Materi Siklus Akuntansi pembelajaran Berdifferensiasi. Mudah dipahami untuk belajar siswa KELAS X .

Summary

TLDRThis lesson introduces the accounting cycle in a service company, focusing on key steps like journalizing transactions, posting to the ledger, and preparing financial statements. Through an interactive quiz and a video, students are engaged in understanding how accounting ensures transparency and decision-making in business. The video explains how every financial transaction is recorded and analyzed, leading to comprehensive reports like the income statement and balance sheet. The lesson concludes with a motivational message, encouraging resilience and determination in the face of challenges, while reinforcing the importance of accounting in maintaining a company's financial health.

Takeaways

- 😀 Accounting is essential to the heart of a business, ensuring financial health and stability through accurate transaction tracking.

- 😀 Financial transactions, such as sales, receipts, and invoices, are the foundation of the accounting process.

- 😀 Source documents provide tangible evidence of financial activities and are vital for auditing and tracking.

- 😀 The process of journalizing involves recording transactions in a journal with details about accounts and amounts.

- 😀 Posting refers to transferring journal entries into the general ledger, where transactions are summarized for each account.

- 😀 Trial balances are used to verify the equality of total debits and credits, serving as a checkpoint for accuracy.

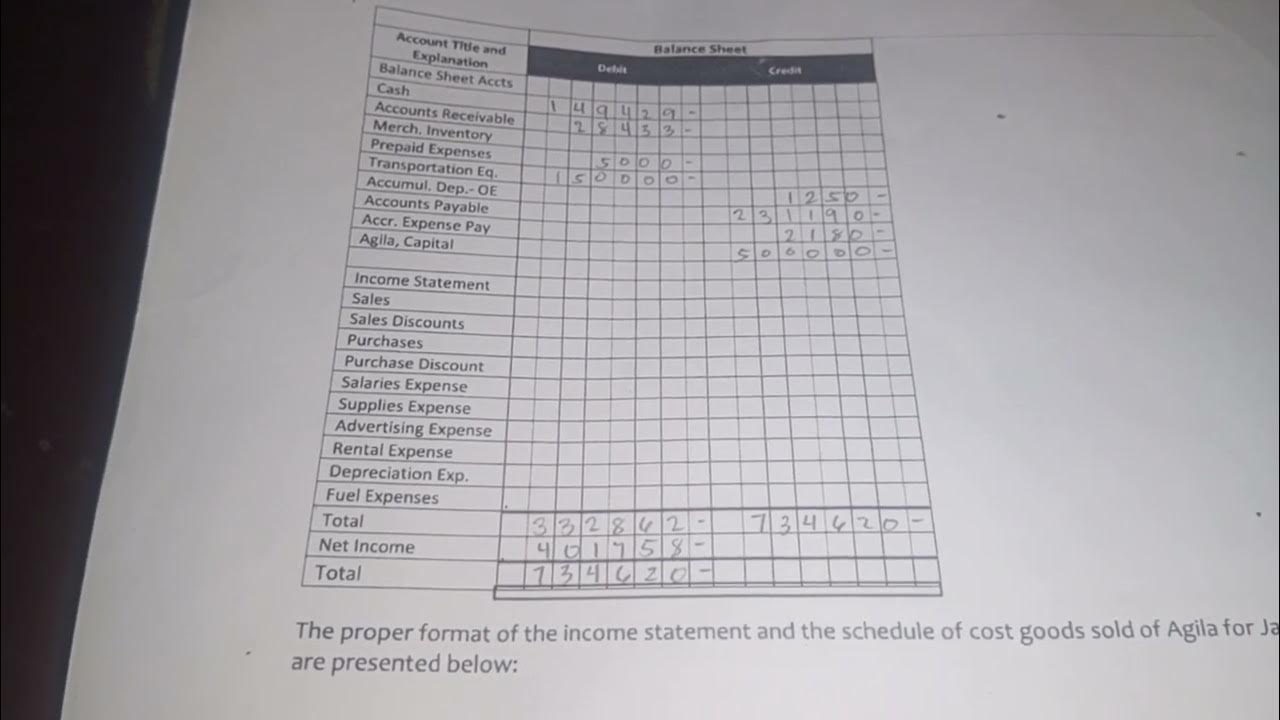

- 😀 Financial statements, including income statements, balance sheets, and cash flow statements, provide a clear overview of a company’s financial position.

- 😀 Closing entries reset revenue and expense accounts to zero, preparing for the next accounting period.

- 😀 The accounting cycle includes meticulous steps for recording, summarizing, and presenting financial transactions.

- 😀 Accounting is more than just record-keeping; it provides critical data for decision-making, planning, and evaluation within a business.

Q & A

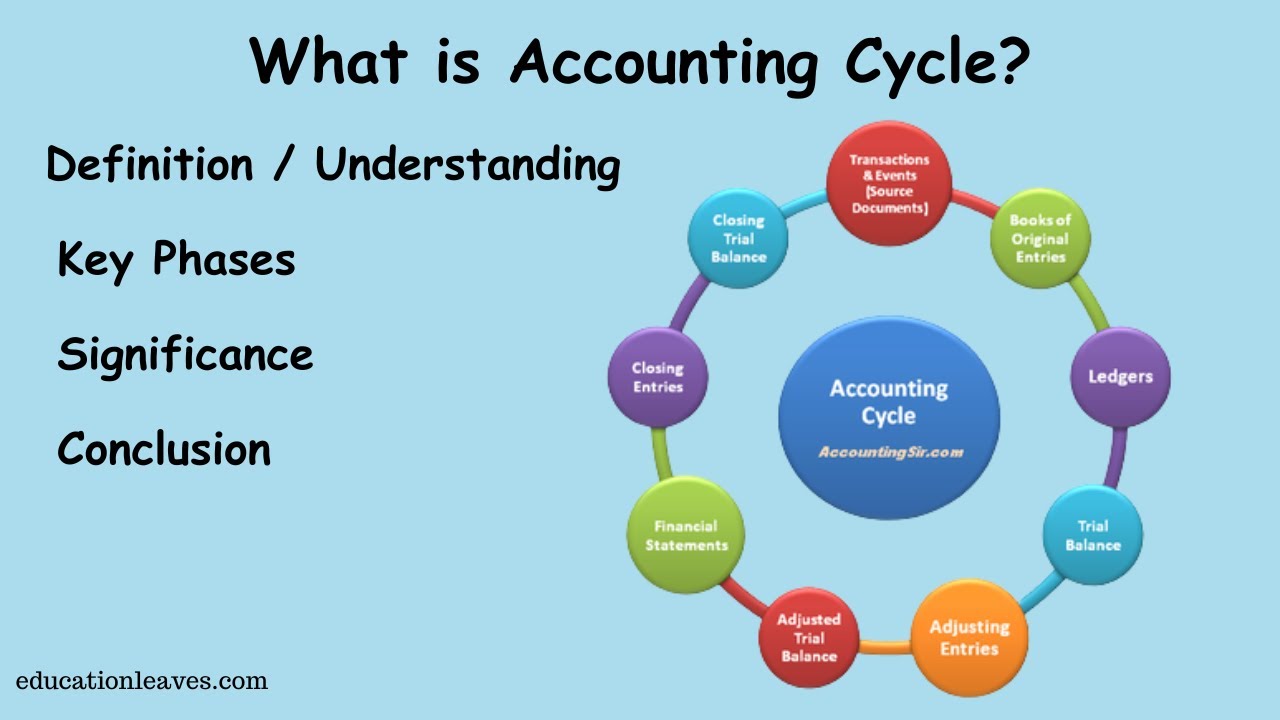

What is the primary purpose of accounting in a business?

-The primary purpose of accounting in a business is to record, summarize, analyze, and present financial transactions, ensuring accountability, transparency, and accuracy in the company's financial dealings.

What are source documents in the accounting process?

-Source documents are tangible records of financial activities, such as sales receipts, invoices, purchase orders, and bank statements. They serve as the evidence of transactions and help auditors track financial activity.

What is the significance of journalizing in accounting?

-Journalizing is the process of recording transactions in the company's books. Each entry details the accounts affected and the amounts debited or credited, serving as a foundation for future financial analysis.

What is the general ledger, and how does it relate to the journal?

-The general ledger is a master document that summarizes all the transactions related to a specific account. It is where the journal entries are posted to, providing a complete record of all financial activities within a business.

What is the purpose of trial balances in accounting?

-Trial balances are used to verify that the total debits equal the total credits. This process ensures that financial records are accurate and balanced before moving forward with financial statement preparation.

What types of financial statements are prepared after the trial balance?

-After the trial balance is confirmed, financial statements are prepared, including the income statement, balance sheet, and cash flow statement. These reports offer a comprehensive overview of a company's financial health and performance.

What are closing entries in the accounting cycle?

-Closing entries are made at the end of an accounting period to reset revenue and expense accounts to zero. This prepares the accounts for the next accounting period, much like resetting a stopwatch.

How does accounting contribute to decision-making in a business?

-Accounting provides crucial data that helps managers plan, control, and evaluate business operations. It offers insights into profitability, liquidity, and financial stability, guiding strategic decisions and shaping the future of the company.

Why is accounting compared to the heartbeat of a business?

-Accounting is often referred to as the heartbeat of a business because it consistently monitors and reports the financial health of a company, ensuring the organization remains financially stable and able to make informed decisions.

What is the importance of accounting for stakeholders?

-Accounting is vital for stakeholders as it provides them with clear and reliable information about a company's financial performance. It helps stakeholders assess the company's profitability, liquidity, and overall stability, influencing their investment and business decisions.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Accounting Cycle - Definition, Example, 9 Steps of Accounting Cycle

Accounting Cycle Step 1: Analyze Transactions

Financial Analysis in Arabic - 04 1080p

Ekonomi Kelas XII Bab 3: Siklus Akuntansi Perusahaan Jasa Tahap Pencatatan (Part 1)

What is Accounting cycle? | Key phase, Significance of Accounting cycle

November 15, 2024

5.0 / 5 (0 votes)