PLANO DE SAÚDE UNIMED SEGUROS Tudo o que você precisa saber antes de contratar a Seguros Unimed

Summary

TLDRIn this video, a health insurance broker explains the differences between Seguros Unimed and other Unimed providers. The key distinctions include the national coverage of Seguros Unimed compared to regional options, its specific plans and the target groups eligible for them, and details on co-participation, reimbursements, and coverage specifics. She also shares information about the various plans available, including their cost, network of care, and how the insurance works for individuals and companies. Lastly, she offers her personal experiences and provides helpful tips for navigating the insurance process, with a call to action for those seeking more information or a personalized quote.

Takeaways

- 😀 The main difference between Seguros Unimed and other Unimeds is that Seguros Unimed offers national coverage, while local Unimeds are often region-specific and vary in the quality of service.

- 😀 Seguros Unimed operates under a blue logo and is a part of the Unimed group, but it is a separate entity from regional Unimeds.

- 😀 Seguros Unimed’s network is extensive, covering almost 90% of cities in Brazil through agreements with local Unimeds, though not all local Unimed clinics participate.

- 😀 Only individuals with a CNPJ (business registration) can directly purchase Seguros Unimed plans. Private individuals can access it through collective plans based on their profession.

- 😀 Dependents that can be included in Seguros Unimed plans include spouses, children, and in some cases, grandchildren (up to 39 years old), with some restrictions depending on the plan.

- 😀 The Seguros Unimed plans offer national coverage, but they also introduced a regional plan for specific areas in São Paulo, which offers emergency and urgent care nationwide.

- 😀 Seguros Unimed offers a variety of plans (Compact, Effective, Complete, Superior, and Cena), with differences in the hospital network and coverage options, such as shared rooms vs. private rooms.

- 😀 Co-payment options are available with Seguros Unimed, where users pay a lower premium but additional fees when using healthcare services. The co-payment percentage can be 20% or 30%.

- 😀 Reimbursement is available for services that are covered by the plan but not available within the network, with varying rates depending on the plan chosen.

- 😀 Carency periods apply for new policyholders, especially for services like surgeries, procedures, and pregnancy-related care. There are also processes to migrate from other plans without fulfilling additional carency periods under specific conditions.

- 😀 Prices for Seguros Unimed plans vary depending on multiple factors, including region, the number of people on the plan, and whether co-payment is included. They tend to be comparable to other large insurance companies in the market.

Q & A

What is the difference between Seguros Unimed and other local Unimed plans?

-Seguros Unimed is a national health insurance provider that offers standardized plans across Brazil, with the same rules and network coverage in all cities. In contrast, local Unimed plans tend to focus on specific regions and may offer different services, networks, and financial management based on the city.

Does Seguros Unimed provide coverage in local Unimed clinics?

-Yes, Seguros Unimed has an agreement with around 90% of the local Unimed networks across Brazil. However, it is not guaranteed in every location, so it’s important to check if the desired medical services are available in your specific area.

Who can contract Seguros Unimed?

-Seguros Unimed offers plans for businesses, including micro-enterprises and small family-run companies, as well as for individuals through collective plans by profession. It does not offer individual health plans directly to individuals without a CNPJ or profession-based collective agreements.

What are the dependents that can be included in a Seguros Unimed plan?

-For Seguros Unimed's business plans, dependents who can be included are spouses, children or stepchildren up to 39 years old, and grandchildren under 39 years old. For collective plans by profession, only spouses and children can be included.

What is the difference between the various Seguros Unimed plans?

-The main differences between Seguros Unimed plans are the network of healthcare providers and reimbursement values. There are five main plans: Compact, Effective, Complete, Superior, and the Essential Regional plan for São Paulo and nearby cities, with network and hospital coverage expanding with each plan tier.

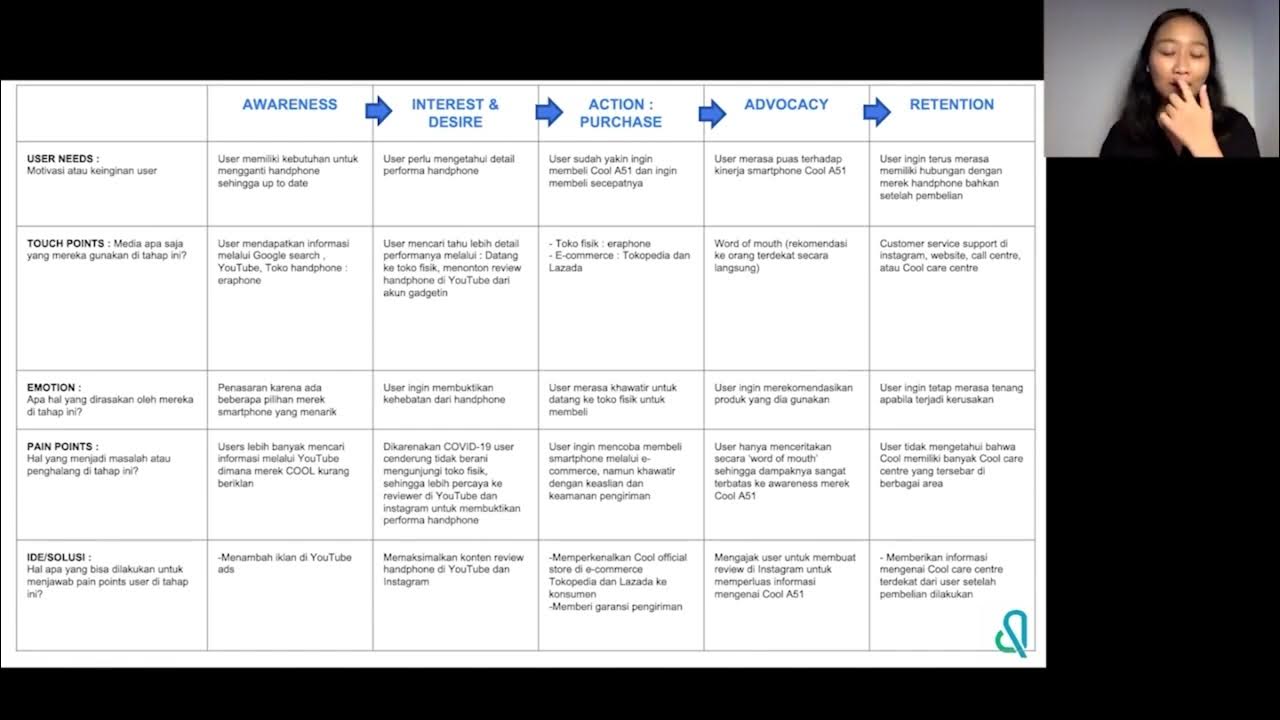

How does co-participation work in Seguros Unimed plans?

-In co-participation plans, you pay a lower monthly fee but are required to pay a percentage of the cost for each medical service you use, such as consultations or exams. The percentage can range from 20% to 30%, based on the plan chosen. The exact amount you pay depends on what the plan reimburses to the medical provider.

Is there a maximum amount for co-participation charges in Seguros Unimed?

-Yes, Seguros Unimed has a maximum cap for co-participation charges. For example, if a doctor receives a specific payment from Seguros Unimed, you will pay a percentage of that amount, but there’s a limit to how much you’ll pay per service, which varies based on your plan.

How does reimbursement work in Seguros Unimed?

-Reimbursement allows you to pay for medical services out-of-pocket and then request a refund from Seguros Unimed based on the reimbursement rate for your plan. The reimbursement amounts are governed by the plan’s specific table, and coverage depends on whether the procedure is included in the plan’s list.

What are the waiting periods (carências) for Seguros Unimed?

-Seguros Unimed has waiting periods for certain services, such as 24 hours for emergencies, 15 days for consultations, 30 days for basic exams, and up to 180 days for surgeries. The waiting period may also apply to pre-existing conditions, with up to 24 months of waiting for high-complexity treatments.

Can you transfer from another health plan to Seguros Unimed without waiting periods?

-Yes, Seguros Unimed allows portability of health plans, meaning you can transfer from another provider without waiting periods for most services, except for pre-existing conditions. You can also transfer existing waiting periods to Seguros Unimed if certain criteria are met.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade Now5.0 / 5 (0 votes)