What is a European Union AML Directive | 6MLD | Money Laundering Directive | AML Regulatory Scope

Summary

TLDRThe 6th EU Anti-Money Laundering (AML) Directive, released in December 2020, updates regulations to combat money laundering and terrorist financing across the EU. It introduces clearer definitions, expands the scope to include new offenses like cybercrime, and emphasizes stronger cross-border cooperation. The directive also imposes stricter penalties, raising the minimum prison sentence for money laundering offenses. All regulated industries must prepare by June 2021, updating policies and training employees to comply with the new rules. This video explains the key changes, their implications, and how businesses should get ready to meet the new compliance standards.

Takeaways

- 😀 The EU AML Directives aim to prevent money laundering and terrorist financing while promoting regulatory consistency across EU member states.

- 😀 The most recent EU AML Directive was released on December 3rd, 2020, with a compliance deadline set for June 3rd, 2021.

- 😀 The sixth EU AML Directive replaces the fifth and fourth directives, building on previous regulations and further enhancing the fight against money laundering.

- 😀 The sixth directive focuses on four key areas: expansion of regulatory scope, improved harmonization, cooperation among member states, and stricter criminal penalties.

- 😀 The definition of money laundering is now broader, holding accountable anyone who helps facilitate or attempt to launder money or finance terrorism.

- 😀 The sixth directive introduces 22 specific offenses that are now legally considered money laundering, including human trafficking, tax crimes, and cybercrimes.

- 😀 For the first time, cybercrimes have been included in the context of an anti-money laundering directive, requiring businesses to adjust their AML programs.

- 😀 The directive emphasizes better cooperation among EU member states when handling cross-border money laundering operations.

- 😀 Stricter criminal penalties are now in place, with the minimum prison sentence for money laundering offenses raised from one year to four years.

- 😀 Financial institutions and regulated businesses must update their AML policies and procedures in preparation for the June 2021 compliance deadline.

Q & A

What is the purpose of the EU AML Directives?

-The EU AML Directives aim to prevent money laundering and terrorist financing while creating a consistent regulatory environment across EU member states.

When was the most recent EU AML Directive released?

-The most recent EU AML Directive was released on December 3, 2020.

By when must EU member states transpose the 6th EU AML Directive into domestic legislation?

-The directive must be transposed into domestic legislation across all EU member states by June 3, 2021.

How does the 6th EU AML Directive differ from the previous directives?

-The 6th Directive replaces the 4th and 5th EU AML Directives and introduces updates such as an expanded regulatory scope, improved harmonization, better cooperation among member states, and stricter criminal penalties.

What does the 6th Directive mean by 'expansion of regulatory scope'?

-It clarifies the definition of money laundering, making sure that anyone enabling money laundering or financing terrorism, even if they don’t directly profit from it, is held legally accountable.

What types of crimes are now included under money laundering offenses according to the 6th Directive?

-The 6th Directive includes a list of 22 offenses, including human trafficking, tax crimes, cyber crimes, environmental crimes, and more, with cyber crimes being a new addition.

What is the significance of cooperation among EU member states in the 6th Directive?

-The directive promotes collaboration between EU countries to handle cross-border money laundering offenses, ensuring centralized legal proceedings and standardized judgments.

How does the 6th Directive affect criminal penalties for money laundering?

-The 6th Directive increases the minimum prison sentence for money laundering offenses from one year to four years, ensuring more consistent penalties across EU member states.

What steps should businesses take to comply with the 6th EU AML Directive before the June 2021 deadline?

-Businesses should familiarize themselves with the changes, update their internal AML policies and procedures, and train employees to prevent and detect the expanded list of money laundering activities.

Why is it important for businesses to adjust their AML programs under the 6th Directive?

-It is crucial because the 6th Directive introduces new categories of crimes and expands the scope of money laundering offenses, meaning businesses must ensure their compliance programs address these changes to avoid legal and financial penalties.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Tim Bennett Explains: Money Laundering - How the world's biggest financial crime affects you

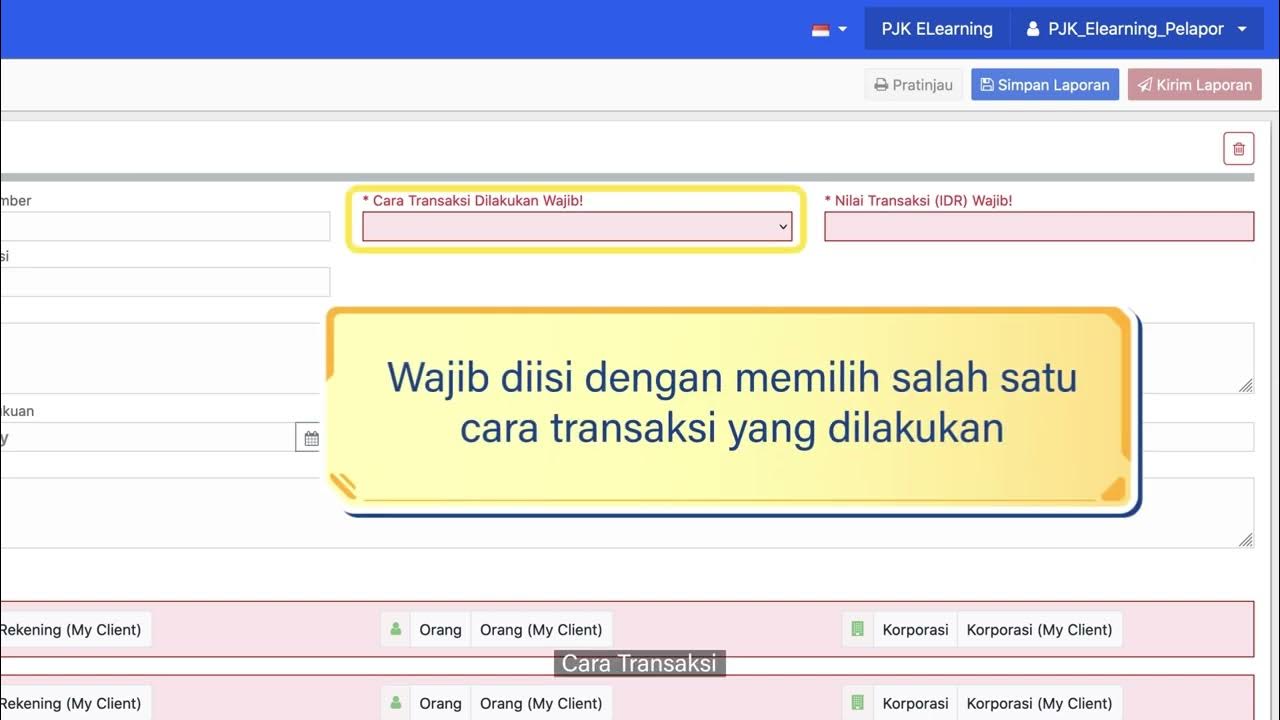

Tata Cara Penyampaian Pelaporan Transaksi Keuangan GoAML bagi Pihak Pelapor

Money Laundering Explained | PMLA Act, 2002 | ED | Recent Supreme Court Verdict |

The Golden Migration May Be on Borrowed Time

Regulasi Fintech di Indonesia

How Money Laundering Actually Works | How Crime Works | Insider

5.0 / 5 (0 votes)