Ngatur Keuangan Jadi Gampang! Tips Bikin Anggaran di Excel

Summary

TLDRThis video tutorial teaches viewers how to manage personal finances with a simple Excel budgeting template. It covers the basics of tracking income and expenses, categorizing spending, and allocating at least 20% of income towards savings. By using easy formulas and creating bar charts, viewers learn to visually track their spending patterns and make informed decisions. The video emphasizes the importance of budgeting for financial health and offers practical, step-by-step guidance on achieving better money management with minimal effort. Viewers are encouraged to implement these simple strategies for effective financial control.

Takeaways

- 😀 Budgeting helps you manage your finances and prioritize needs like saving for the future while avoiding unnecessary spending.

- 😀 Without a financial plan, money can flow uncontrollably, leaving you unaware of where it's being spent.

- 😀 Creating a budget in Excel is simple and effective, offering a clear structure for financial tracking.

- 😀 The basic budget template includes two main columns: income and expenses.

- 😀 Income should be recorded in detail, including not only salary but also bonuses, sales, and cashback.

- 😀 Expenses, even small ones like coffee or parking, should also be tracked in detail for accuracy.

- 😀 It's essential to balance total income and expenses to determine if spending exceeds income or if savings can be made.

- 😀 Categorizing expenses into different groups (e.g., necessities, entertainment, savings) helps track where your money is going.

- 😀 A minimum of 20% of income should be allocated to savings, though higher savings are encouraged if possible.

- 😀 Using formulas in Excel can help calculate the percentage spent on each category and assess if adjustments are needed.

- 😀 Visualizing data with bar charts makes it easier to understand spending patterns and see where you might be overspending, especially in non-essential categories.

Q & A

What is the purpose of creating a financial budget?

-A financial budget serves as a plan to manage money, prioritize needs like savings for the future, and avoid unnecessary spending, much like a GPS for your finances.

How can Excel be used to create a budget?

-In Excel, you can create a simple budget template by organizing your income and expenses into two main columns, then categorizing the expenses, calculating percentages, and even creating visual graphs for a better understanding of your financial status.

What should be included in the income section of the budget?

-The income section should include all sources of money, not just your salary. This includes bonuses, cashbacks, sales, and other income sources.

Why is it important to categorize expenses in a budget?

-Categorizing expenses helps you see where your money is going, which allows you to manage your spending more effectively and make necessary adjustments for a healthier financial lifestyle.

What is the minimum percentage of income that should be allocated for savings?

-It is recommended to allocate at least 20% of your income to savings. If possible, saving more than 20% is even better for long-term financial health.

How can you check if your spending is balanced?

-You can check if your spending is balanced by comparing your total income with your total expenses. If your expenses exceed your income, it's a signal to reduce spending or increase savings.

What formula is used to calculate the percentage of each expense category?

-The formula to calculate the percentage for each category is: (Expense amount ÷ Total income) × 100.

How does visualizing the data with graphs help in managing finances?

-Visualizing the data with graphs, such as bar charts, gives you a clear picture of where your money is being spent. It can highlight areas where you might be overspending, helping you make adjustments as needed.

What does it mean if your entertainment expenses are higher than your savings?

-If your entertainment expenses are higher than your savings, it could indicate that you're spending too much on non-essential items, and you may need to cut back on discretionary spending to save more.

What is the next topic covered in the following video after budgeting?

-The next video will cover tips on how to save money and pay off debts without stress, building on the foundation of budgeting.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Every Dollar Matters

Como Aprender Excel do Zero

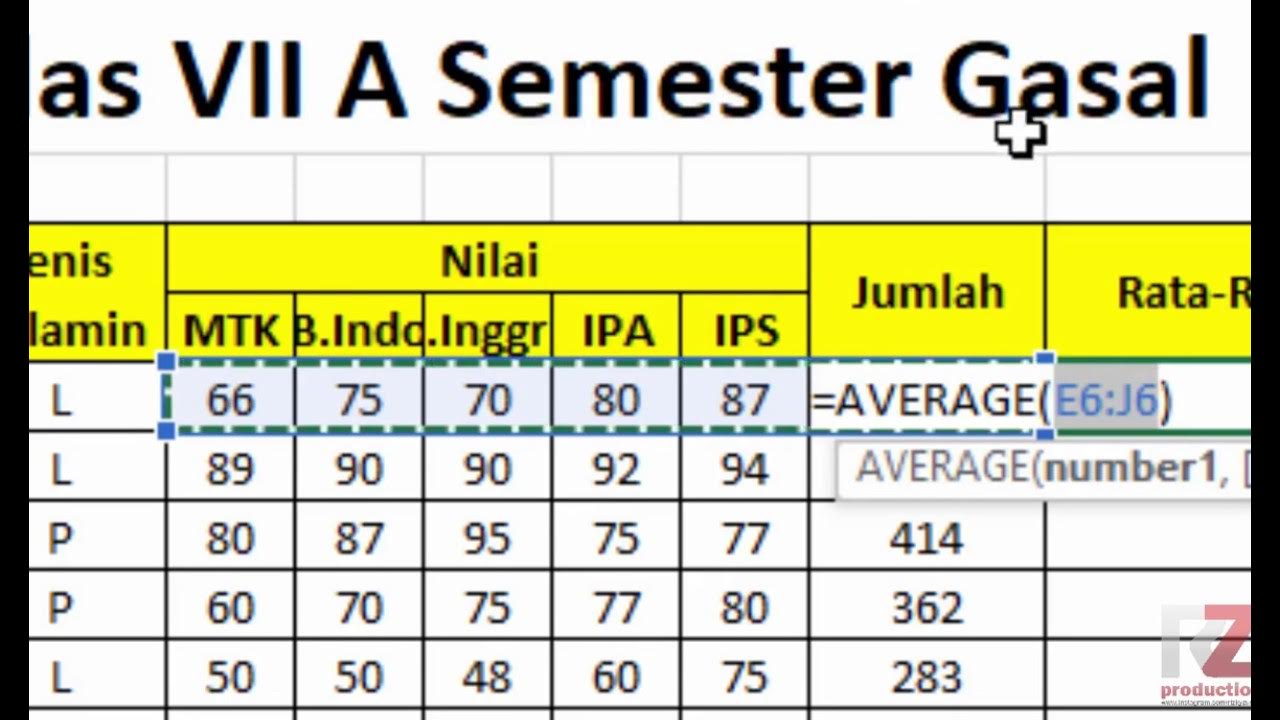

Materi Excel - Cara Menghitung Jumlah Nilai, Rata-Rata, dan Menentukan Nilai Tertinggi Terendah

the student guide to personal finance 💸 adulting 101

LITERASI KEUANGAN | KELAS X SMA | KURIKULUM MERDEKA

How to keep Inventory using an Excel Spreadsheet - [create your own Template]

5.0 / 5 (0 votes)