SAIGEx | bb strategy

Summary

TLDRIn this video, the trader shares a detailed strategy for effective scalping using Bollinger Bands and trendlines, emphasizing risk management and patience. They caution against using full margin with small accounts and advise on starting with smaller positions to reduce exposure to floating losses. The trader also highlights the importance of avoiding one-minute time frames and instead focusing on higher time frames for more reliable setups. With a blend of technical analysis and psychological insights, they stress the need for discipline, emphasizing that success comes through consistent, well-managed trades rather than quick profits.

Takeaways

- 😀 Patience is key in trading: Waiting for the right setups, such as breakouts or retests, is essential to successful trades.

- 😀 Avoid using small time frames like the 1-minute chart for trading; instead, focus on higher time frames like H4 and H1 for better trend accuracy.

- 😀 Risk management is crucial: Small position sizes (e.g., 10-20 cents) help limit floating losses and prevent large account drawdowns.

- 😀 The Bollinger Bands can be used to time entries, especially when the price touches the bands after a breakout or retest.

- 😀 Trend lines are an essential tool for identifying breakout points, and they should be drawn accurately to maximize profits.

- 😀 Don’t go full margin on small accounts: Use incremental position sizes to manage risk and avoid getting wiped out by floating losses.

- 😀 Patience pays off: Even though waiting for the right moment to trade can be difficult, it ultimately leads to better outcomes.

- 😀 A strong trading mindset requires discipline to avoid the temptation of quick profits or emotional decisions.

- 😀 Risk tolerance should be adjusted based on account size, and traders should always consider the potential impact of floating losses.

- 😀 Building a trading community through social media can help support your growth, as the creator encourages viewers to share his content for broader reach.

Q & A

What is the role of Bollinger Bands in the trading strategy discussed in the video?

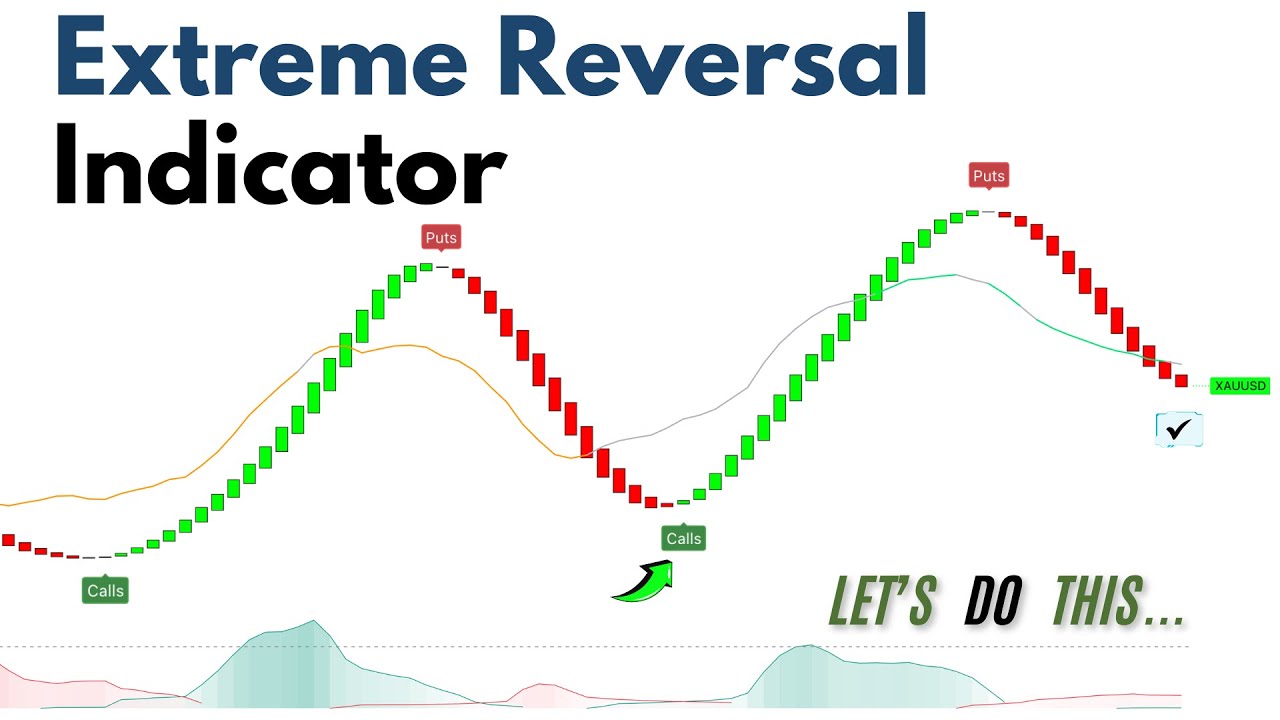

-Bollinger Bands are used to identify breakout opportunities and retests. The speaker suggests using them in combination with trendlines. A breakout above or below a trendline followed by a retest of the Bollinger Bands (either the upper or lower band) can serve as a signal to enter the market.

Why does the speaker emphasize patience when trading?

-The speaker stresses patience because trading involves waiting for the right setups, such as trendline breakouts and Bollinger Band retests. Quick trades or impulsive decisions can lead to losses, especially in highly volatile markets. The speaker highlights the challenge of waiting for price spikes, which can be difficult but are essential for successful trading.

What advice does the speaker give regarding trading timeframes?

-The speaker advises against using very short timeframes like the 1-minute chart, as it increases the risk of losses due to frequent price fluctuations. Instead, they recommend using higher timeframes, such as the H4 (4-hour) or H1 (1-hour) charts, which tend to provide more reliable signals and reduce emotional decision-making.

What is the significance of using smaller position sizes in trading?

-Using smaller position sizes allows traders to manage risk more effectively, especially with smaller accounts. By avoiding full margin trading, traders can limit their losses if the market moves against them. Smaller positions give traders more flexibility and reduce the risk of blowing up their accounts.

What is the impact of greed on trading, according to the speaker?

-Greed can lead to impulsive decisions and excessive risk-taking, often resulting in significant losses. The speaker reflects on their own experiences of greed and stresses that it’s crucial to avoid chasing the market or making decisions based on emotions, particularly after experiencing successful trades.

How does the speaker suggest handling floating losses in trading?

-The speaker suggests being patient and not exiting trades too early. If the market moves against the trade, floating losses can be managed by not panicking. The idea is to wait for the price to either reverse or reach a target, without letting emotions dictate the decision.

What does the speaker mean by 'flipping small accounts'?

-Flipping small accounts refers to the practice of starting with a small amount of money (such as cents) and turning it into a larger sum through successful trades. The speaker uses this term to describe their ability to grow small accounts into bigger ones, but also acknowledges the risks involved.

Why does the speaker advise against trading the 1-minute time frame?

-The speaker advises against using the 1-minute time frame because of its extreme volatility. Small timeframes often lead to rapid price fluctuations, making it difficult to make accurate predictions. This can cause traders to make hasty decisions and incur significant losses.

What is the importance of trendlines in the trading strategy shared in the video?

-Trendlines are crucial for identifying key price levels and breakouts. The speaker uses trendlines to determine where price may reverse or continue in a given direction. A breakout from a trendline often signals the start of a new trend, and the speaker uses these breakouts in combination with Bollinger Bands for entry points.

What does the speaker recommend for traders who want to learn the strategies mentioned in the video?

-The speaker recommends practicing with demo accounts to gain experience before going live. They also suggest subscribing to their channel, following their educational content on platforms like WhatsApp and Telegram, and focusing on mastering trendline drawing and Bollinger Band usage.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Powerful swing or scalp strategy tuned for minimal drawdown and consistent results!

Reversal Easy Setup, Quick Profit: My Simple Trading Secret!

The ONLY Trading Strategy You Need for 2026

O melhor sistema de scalp para criptomoedas que você vai encontrar no youtube

The Only Strategy I’ve Used For 10 Years (Proven)

MHV Trading Strategy(BBMA Oma Alley)

5.0 / 5 (0 votes)