SONO MILIONARIO.

Summary

TLDRIn this video, the speaker provides a detailed overview of their financial journey, including asset performance and emotional reflections. They discuss fluctuations in ETF, crypto, and real estate investments, highlighting challenges like liquidity issues and recent borrowing. The speaker shares personal experiences of managing anxiety and uncertainty while navigating the ups and downs of investments. They also emphasize the importance of transparency, learning from mistakes, and sticking to long-term plans. With an eye on reaching a seven-figure net worth, they showcase their strategy of consistent monthly investments, offering practical advice for beginners in investing.

Takeaways

- 😀 The speaker has a diversified portfolio, including ETFs, stocks (like Tesla), crypto, real estate, and private equity.

- 😀 There is a noticeable decrease in ETF value due to categorizing a loan as part of this category.

- 😀 Crypto investments have increased, but the speaker feels anxious about the high exposure to this volatile asset class.

- 😀 The speaker recognizes the emotional aspect of investing, acknowledging the anxiety tied to having low liquidity and recent borrowing.

- 😀 Real estate has grown significantly, with the purchase of a home in Dubai and ongoing transactions involving two apartments in Bergamo.

- 😀 The speaker's total asset value has surpassed $1 million, which includes both assets and liabilities, marking a significant milestone.

- 😀 Plans are in place to liquidate certain positions in crypto and stocks to regain balance and reduce exposure to high-risk assets.

- 😀 The speaker emphasizes the importance of managing emotions and sticking to investment plans, even during periods of uncertainty.

- 😀 The speaker is aware that not all investments are liquid, such as private equity, and some assets may not fetch expected prices if sold in the market.

- 😀 The speaker's goal with their financial updates is to share their journey transparently, discussing both successes and mistakes for learning and growth.

- 😀 A key strategy mentioned for beginners is starting with an accumulation plan of €200 per month, which has yielded positive results over time.

Q & A

What was the reason for the decrease in the ETF category in the speaker's portfolio?

-The decrease was mainly due to the categorization of the speaker's Credit Lombard loan under ETFs, which amounted to $75,000, affecting this category's value.

How did Tesla's stock impact the speaker's portfolio?

-Tesla's stock had a small positive impact, with a 0.2% increase in the 'stock' category due to its performance.

Why did the speaker's crypto portfolio experience a significant increase?

-The crypto portfolio increased by 7.5% due to the ongoing Bull Market, which positively affected the value of cryptocurrencies in the speaker's assets.

What emotional challenges does the speaker face regarding their investments?

-The speaker experiences anxiety due to the lack of liquidity in their portfolio, particularly around their crypto positions. They also express concern over the loans they have taken, which is a situation they haven't encountered before.

How did the speaker's real estate investments perform?

-The speaker's real estate investments had a positive performance, with the value of a property in Dubai increasing by over $150,000. Additionally, they are still waiting for the return of funds from two apartments in Bergamo.

What does the speaker plan to do in the upcoming month with their portfolio?

-The speaker plans to close some crypto positions and sell certain stocks, like Tesla, as part of a portfolio rebalancing strategy.

How does the speaker feel about the value of their cloud kitchen asset?

-The speaker has reduced the value of their cloud kitchen asset in the market to expedite the sale, acknowledging the lower value in this context.

What advice does the speaker give to others who are starting their investment journey?

-The speaker recommends a monthly accumulation plan, specifically the €200/month plan they are working on with their brother, as a solid starting point for newcomers to investing.

What is the speaker's perspective on the accuracy of their portfolio's value?

-While the speaker acknowledges that their portfolio's total value can fluctuate, they emphasize that their asset tracking reflects their actual situation, even if some assets, like their cloud kitchen, are less liquid and harder to value accurately.

How does the speaker plan to deal with the emotional stress of their financial situation?

-The speaker plans to manage their emotions by consulting friends who have faced similar situations and by staying committed to their financial plans despite the anxiety and challenges.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

What is Asset management? Importance of Asset management | Asset management softwares.

CRYPTO ALERT: I JUST FOUND SOMETHING...

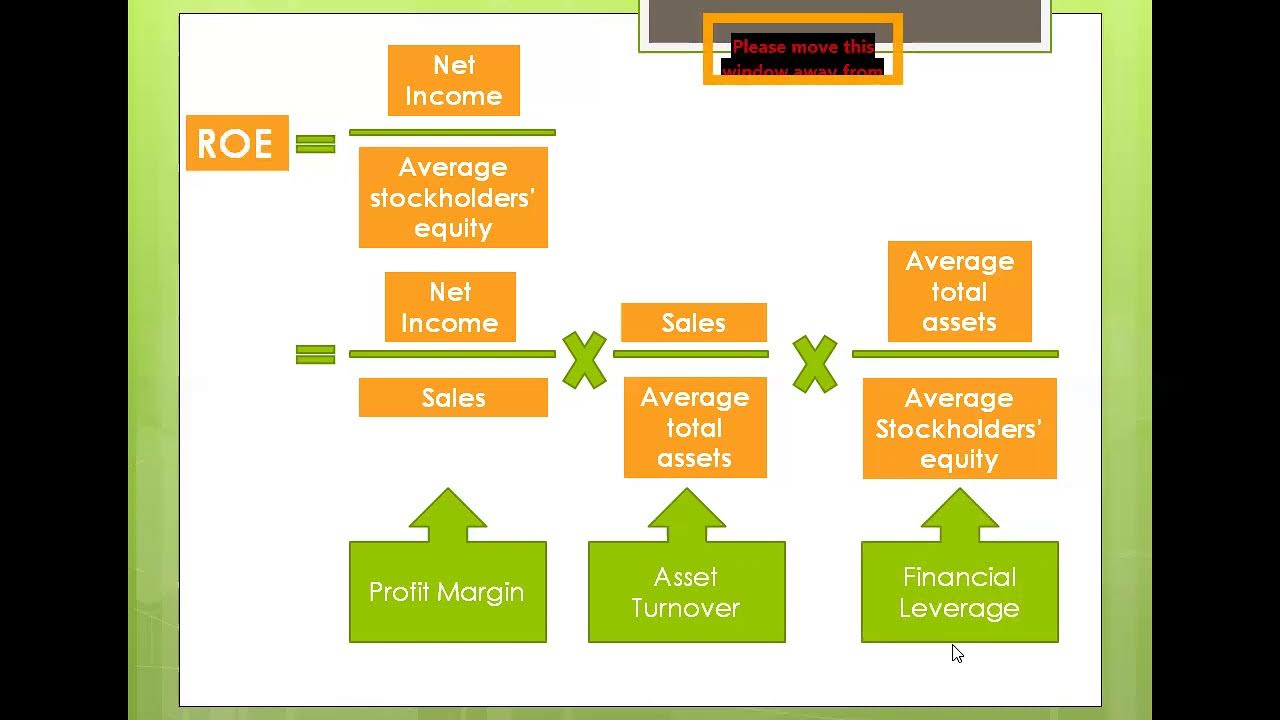

DuPont Analysis

15 Stocks BlockBuster Results - Good Time to Buy? Investment Works

materi Lembaga jasa Keuangan Kelas 10 Pertemuan 1

INTI ILMU : PENJELASAN SLIDE ALK LANJUTAN MEMAHAMI LK INDOFOOD

5.0 / 5 (0 votes)