Ep. 115 - We Sold Some Stocks!

Summary

TLDRIn this Market Radar podcast, the hosts offer a sneak peek into their latest Quant deck report, analyzing market trends and discussing the NASDAQ's performance. They highlight Nvidia's impressive earnings and stock split, and touch upon PMI data's impact on market volatility. The conversation delves into the growth and inflation indicators, revealing a slight decline in growth strength while remaining positive. The team at Market Radar emphasizes their data-driven approach, adjusting their portfolio strategy based on model signals rather than emotions or market narratives. They also discuss sector performances, particularly utilities, in the context of potential Fed rate cuts and the current high-rate environment.

Takeaways

- 📈 The podcast discusses a sneak peek into the latest Quant deck report, indicating a shift in market conditions that could impact portfolios.

- 💾 Nvidia's earnings report and subsequent stock split caused significant market movement, highlighting the impact of mega-cap companies on market trends.

- 📊 PMI data release influenced bond yields and contributed to market volatility, showing the importance of economic indicators on investment decisions.

- 📉 Concerns about overall market earnings growth are emerging, suggesting that not all companies may sustain their rapid growth rates.

- 🎯 The NASDAQ experienced significant fluctuations, opening at a new all-time high but with mixed performance across different companies.

- 📊 Market Radar's Quant models are data-dependent, focusing on capturing market trends without bias or emotional decision-making.

- 💹 The market is currently in a bullish trend with a risk-on regime, suggesting that market outcomes should be higher over time unless there's a significant shift.

- 💸 The VIX environment has changed, with less fear and elevated volatility, indicating a potential shift in market dynamics.

- 📉 The Aries model within the RQF model has reduced equity exposure due to the second layer growth index nearing zero, signaling potential elevated volatility.

- 📊 The regime map indicates a positive state for both growth and inflation, suggesting a bullish environment for most assets, excluding bonds.

- 🏆 Market Radar emphasizes the importance of data-driven models over personal opinions or market narratives, focusing on actionable insights.

Q & A

What is the main focus of the Market Radar podcast episode discussed in the transcript?

-The main focus of the episode is to provide a sneak peek into the latest Quant deck report, discuss the current market situation, and explain the actions taken by the Market Radar team in response to the market trends and data.

What significant event involving Nvidia was mentioned in the podcast?

-Nvidia announced earnings and a stock split, which caused a significant price action, including a reversal that was initially triggered by the company's performance and announcements.

What economic data release was mentioned as affecting the market's movement?

-The PMI (Purchasing Managers' Index) data release was mentioned as having an impact on the market's movement, as it sent yields up and contributed to market volatility.

How did the speaker describe the NASDAQ's performance during the week of the podcast?

-The speaker described the NASDAQ's performance as having a lot of up and down action, with a particular focus on the day when Nvidia's earnings and stock split announcement caused significant price movement.

What is the significance of the VIX environment mentioned in the podcast?

-The VIX environment is significant as it indicates the market's expectation of volatility. The speaker mentioned that the VIX environment has changed and is not staying elevated, suggesting a reduction in fear and hedging activities compared to previous periods.

What action did the Market Radar team take regarding their QQQ position according to the transcript?

-The Market Radar team sold out of their QQQ position by 45%, raising 45% of NAV into cash, in response to the market conditions and their models' signals.

What does the speaker mean by 'price discovery territory' in the context of the NASDAQ reaching a new all-time high?

-The term 'price discovery territory' refers to a situation where the market is at uncharted levels, and there is no historical reference point for pricing assets. It suggests that the market is in a phase where it is determining new values for assets.

What is the role of the 'Aries model' within the RQF model as described in the podcast?

-The Aries model is a three times leveraged long bonds or long equity model within the RQF model. It decides whether to go long on bonds or equities, and if there is no position, it stays in cash. It also has a second layer growth index filter to manage risk when growth expectations are choppy.

What is the significance of the growth index and second layer growth index in the Aries model?

-The growth index and its second layer are significant as they help determine the model's position sizing. When the second layer growth index reaches zero, the model takes some risk off the table, either reducing long equity exposure if the index is positive or long bond exposure if it is negative.

What does the speaker suggest about the current state of inflation and growth in the market?

-The speaker suggests that while growth has been weakening and inflation remains strong, it does not necessarily indicate an imminent shift to a stagflationary environment. The key is to monitor what happens next, as the market could potentially shift towards expansion or experience inflation weakness.

What is the speaker's view on the performance of the utilities sector being a deflationary signal?

-The speaker believes that the utilities sector's performance is not necessarily a deflationary signal. Instead, it is a reflection of the current environment where the Federal Reserve's policy rate is high, and there is potential for rate cuts, making utilities attractive due to their dividend yields.

How does the speaker describe the approach of Market Radar in terms of data dependency and risk management?

-The speaker describes Market Radar's approach as data-dependent, meaning they build and follow models that are unique and dynamic. They aim to manage risk by taking signals from the models without being influenced by emotions or biases, focusing on capturing returns and adjusting positions accordingly.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Equal-Weighted Benchmarks Outperform In Mixed Day; AVGO, ARGX, FNV In Focus | Stock Market Today

The Crypto Q4 Rally Is Coming! Market Check

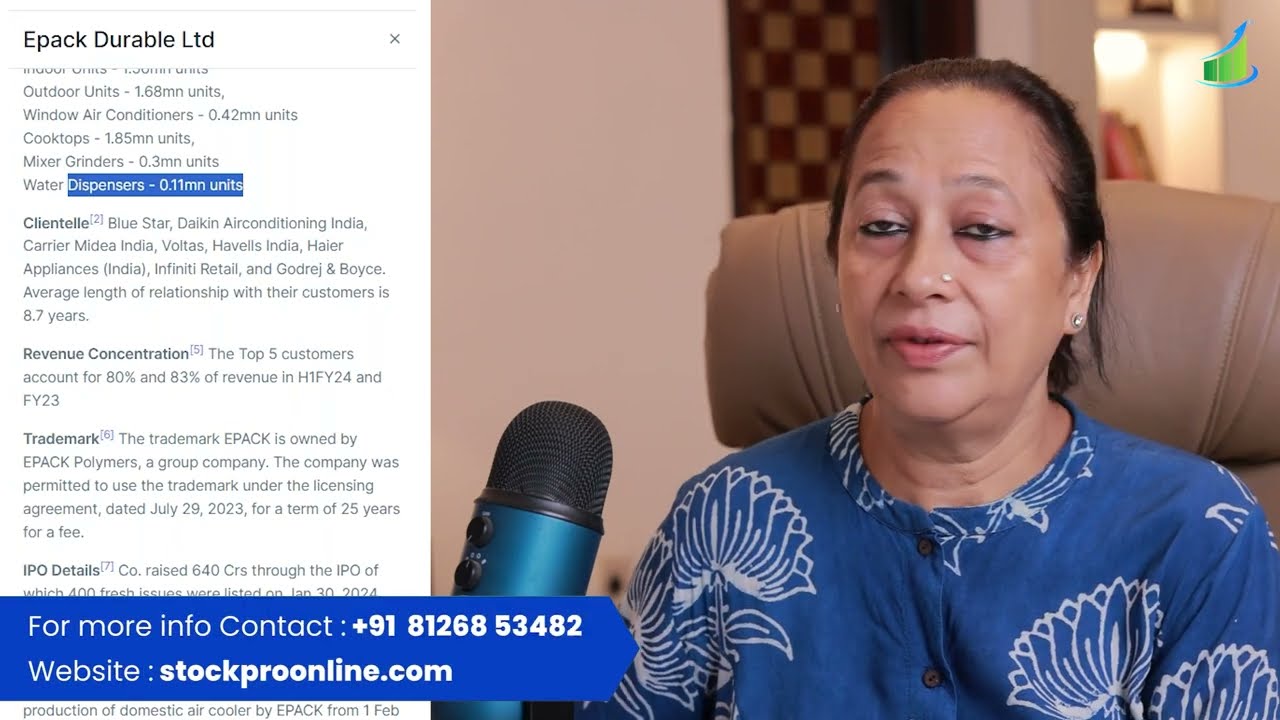

StockPro | 4 IPO STOCKS WITH STRONG BUILDUP'S ON RADAR

My New Strategy │ Road to Profitability Pt.27

Windows 11 IA : La FIN des PC Actuel ? - Tech Actu #161

Stock Market Index | by Wall Street Survivor

5.0 / 5 (0 votes)