BMTV episode 1 the debut - How my property investment journey began

Summary

TLDRSRA Hayi shares her diverse life experiences on 'Let's Talk', starting from her early marriage to her first cousin, becoming a single mother, and eventually excelling in financial services. She narrates her journey from general insurance to estate agency, managing a property portfolio, and facing challenges during the 2008 market crash. Hayi's story details her ventures in property management, her re-entry into finance, and her decision to start a food business. She positions herself as a problem solver, inviting listeners to share their stories and seek guidance from her wide-ranging expertise in property, finance, and life's complexities.

Takeaways

- 😀 SRA Hayi introduces herself and sets the stage for a series of discussions on various life experiences.

- 👶 At the age of 14, SRA Hayi was engaged to her first cousin and married at 18, which led to her first child at 20 while her husband was abroad.

- 🌍 She experienced immigration challenges when her husband was granted permission to move to the UK.

- 💔 After her first marriage ended, she became a single mother and later remarried, gaining insights into the struggles and drives of single parenthood.

- 💼 SRA Hayi pursued a career in General Insurance, estate agency, and eventually financial services, gaining qualifications and excelling as a top mortgage advisor.

- 🏠 She ventured into property investment, learning from others and eventually managing a property management business with a friend.

- 📉 Despite the 2008 market crash, her property management business adapted and became successful, highlighting the importance of flexibility and foresight.

- 💡 SRA Hayi emphasizes the value of self-education, hard work, and taking control of one's life through financial independence.

- 👪 She discusses the importance of family support, particularly from her mother, and the impact of giving back to one's parents.

- 🔄 After selling her shares in the property management business, she returned to mortgages and finance, aiming to help others find their homes.

- 🎓 SRA Hayi shares her extensive experience in property, finance, and life's challenges, positioning herself as a problem solver and mentor for future discussions.

Q & A

At what age was SRA Hayi engaged to her first cousin?

-SRA Hayi was engaged to her first cousin at the age of 14.

How did SRA Hayi's first marriage end?

-SRA Hayi's first marriage ended in a breakdown, leading her to become a single mother for a period of time.

What career path did SRA Hayi initially pursue after her marriage broke down?

-SRA Hayi initially pursued a career in General Insurance, which later led her to estate agency and then financial services.

What motivated SRA Hayi to study for a financial advisor course while working and taking care of her family?

-SRA Hayi was motivated by a hunger and drive to take control of her life, as well as the desire to gain qualifications that would improve her career prospects.

How did SRA Hayi's experience in estate agency influence her understanding of property investment?

-SRA Hayi observed wealthy investors purchasing properties without even seeing them, which sparked her interest in property investment, although she did not fully understand the reasons behind their actions at the time.

What led to SRA Hayi's transition from working in estate agency to working in a bank?

-SRA Hayi transitioned to working in a bank after she remarried and was qualified as a financial advisor, which led her to take on roles in pensions and investments.

What significant event in 2008 impacted SRA Hayi's property management business?

-The market crash in 2008 impacted SRA Hayi's business, but they had prior information about the crash and adjusted their operations to focus purely on property management.

How did SRA Hayi's involvement in property management contribute to her success in the field?

-SRA Hayi's hands-on approach, involvement in every aspect of the business, and her ability to adapt and improve systems contributed to her becoming one of the best property managers in her area.

What personal realization did SRA Hayi have about her passion for property?

-SRA Hayi realized that her passion for property was rooted in her talent for arts and her enjoyment in making cosmetic changes to improve the appearance of properties.

What advice did Mr. X give SRA Hayi that significantly impacted her property portfolio?

-Mr. X advised SRA Hayi to leverage her existing properties to finance the purchase of more properties, ensuring that even if one property was empty, the others would cover the costs.

How did SRA Hayi's approach to her business and personal life reflect her organizational skills?

-SRA Hayi's ability to manage multiple aspects of her business, from sales to maintenance, and her personal life, including her family and children, demonstrated her highly organized nature.

What significant change did SRA Hayi experience when she returned to the finance and mortgage sector?

-When SRA Hayi returned to the finance and mortgage sector, she found enjoyment in helping people buy homes and expand, which was reignited by the changes in the rental field and the introduction of the tenant fee ban.

What was the outcome when SRA Hayi decided to sell her shares in the property management business?

-After deciding to sell her shares in the property management business, SRA Hayi used the lump sum of money to pay off her mortgage and planned to retire, while also doing mortgages from home.

What new venture did SRA Hayi undertake after selling her shares in the property management business?

-SRA Hayi started a food business, specifically a kebab roll business, after acquiring a commercial property with a kitchen.

What is the purpose of the 'Let's Talk' show hosted by SRA Hayi?

-The purpose of the 'Let's Talk' show is to share SRA Hayi's experiences and knowledge, and to engage with the audience by hearing their stories and helping them find solutions to their problems.

What is the policy of Penny Appeals H's Orphan Campaign regarding donations?

-Penny Appeals H's Orphan Campaign has a 100% donation policy, ensuring that all donations go directly to helping, inspiring, and educating orphans, providing them with education, daily meals, and medical care.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

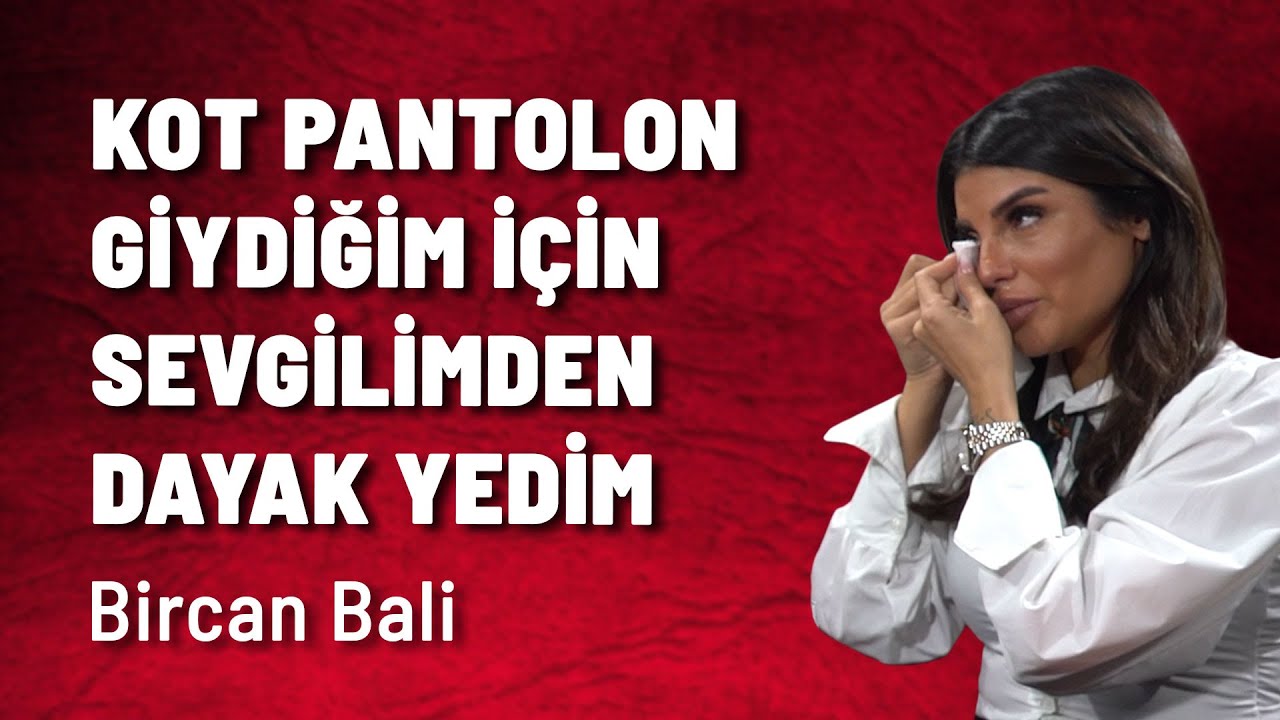

''Seren Serengil Mantıksız, Kalbi Çalışıyor ama Kafası Çalışmıyor'' | Bircan Bali

Teen Pregnancy in the Philippines

How to challenge workplace discrimination and win | Donna Patterson | TEDxLondonWomen

#तलाक के दो साल बाद पत्नी जिला कलेक्टर बन गई और पति उसी ऑफिस में क्लर्क था #talak #divorce #dm #ias

Gue Punya Cerita Nikah MBA

Suzanne interviews Rebel Rhyder

5.0 / 5 (0 votes)