A MÁGICA dos R$10 MIL REAIS FUNCIONA MESMO? (Testei na prática)

Summary

TLDRThe video explains how reaching the first R$ 1,000 can be a transformative milestone for many people. It introduces the concept of compound interest and how time plays a crucial role in growing investments. Through a detailed example using the SELIC rate, the video demonstrates how consistent monthly contributions, even small amounts, can accumulate significantly over time. It emphasizes the power of compound interest and how increasing contributions over the long term can lead to exponential financial growth. Viewers are encouraged to start investing early and make their money work for them, regardless of the amount.

Takeaways

- 😀 Reaching your first R$ 1,000 is a significant milestone for most people, and it can mark the beginning of your financial growth.

- 😀 The key to wealth building is not just about how much you invest, but also how long you leave your money invested. Time is the most influential factor in compounding interest.

- 😀 Compound interest works exponentially, meaning the longer you leave your money invested, the greater the returns will be, due to the compounding effect.

- 😀 A formula for compound interest reveals that the amount of money you accumulate is a product of the initial investment, the interest rate, and the time the money is invested.

- 😀 The longer you invest, the less time it takes to make additional returns, as your money starts generating more interest over time.

- 😀 A realistic and tangible example using the SELIC rate (9.12% annual) shows how a consistent investment of R$ 200 per month can accumulate over time, even without high-risk investments.

- 😀 Time is crucial: once you accumulate a certain amount, it becomes easier and faster to accumulate more, due to the snowball effect of compound interest.

- 😀 Starting small can still lead to significant growth over time. Even if you can only invest a small amount each month, consistency will lead to big returns in the long run.

- 😀 It’s important not to chase high-risk, high-return investments but to focus on steady, consistent investing over time with realistic expectations.

- 😀 Regardless of how much you can invest initially, the key is to start now and make it a habit, as the earlier you begin, the greater the benefits of compounding over the years.

Q & A

What is the significance of reaching your first R$1,000 in the script?

-Reaching your first R$1,000 is seen as a crucial milestone because it represents the point at which the power of compound interest starts to make a noticeable difference. It marks the beginning of long-term financial growth through smart investing and saving.

Why does the script emphasize the importance of time in compound interest?

-The script highlights time as the most critical variable in the formula for compound interest because it is the exponent in the formula. The longer your money is invested, the more it compounds, leading to exponentially higher returns over time.

What formula does the script refer to when explaining how investments grow?

-The formula referred to is the compound interest formula: M = C * (1 + i)^t. Here, M is the final amount (montante), C is the capital invested, i is the interest rate, and t is the time the money is invested.

Why does the video use the SELIC rate as the basis for the investment simulation?

-The video uses the SELIC rate because it is a realistic and easily accessible benchmark for most investors. The SELIC rate reflects the average return on low-risk investments like the Treasury SELIC or CDBs, making it a more relatable example for viewers.

How long does it take to accumulate R$10,000 according to the simulation?

-The simulation shows that with an investment of R$200 per month and a return of 9.12% annually (after taxes), it would take approximately 43 months to accumulate the first R$10,000.

What happens to the time it takes to accumulate money as the balance increases?

-As the balance grows, the time required to accumulate additional amounts decreases. For example, it takes 43 months to reach R$10,000, but only 33 months to reach the next R$10,000, and 26 months to reach R$30,000. This is due to the compounding effect.

What is the concept of 'compound interest snowball' discussed in the video?

-The 'compound interest snowball' refers to how the growth of your investments accelerates over time. As your investment grows, the interest earned also grows, leading to faster accumulation of wealth. This effect is amplified as the principal increases.

How much time would it take to go from R$100,000 to R$200,000, according to the video?

-The video illustrates that after reaching R$100,000, it would only take around 80 months (approximately 6.5 years) to accumulate an additional R$100,000, showcasing the effect of compound interest over time.

Why is the script's focus on long-term investing rather than chasing high returns?

-The script emphasizes that the key to growing wealth is consistent investment over time, not relying on high-risk, high-return investments. Time, consistent contributions, and a reasonable return are the real drivers of financial growth.

How does the script address inflation when discussing investment returns?

-While the script does not account for inflation directly, it acknowledges that the value of money will decrease over time, meaning that the purchasing power of R$1,000 today will not be the same in the future. It suggests that a real interest rate, accounting for inflation, is necessary to understand the true growth of investments.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

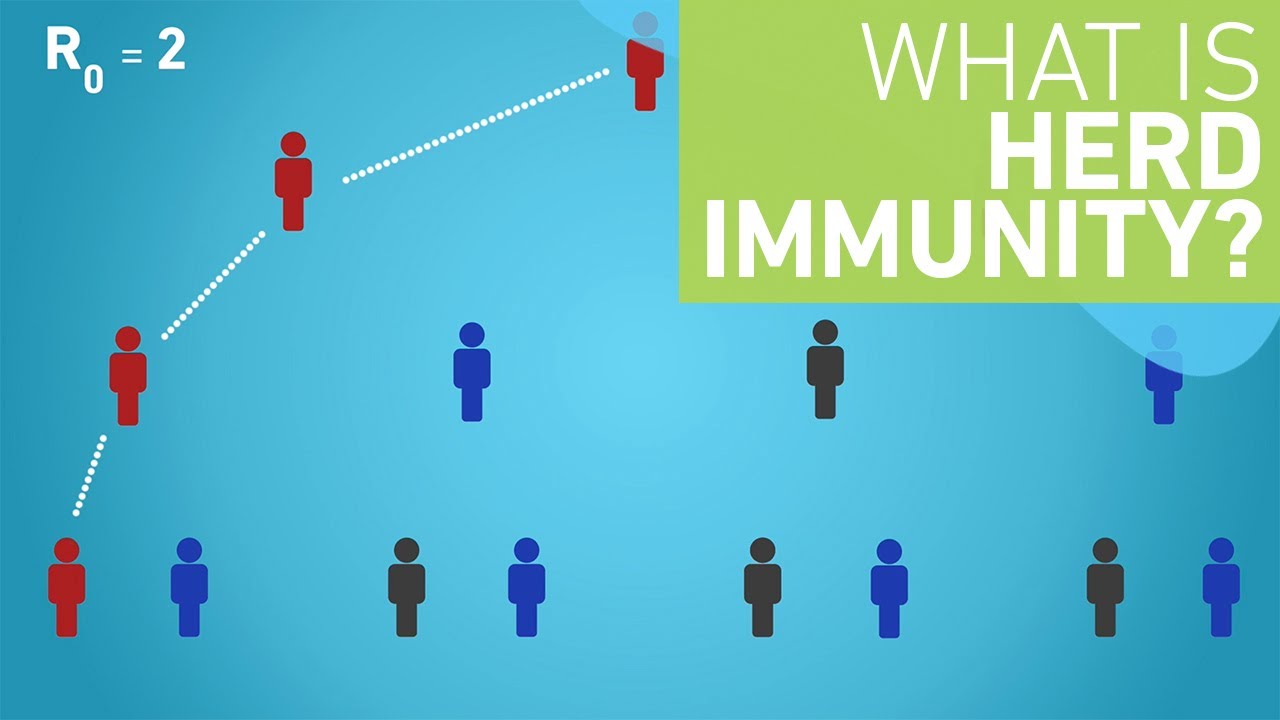

What is Herd Immunity?

Meet the Captain of the world's first container vessel sailing on green methanol

RENDA PASSIVA COM CRIPTO - COMO GANHAR 1000 REAIS POR MÊS - ENGANAÇÃO? MOSTREI OS DADOS!

Why EVERYTHING Changes After $20,000

Why Your First 100K Is Hard But Your First MILLION Is Easy!

Warum DEIN Depot ab 100.000 Euro EXPLODIERT!

5.0 / 5 (0 votes)