How to Profit in Trending Markets (ICT Scalping Strategy)

Summary

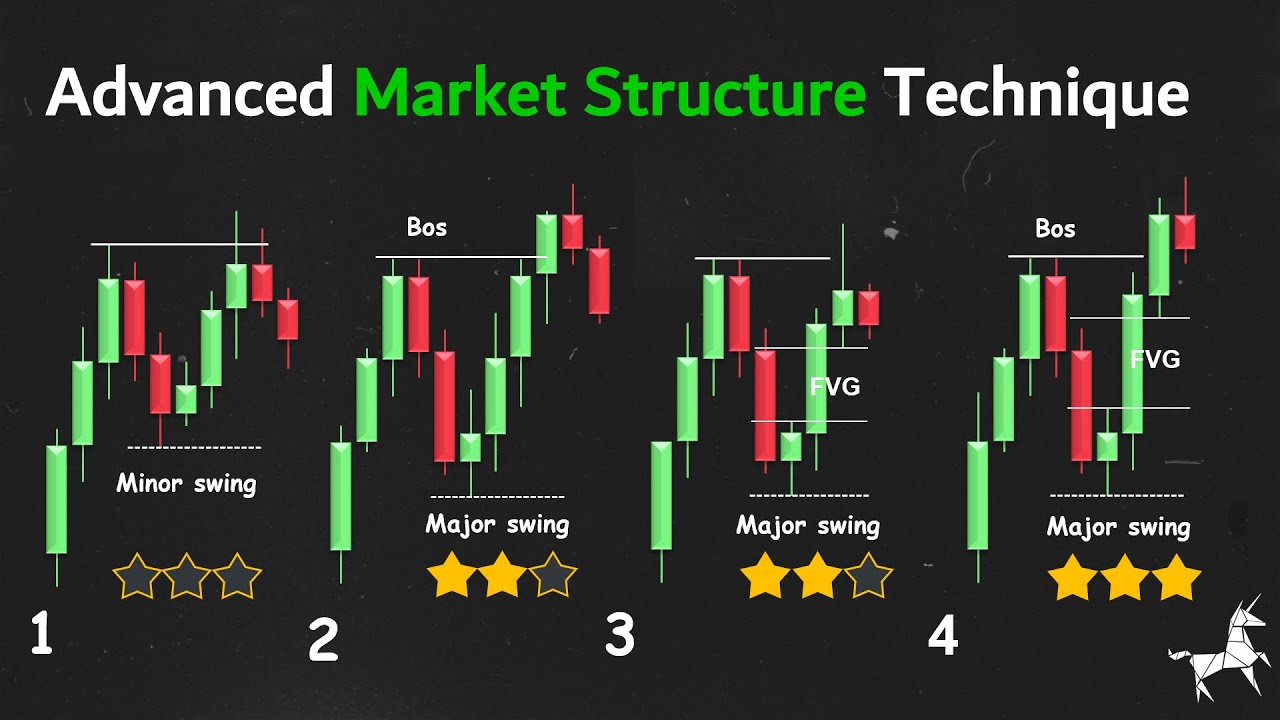

TLDRThis video delves into effective trend continuation strategies for forex traders, focusing on entry models, liquidity analysis, and risk management. The presenter emphasizes the importance of waiting for price action confirmation, particularly using Fair Value Gaps (FVGs) and Optimal Trade Entry (OTE) techniques. By marking key levels like the 0.5 Fibonacci and recognizing liquidity sweeps, traders can pinpoint optimal entry points with tight stop losses. The video also highlights patience and market timing, with insights into session-specific liquidity dynamics and adjusting targets for risk mitigation as trends develop.

Takeaways

- 😀 Always assess liquidity targets before entering a trade to ensure a clear and favorable market direction.

- 😀 Use larger timeframe macros to understand the overall market structure and decide whether a trend continuation is likely.

- 😀 Focus on entering trades at favorable levels within the market, such as at the 0.5 Fibonacci retracement for better risk-to-reward ratios.

- 😀 Keep your stop losses tight by placing them just above or below recent swing highs or lows, depending on your entry point.

- 😀 Avoid using wide stop losses; they increase your risk unnecessarily. Tight stop losses are preferable for better risk management.

- 😀 The ideal target for trend continuation trades is often a 1:1 risk-reward ratio, such as a 10-handle target for quick exits.

- 😀 Patience is crucial in trend continuation; wait for the market to reach your optimal entry point before making a move.

- 😀 In choppy market conditions, like during the Asian session, be cautious and wait for clearer signals in the London or New York sessions.

- 😀 When entering after a liquidity sweep, look for confirmation of rejection at fair value gaps or inversion gaps before executing the trade.

- 😀 Always use a dealing range to mark important levels such as the 0.25 and 0.5 Fibonacci levels for better entry timing and trade execution.

Q & A

What is the primary focus of the video?

-The video focuses on trend continuation trading strategies, particularly how to identify, enter, and manage trades in trending markets. The content aims to help traders enter trends after missing the initial reversal or setup by using concepts like liquidity, macros, and optimal entry points.

Why is it important to consider liquidity when trading trend continuations?

-Liquidity is crucial in trend continuation trading because it shows where market participants are active, helping to identify areas where price may react or move in the expected direction. Focusing on liquidity zones, such as relative equal highs/lows, increases the probability of successful trades.

What does the speaker mean by 'dealing range' in the context of trend continuation?

-A 'dealing range' refers to the price range between a swing low and swing high, which is used to assess price action and potential entry points. Traders identify the 0.5 Fibonacci level within this range to help time their entries during pullbacks in a trending market.

What are 'macros' and why are they significant in trend continuation trading?

-Macros refer to significant time frames or broader market contexts (such as larger price swings or key economic events). They are significant because they can influence market direction and liquidity. Entering trades close to these macro levels increases the likelihood of capturing a trend continuation.

How does the speaker suggest handling stop placement in trend continuation trades?

-The speaker suggests placing stops just above or below significant swing highs or lows, depending on the direction of the trade. A tight stop is preferable, especially when entering early in the move, to manage risk effectively and increase the risk-to-reward ratio.

What role does patience play in successful trend continuation trading?

-Patience is crucial for waiting for the ideal setups and allowing price to reach the optimal levels before entering a trade. Rushing into trades without proper setup or confirmation increases the risk of failure. The video emphasizes waiting for clear signs of price action that confirm the continuation of the trend.

What is an 'Optimal Trade Entry' (OTE) and how does it factor into the strategy?

-An Optimal Trade Entry (OTE) is an entry strategy based on price retracing to key Fibonacci levels (like the 0.5 or 0.618 levels) within a larger trend. The strategy involves waiting for price to pull back into these levels for more favorable entries with tighter stops, increasing the probability of successful trades.

How should traders handle market conditions during different sessions (e.g., Asian, London, New York)?

-Traders should adjust their strategies based on market conditions during different trading sessions. For example, during the Asian session, it's better to wait for a clearer market structure and avoid entering trades too early, while in the London or New York sessions, more significant liquidity moves may offer clearer entry opportunities.

What is the significance of 'Fair Value Gaps' (FVG) in identifying entry points?

-Fair Value Gaps (FVG) refer to areas on the chart where price moves quickly, creating an imbalance between buying and selling activity. These gaps act as potential entry points for trend continuation, as price often retraces to fill these imbalances before continuing in the direction of the trend.

Why does the speaker recommend entering a trade closer to the beginning of the move rather than later in the trend?

-Entering closer to the beginning of the move reduces risk and improves the risk-to-reward ratio. When entering later in the trend, the risk increases because the price is further from key support or resistance levels, making it harder to predict price movement with certainty.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade Now5.0 / 5 (0 votes)