Expect the Fed to be on hold for some time here, says Rockefeller Capital CEO Greg Fleming

Summary

TLDRIn this insightful conversation, economic experts discuss the challenges facing the U.S. economy, particularly inflation, tariffs, and federal deficit spending. They explore the potential consequences of onshoring labor and the risks of rising inflation, while stressing the need for sustainable deficit reduction. There's a focus on the Federal Reserve's cautious approach to monetary policy and the impact of recent market volatility. The speakers also examine the balance between tax cuts and fiscal responsibility, emphasizing the urgency of addressing rising debt and military spending. The dialogue provides a nuanced perspective on the current economic landscape and policy outlook.

Takeaways

- 😀 The Fed's recent survey shows a downward revision in GDP expectations, in line with a broader economic caution.

- 😀 Real inflation may emerge when onshoring occurs, which could result in higher labor costs, potentially making goods more expensive.

- 😀 Scott Bessent advocates for the idea that the American Dream is not defined by cheap products, but rather by employment opportunities.

- 😀 The target of 3% real growth, 3% inflation, and 3% federal deficit by 2028 is a key economic goal, but it remains uncertain whether this will be achievable.

- 😀 The Fed is currently on hold with no interest rate cuts, as they await more data regarding the economy's reactions to ongoing policies and uncertainties.

- 😀 Tariffs, if they lead to inflation, could add more complexity to the Fed's decisions as they balance economic weakening with inflationary pressures.

- 😀 The U.S. economy saw strong growth in 2023-2024, which may cause increased market volatility as new administration policies are introduced.

- 😀 Excluding the top seven stocks, the broader market's performance over the past two years has been relatively flat, despite the perception of a major correction.

- 😀 There's a growing concern over the federal budget deficit, with the U.S. government needing to balance spending and revenues to avoid unsustainable debt.

- 😀 The interest on national debt now exceeds military spending, signaling a national challenge of balancing defense priorities with fiscal health.

Q & A

What is the CEO's perspective on the current GDP expectations?

-The CEO agrees that GDP expectations are being ratcheted down, which aligns with the trends observed in various economic surveys. This is primarily due to a variety of factors affecting the economy, such as inflation and global uncertainties.

What potential inflation risks does the CEO highlight in the transcript?

-The CEO points out that inflation could potentially rise when labor and manufacturing are onshored, as the costs associated with bringing jobs back to the U.S. could drive up prices.

What does Scott Bessent's statement about the American Dream imply?

-Scott Bessent's statement, 'the American Dream isn't a cheap, widescreen TV,' suggests that while goods might become more expensive, it’s important that everyone has a job to afford them. This implies a trade-off between affordability and job availability.

What does the CEO hope for regarding the federal budget deficit?

-The CEO hopes that the U.S. can reduce the federal deficit to a sustainable level, targeting 3% of GDP by 2028. This would require significant cuts to spending while managing tax policies responsibly.

How does the CEO view the Federal Reserve's current position on interest rates?

-The CEO believes that the Federal Reserve is in a holding pattern with interest rates, waiting to observe the economic impacts of tariffs, inflation, and other uncertainties before making further moves.

What does the CEO think about the economic volatility in 2025?

-The CEO expects significant volatility in 2025 due to the changes in administration and policy shifts. This follows a similar pattern seen in 2000 when the election year brought substantial uncertainty.

How does the CEO explain the market performance over the last two years?

-The CEO notes that while there has been substantial market growth in the last two years, much of this has been driven by just a few major stocks. When excluding those stocks, the overall market has shown much more modest growth.

What concerns does the CEO express about the U.S. federal budget deficit?

-The CEO emphasizes that the U.S. cannot afford to continue running a large deficit, particularly when employment levels are high, and government spending is unsustainable. The federal deficit needs to be reduced to ensure long-term economic stability.

What role does military spending play in the CEO's economic analysis?

-The CEO highlights that military spending is crucial, especially given current global uncertainties. However, the U.S. is currently spending more on debt interest than on military funding, which is considered a national challenge.

What is the CEO's opinion on additional tax cuts in the current economic environment?

-The CEO is cautious about further tax cuts, particularly if they are not offset by reductions in spending. While tax cuts are typically seen as pro-growth, additional cuts without fiscal discipline could worsen the federal deficit.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

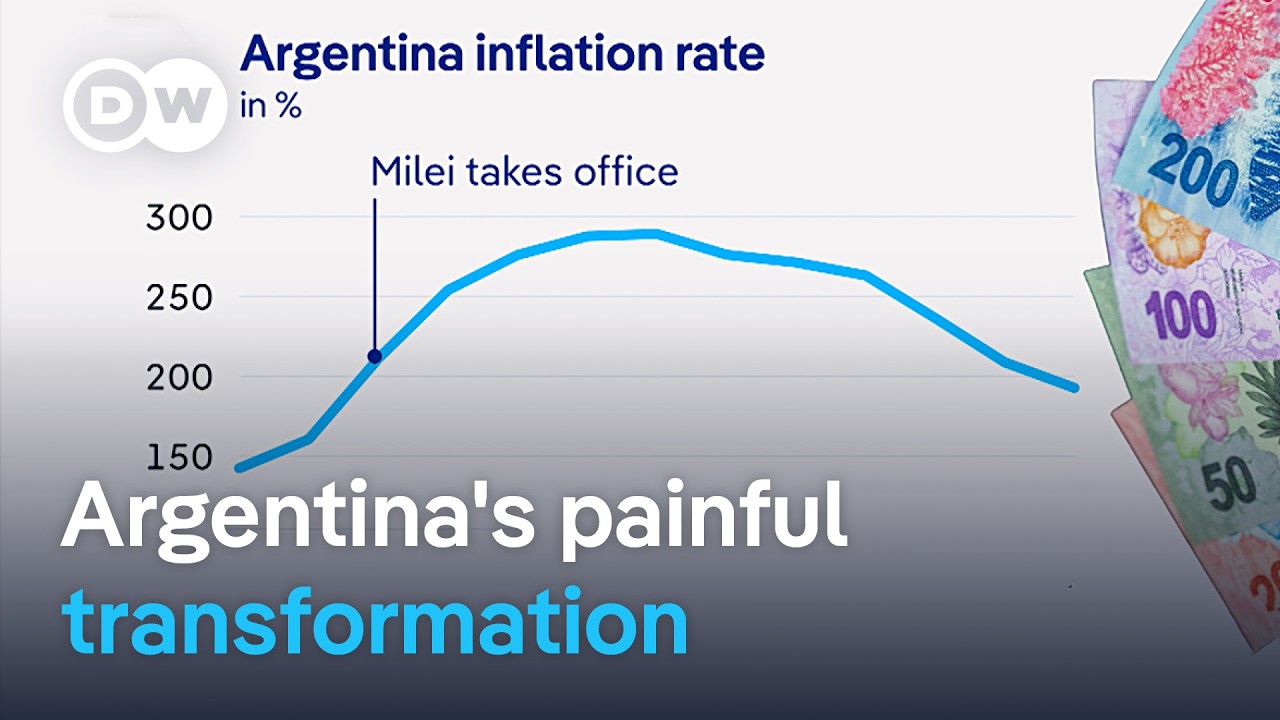

Did Milei follow through on his radical economic plans? | DW News

Life On 3 Legs - What Every Pet Parent Needs To Know About Amputation

Is a new world economic order emerging? | Counting the Cost

Luke Gromen Global Macro and Bitcoin Q1 2025 (BTC215)

Kalah 6-0 dari Korea Utara, Timnas Indonesia U17 Gagal ke Semifinal Piala Asia

2025 Outlook: Europe’s economies brace for more political upheaval

5.0 / 5 (0 votes)