قرار الـ100⛔️سياسة سوق النقد الأجنبي📣نقص معروض السيارات👆عام ع التعويم

Summary

TLDRThe transcript discusses Egypt's foreign exchange policies, particularly the government's claims of implementing a flexible exchange rate system. However, it highlights how the actual practice is more about restricting imports and controlling demand. Issues like the importation of cars, bureaucratic hurdles, and the reliance on 'hot money' are addressed. The government's claims of economic reforms and the stability in the exchange rate are scrutinized, with critics pointing out the lack of sustainable foreign currency reserves and the real limitations on imports. The narrative of a successful 'flexible exchange rate' policy is questioned, revealing underlying economic challenges.

Takeaways

- 😀 The government celebrates the first anniversary of the major flotation that devalued the Egyptian pound from 31 EGP to nearly 50 EGP.

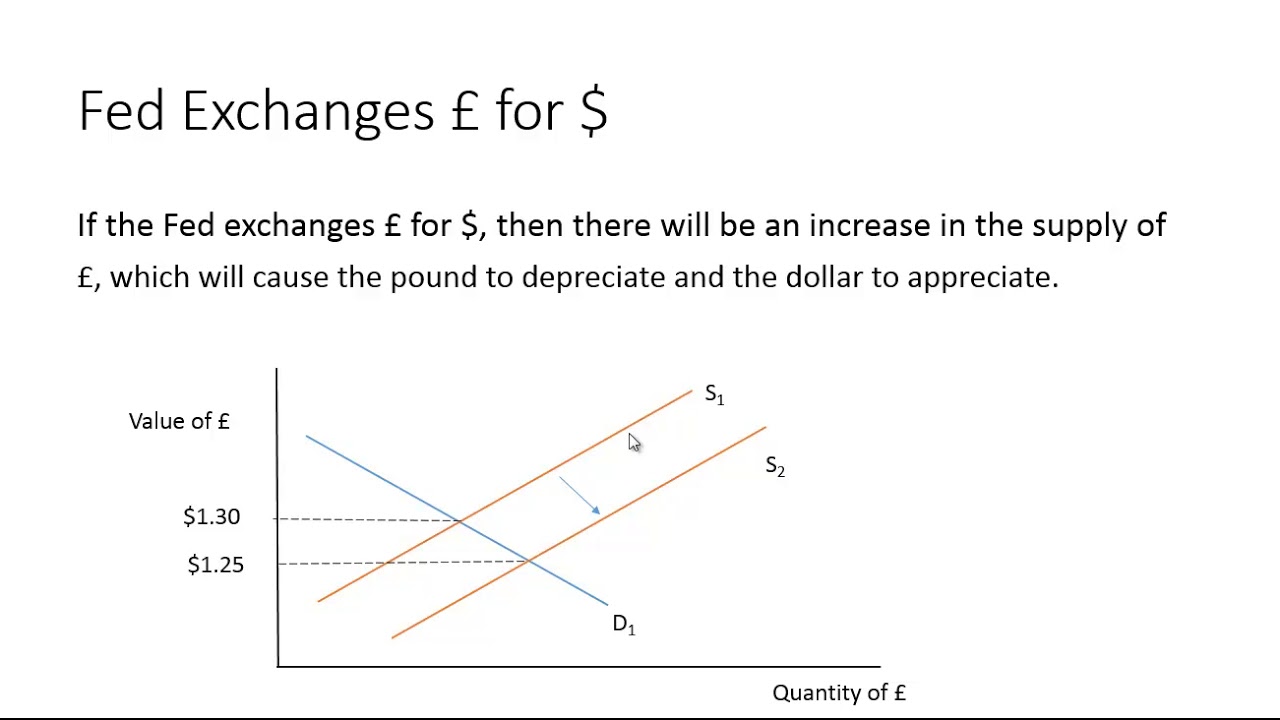

- 😀 Officials claim that the exchange rate has stabilized due to the implementation of a flexible exchange rate policy, though this is questioned by some as being more of a demand restriction strategy.

- 😀 The Egyptian negotiation team and the International Monetary Fund (IMF) have different views on the flexibility of the exchange rate, with discussions hinting at a gradual increase in the exchange rate towards 55 EGP and 60 EGP.

- 😀 A key part of Egypt’s monetary policy is restricting the import of 13 products, including cars, which can only be imported with approval from the central bank.

- 😀 There is a general sense that the market’s stability is artificially created, with restrictions on imports such as toys, Ramadan lanterns, and electronics limiting the demand for foreign currency.

- 😀 A significant source of foreign currency for Egypt comes from Egyptians working abroad, which saw a 51% increase in remittances from 2023 to 2024, amounting to around 29 billion USD.

- 😀 Despite the increase in remittances, the country is still heavily reliant on 'hot money'—foreign capital that is temporary and leaves when the market conditions change.

- 😀 Egypt has not yet developed a sustainable way to replace hot money with a more stable source of dollars due to the continuing debt burden and challenges in generating real economic growth.

- 😀 The government has imposed restrictions on the importation of vehicles, with only 100,000 cars allowed to be imported in 2025, a figure considered insufficient to meet domestic demand.

- 😀 There are difficulties in implementing the import approval process, as even though the central bank approved funding for imports, the Ministry of Finance has not provided the required registration numbers for car imports, leading to further delays and a thriving black market for foreign currency.

Q & A

What is the significance of the first anniversary of the devaluation of the Egyptian pound?

-The first anniversary marks the significant shift in the exchange rate from 31 EGP to nearly 50 EGP, reflecting the adoption of a flexible exchange rate policy, and the ongoing challenges in achieving true currency stabilization.

What is the key difference between a flexible exchange rate policy and the current policy in Egypt?

-While the Egyptian government claims to implement a flexible exchange rate, the policy is actually more about demand restrictions, with limits on imports and restricted access to foreign currency, rather than truly allowing market forces to determine the rate.

Why is the Egyptian government using demand restrictions instead of a true flexible exchange rate?

-The government is attempting to stabilize the exchange rate by limiting demand for foreign currency, including restricting the import of certain goods and products. This approach aims to manage the demand for dollars, though it does not fully implement a free market exchange rate.

How do the restrictions on imports, particularly cars, impact the economy?

-Restrictions on car imports contribute to a shortage of vehicles in the country, driving up prices and limiting the availability of essential goods, further complicating Egypt's economic situation.

What is the role of the International Monetary Fund (IMF) in Egypt's exchange rate policy?

-The IMF has been involved in advising Egypt on its monetary policies, including the devaluation of the pound and the implementation of a flexible exchange rate. However, there are concerns that this policy is not a genuine market-driven solution but rather one that manipulates demand through government restrictions.

How did the Egyptian government's decision to limit certain imports affect foreign currency reserves?

-By limiting the import of non-essential goods, such as cars and luxury items, the government hopes to conserve foreign currency reserves and reduce pressure on the exchange rate. However, this strategy does not address the underlying structural issues in the economy.

What are the key consequences of relying on 'hot money' for foreign currency reserves?

-Relying on 'hot money,' or short-term foreign investments, exposes the country to potential volatility. If these investors pull out their funds, it could lead to a sudden devaluation of the pound, causing a significant economic crisis.

How have remittances from Egyptians abroad contributed to Egypt's foreign currency reserves?

-Remittances from Egyptians working abroad have been a major source of foreign currency, with a 51% increase in 2024 compared to the previous year, significantly contributing to the country's foreign reserves.

What steps are being taken to manage the scarcity of cars in Egypt?

-The government has allowed the import of 100,000 cars for 2025 but has imposed strict regulations, including requiring foreign currency for importation. These measures are intended to address the shortage, though the number of vehicles allowed is considered low.

How is the Egyptian government managing foreign currency for the import of vehicles?

-The government has authorized the use of foreign currency obtained through various channels, including exports and borrowing from abroad, to facilitate car imports. However, a shortage of official foreign currency sources has led to reliance on the black market for dollars.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)