How I created an arbitration bot using an AI assistant

Summary

TLDRIn this tutorial, George explains how to make passive income using decentralized exchanges like Uniswap by deploying a front-running bot. He walks through the steps of setting up MetaMask, compiling and deploying the bot contract in Remix, funding it with Ethereum, and monitoring the liquidity pool. The bot’s job is to buy tokens at low prices, then sell them for profit while monitoring the Ethereum network for favorable trades. George demonstrates how the bot generates profits over time, and shares his own earnings, showcasing the potential for consistent returns with the right setup.

Takeaways

- 😀 The tutorial explains how to make passive income using decentralized exchanges like Uniswap.

- 😀 No prior knowledge is required to implement the method, making it accessible to anyone.

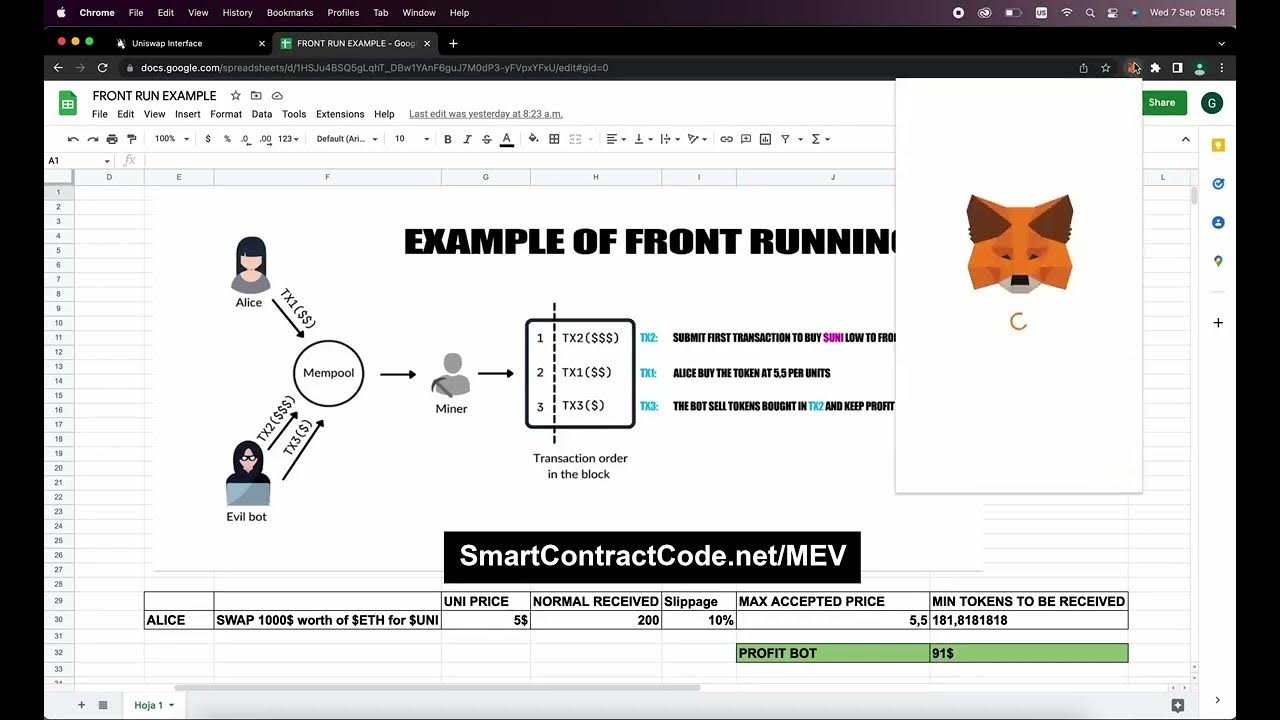

- 😀 Jack swaps $1,000 worth of Ether for UNI tokens, with potential price fluctuations considered through slippage settings.

- 😀 By setting a 10% slippage, Jack agrees to pay a maximum of $11 per UNI token, buying 90 tokens instead of 100.

- 😀 The bot tracks Jack's transaction, buys UNI tokens at a higher price, and sells them to capture the profit.

- 😀 To use the method, you need Metamask installed and linked to the Ethereum mainnet.

- 😀 Remix is used to create, deploy, and execute smart contracts written in Solidity, and the bot contract code is provided.

- 😀 After deploying the contract, you must fund it with Ether to access liquidity pools and execute front-running transactions.

- 😀 Gas fees are necessary for deploying and executing the contract on the Ethereum blockchain.

- 😀 The bot monitors the mempool for liquidity pairs to front-run transactions, generating profits through slippage.

- 😀 Over time, the bot can generate substantial profits, with an example of increasing the initial deposit by 40% in one day.

Q & A

What is the main purpose of the tutorial in the video?

-The tutorial explains how to make passive income using decentralized exchanges like Uniswap by setting up a front-run bot that monitors the mempool for profitable transactions.

What does 'slippage' refer to in the context of this tutorial?

-Slippage refers to the percentage of potential price change that the user is willing to accept during a transaction. It allows for the completion of trades even if the price fluctuates slightly.

How does the front-run bot work?

-The bot detects transactions in the mempool and raises the price to ensure the user buys at a higher price. Afterward, it sells the purchased tokens at a higher price, retaining the profit, minus gas fees.

What is the role of Metamask in this process?

-Metamask is used to connect to the Ethereum mainnet, allowing the user to interact with decentralized exchanges and deploy the front-run bot contract on the blockchain.

How do you deploy the front-run bot contract on Ethereum?

-The bot contract is deployed through Remix, an online tool, by selecting the appropriate Solidity version, compiling the code, and confirming the deployment via Metamask with the necessary gas fees.

What does the 'start' button in the contract do?

-Pressing the 'start' button initiates the bot, causing it to monitor the mempool for profitable liquidity pairs and transactions that can be front-run for profit.

What happens when the 'withdrawal' button is pressed?

-Pressing the 'withdrawal' button stops the bot and transfers the funds back to the wallet, including any profits earned from front-running transactions.

How much Ethereum was initially funded into the contract?

-The contract was initially funded with 1 Ethereum, which was used to access liquidity pools and enable the front-running bot to perform its tasks.

How profitable was the bot's performance in the video?

-The bot generated approximately 1.7 Ethereum, which is a 177% profit, with the initial transactions resulting in 0.17 Ethereum profit after gas fees. Over time, the profits can fluctuate, but it's shown that the bot can generate significant returns.

Can the bot generate consistent profits?

-While the bot can generate significant profits, the earnings fluctuate week-to-week. In some weeks, the user earned 5 to 6 Ethereum, but generally, they make over 2 Ethereum per week, although profits are not guaranteed.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

How You Can Make $200k In Passive Income Farming Daily On Uniswap (MEV Bot) Working

[ChatGPT] How AI helps me earn Ethereum 2,400$ Daily

ChatGPT AI Trading Bot Helped Me Make $2,500 in One Day

November Success Story: 3-5 ETH Daily with ChatGPT | Beginner’s Guide to AI Trading

Make 1ETH Daily Using AI with ChatGPT | Updated 2024 Tutorial | Step-by-Step Guide

Make 1ETH Daily with an AI Bot by ChatGPT | Complete 2024 Tutorial in My Video | Step-by-Step Guide

5.0 / 5 (0 votes)