KELOMPOK 2 || PERAN UANG DAN KEBIJAKAN MONETER

Summary

TLDRThis transcript explores the concept of money from both legal and functional perspectives. It delves into how money is defined legally, accepted for trade, and used for debt repayment. The script highlights money’s essential role in the economy, emphasizing its functions such as a medium of exchange, unit of account, store of value, and standard of deferred payment. The video also covers the principles of monetary policy, detailing expansionary and contractionary measures implemented by central banks, such as interest rate adjustments, open market operations, and reserve requirements, to manage the money supply and control inflation.

Takeaways

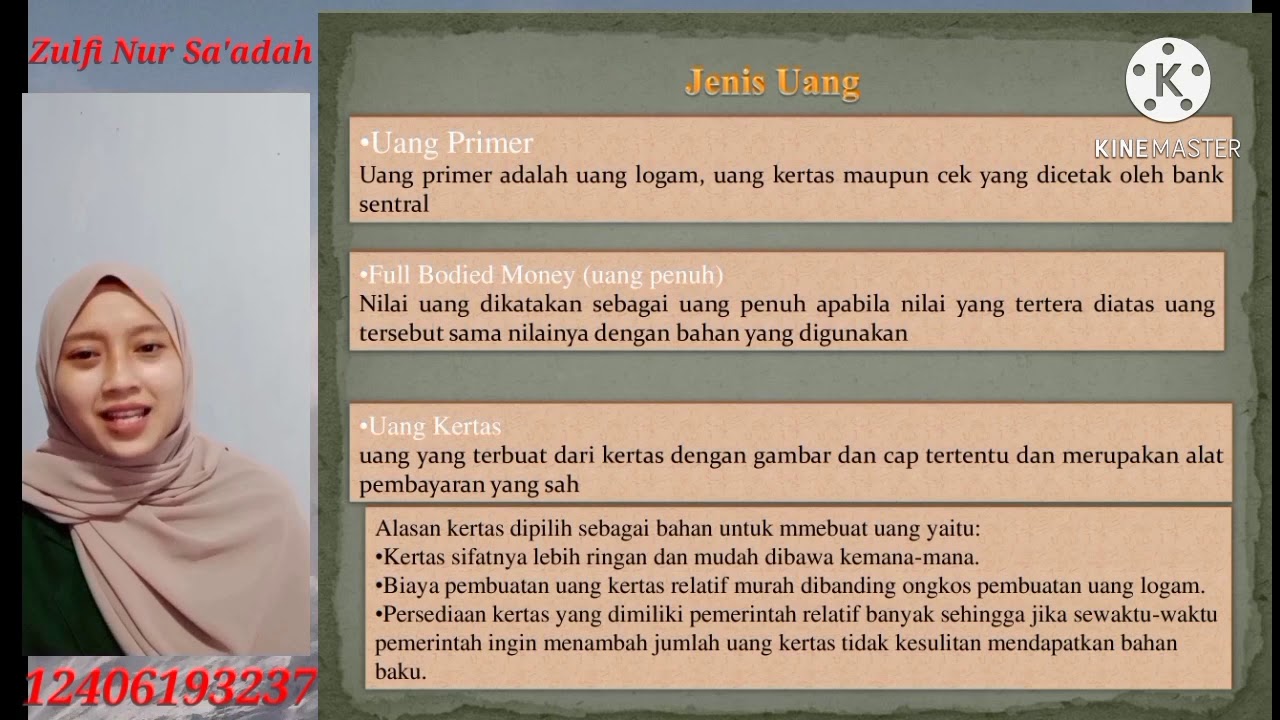

- 😀 Money is defined in two main ways: legally (established by law as a valid medium of exchange) and functionally (widely accepted for transactions and debt payments).

- 😀 In a narrow sense, money refers to currency and bank deposits used for economic transactions.

- 😀 In a broad sense, money includes not only currency but also assets like stocks, bonds, and savings that can be used for transactions.

- 😀 The four primary functions of money are: a medium of exchange, a unit of account, a store of value, and a standard of deferred payment.

- 😀 Money in the economy is compared to blood in the human body, essential for economic circulation and metabolism.

- 😀 The ideal amount of money circulating in an economy ensures smooth functioning and optimal economic activity.

- 😀 Expansionary monetary policy increases the money supply, typically by lowering interest rates and encouraging borrowing.

- 😀 Contractionary monetary policy reduces the money supply, generally by raising interest rates to control inflation.

- 😀 The three main instruments of expansionary monetary policy include lowering interest rates, central bank purchases of government securities, and adjusting reserve requirements.

- 😀 Contractionary monetary policy uses instruments like raising interest rates, selling government securities, and increasing reserve requirements to reduce money supply.

- 😀 Proper management of money supply is essential for controlling inflation and maintaining a stable economy.

Q & A

What is the definition of money according to the law?

-According to the law, money is something that is legally established by legislation and recognized as valid for trade and transactions.

What is the definition of money based on its function?

-Money, based on its function, is something that is generally accepted in transactions, including paying debts, purchasing goods or services, and fulfilling financial obligations.

What is the difference between the narrow and broad definitions of money?

-The narrow definition of money refers to currency used for economic transactions, such as banknotes and coins, while the broad definition includes other forms of assets like stocks, bonds, and savings that can also be used in transactions.

What is the role of money in an economy?

-Money in an economy is compared to blood in the human body, as it regulates economic activity. An ideal amount of money in circulation ensures smooth economic functioning, while too little or too much money can cause instability.

What are the four primary functions of money?

-The four main functions of money are: 1) as a medium of exchange, 2) as a unit of account, 3) as a store of value, and 4) as a standard of deferred payment.

What is the purpose of monetary policy?

-Monetary policy aims to control the money supply and manage economic stability. It can be either expansive or contractive, depending on whether the goal is to stimulate or reduce economic activity.

What is the difference between expansive and contractive monetary policy?

-Expansive monetary policy aims to increase the money supply to stimulate economic activity, while contractive monetary policy seeks to reduce the money supply to curb inflation and stabilize the economy.

How does expansive monetary policy affect interest rates?

-In expansive monetary policy, the central bank lowers interest rates, making borrowing cheaper for commercial banks. This leads to lower loan costs for households and businesses, encouraging spending and investment.

What role do open market operations play in monetary policy?

-Open market operations involve the central bank buying and selling government securities. When the central bank sells securities, it reduces the money supply in the economy, and when it buys securities, it increases liquidity.

What is the required reserve ratio for commercial banks?

-The required reserve ratio is the percentage of deposits that commercial banks must hold in reserve, either at the central bank or within their own vaults. This reserve is a safeguard against the risk of insolvency.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Pengembangan Wilayah | Geografi SMA

Hubungan Negara & Warga Negara

KONSEP UANG DALAM PERSPEKTIF ISLAM || TUGAS UTS || MANAJEMEN KEUANGAN SYARIAH 3F || IAIN TULUNGAGUNG

Are we mature by 18? - CrowdScience podcast, BBC World Service

"จินตนาการเกินไป" เชื่อคดีชั้น 14 ไม่สะเทือน "นายกฯอิ๊งค์"| PPTVNews

Kerangka Dasar Laporan Keuangan

5.0 / 5 (0 votes)