Pertemuan-11. Rumah Tangga dan Perusahaan (Bagian-1)

Summary

TLDRThe transcript discusses key concepts in macroeconomics, focusing on household and firm behaviors. It explores the consumption decisions of households, factors influencing consumption like income and wealth, as well as the relationship between income and labor supply. The lecture covers consumption patterns, the life-cycle theory of consumption, and how changes in wages, wealth, and government policies impact household behavior. It also delves into supply and demand dynamics in labor markets, with an emphasis on the factors influencing labor supply and its connection to household income and consumption.

Takeaways

- 😀 Households make key economic decisions regarding consumption, savings, and labor supply.

- 😀 Consumption is a positive function of income; higher income generally leads to higher consumption.

- 😀 The life cycle theory of consumption suggests that households consume based on expected future income, not just current income.

- 😀 The propensity to consume is the proportion of income spent on consumption, which varies depending on income level and age.

- 😀 Households tend to consume more during the early and mid-years of their life cycle and save for later years, such as retirement.

- 😀 Labor supply decisions are influenced by wages, wealth, and non-labor income, such as dividends and inheritance.

- 😀 An increase in wages can lead to both an income effect (less work, more leisure) and a substitution effect (more work to earn higher income).

- 😀 Real wages (adjusted for inflation) are critical in household decisions about consumption and labor supply.

- 😀 Wealth affects consumption patterns, where increased wealth typically leads to higher consumption and reduced labor supply.

- 😀 Government policies, such as tax rates and transfer payments, significantly impact household consumption and labor supply decisions.

Q & A

What factors influence a household's decision to consume goods and services?

-A household's consumption decisions are influenced by factors such as income levels, wealth, expectations of future income, and interest rates. Additionally, factors like government policies, including tax rates, also play a significant role.

What is the relationship between income and consumption as per the theory of consumption?

-The theory of consumption suggests that consumption is a positive function of income, meaning as income rises, consumption generally increases. However, higher-income households tend to spend a smaller proportion of their income compared to lower-income households.

What is the 'propensity to consume' and how is it calculated?

-The propensity to consume refers to the proportion of household income that is spent on consumption. It is calculated by dividing consumption by income.

How does the Life Cycle Theory of Consumption explain household behavior?

-The Life Cycle Theory of Consumption suggests that households make consumption decisions based on their expected lifetime income, with early years showing lower consumption and later years relying on savings as income decreases. It emphasizes that consumption is based on long-term income expectations rather than current income.

What role does labor supply play in a household's economic decisions?

-Labor supply is closely tied to consumption decisions. Households decide how much labor to supply based on income needs, which are driven by the necessity to fund consumption. Increases in wages can lead to higher labor supply, as the opportunity cost of leisure increases.

How do wage changes affect household consumption and labor supply?

-A wage increase can have two effects: the substitution effect, where higher wages encourage more work and less leisure, and the income effect, where higher wages allow households to consume more without working more. Both effects influence consumption and labor supply.

What is the difference between nominal and real wages, and how do they impact labor supply?

-Nominal wages refer to the amount paid in current monetary terms, while real wages are adjusted for inflation and reflect the actual purchasing power of earnings. Real wages have a stronger influence on labor supply because they indicate how much goods and services can be purchased.

How does wealth influence household consumption and labor supply?

-Wealth increases household consumption since higher wealth allows for more spending. However, higher wealth typically reduces the supply of labor, as households may no longer need to work as much to sustain their consumption levels.

How do interest rates impact household decisions regarding consumption and saving?

-Higher interest rates often lead to increased saving and reduced consumption, as the return on savings becomes more attractive. Conversely, lower interest rates can encourage consumption as the cost of borrowing decreases.

How do government policies, such as taxes and transfer payments, affect household consumption and labor supply?

-Government policies such as higher income taxes reduce disposable income, leading to decreased consumption and labor supply. Conversely, lower taxes or transfer payments can boost consumption and increase labor supply as households have more disposable income.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

EKONOMI MIKRO DAN EKONOMI MAKRO (Materi EKONOMI XI BAB 5 Semester Genap) KURIKULUM MERDEKA

What is economics and what do economists do?

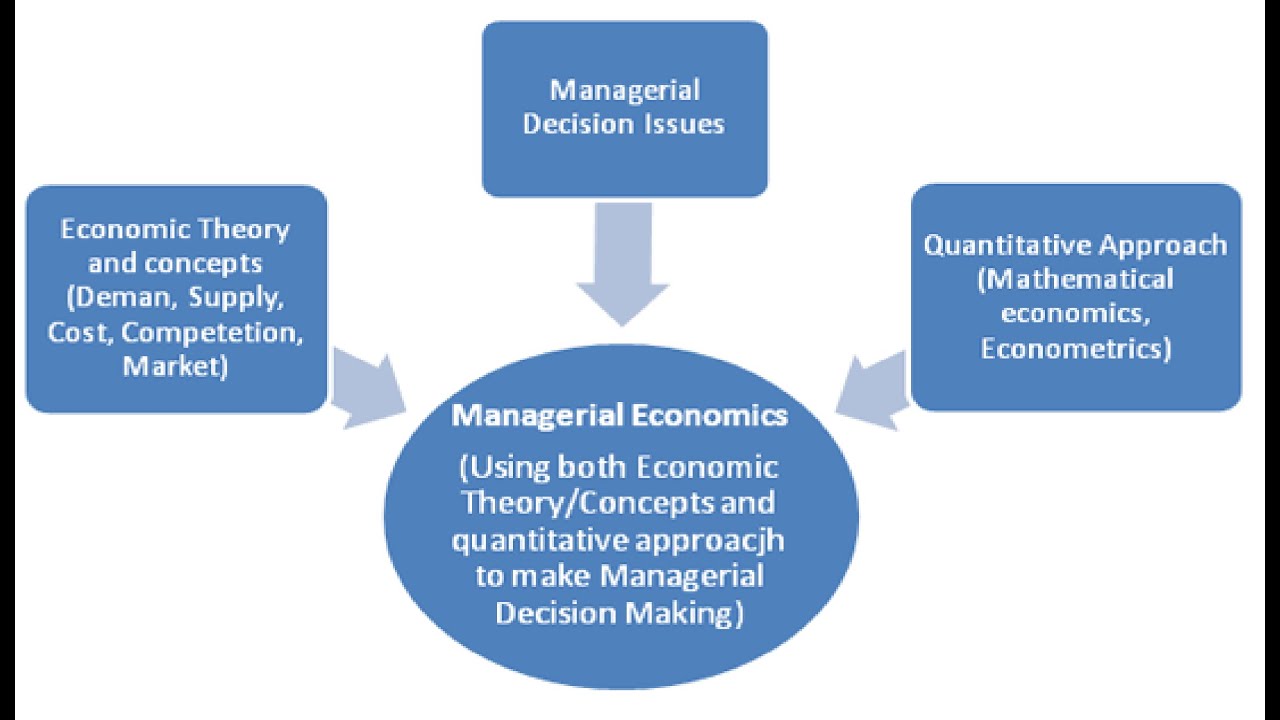

Chapter 1: 1 Introduction to Managerial Economics

EKONOMI SMA - Konsep Dasar Ilmu Ekonomi

Macroeconomics | Unit 1 | Circular flow of Income | Class 12 | Part 1

Materi Makro M13 - Uang, Bank, dan Penawaran Uang (Bagian 3)

5.0 / 5 (0 votes)