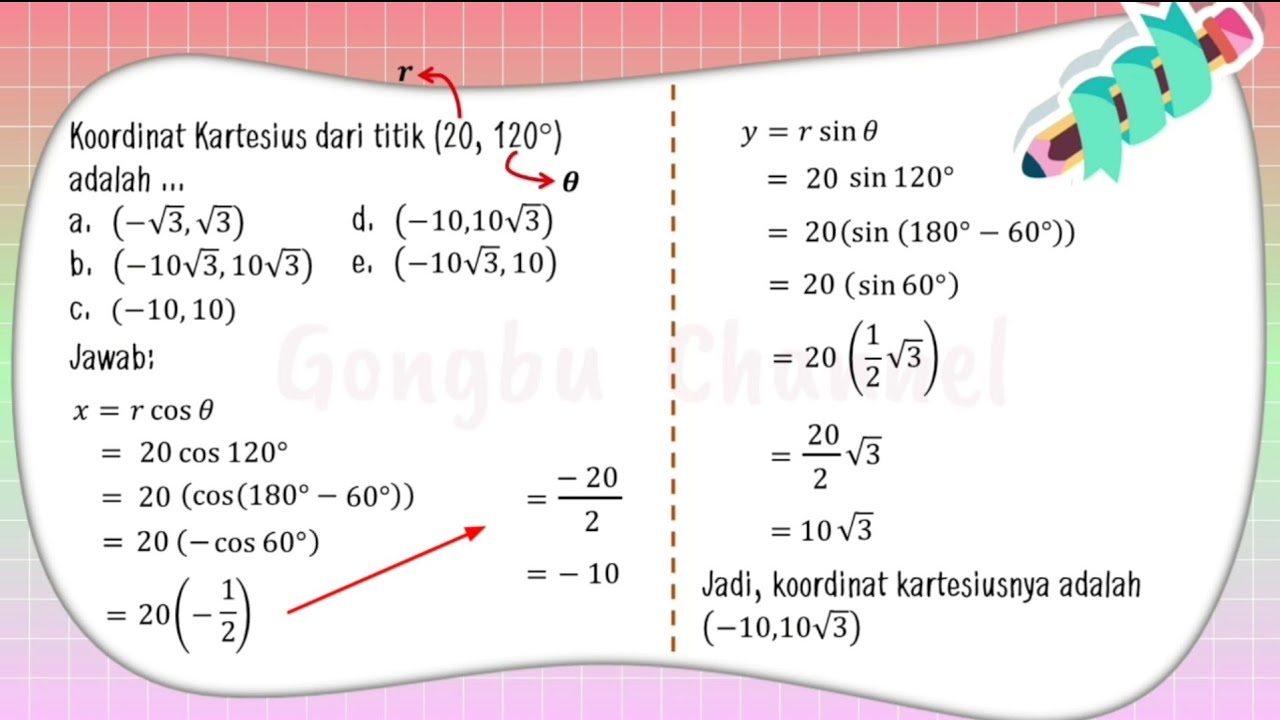

TRIGONOMETRI (Konversi Koordinat Kutub Ke Koordinat Kartesius)

COMO ENSINEI MEU AMIGO A DOBRAR SUA RESERVA DE FORMA SIMPLES E NA PRÁTICA! COMPARTILHEI COM VOCÊ !!

How to Change Google My Business Address? Hindi | How to Change Address in Google Business Profile

STATISTIKA - Cara Manual Uji Validitas Pearson Product Moment Correlation

SUA NOVA RENDA

5.0 / 5 (0 votes)