Quantitative Finance - Course Introduction

Summary

TLDRThis course on Quantitative Finance, taught by Ensign Gupta from IIT Kanpur, offers a comprehensive exploration of mathematical, statistical, and computational techniques applied in finance. The syllabus covers topics like portfolio analysis, risk management, derivatives, and time-series econometrics. The course emphasizes practical application over theory, focusing on minimizing risk rather than maximizing profits. Students will learn how to utilize tools like stochastic processes and Monte Carlo simulations for financial modeling and optimization. The course also includes recommended textbooks for deeper study and encourages independent research for a thorough understanding of the field.

Takeaways

- 😀 The course on Quantitative Finance at IIT Kanpur will focus on both tools and their applications in finance, with emphasis on practical uses rather than deep theoretical proofs.

- 😀 Key quantitative techniques covered will include mathematical, statistical, and computational methods such as regression analysis, simulation techniques, and optimization.

- 😀 The course will introduce topics like portfolio analysis, derivative pricing, interest rates, and risk management, focusing on their real-world applications in finance.

- 😀 Risk minimization is the central theme of the course, with methods like Value-at-Risk (VaR) and Conditional Value-at-Risk (CVaR) explored in detail.

- 😀 The syllabus includes econometric techniques such as linear regression, multiple regression, and time-series analysis to model and analyze financial data.

- 😀 Derivative products like forward contracts, futures, and options will be explained, with an emphasis on understanding their role in reducing financial risks.

- 😀 The course will discuss optimization methods like Lagrangian, dynamic programming, and robust optimization to help manage financial portfolios effectively.

- 😀 Real-world risk management topics such as operational risk, multi-period risk analysis, and copula theory will be covered to address complex financial challenges.

- 😀 The course will not focus on stock market investing or fundamental analysis but will instead concentrate on understanding and applying quantitative finance techniques.

- 😀 Recommended textbooks for further reading include works by Prasanna Chandra, John Hull, William Sharpe, and Stephen Blythe, offering a broad range of insights into quantitative finance.

- 😀 The course will be taught using PowerPoint presentations, supplemented by board work and computer demonstrations to illustrate key financial models and concepts.

Q & A

What is the main focus of the Quantitative Finance course?

-The course focuses on understanding the tools and techniques used in quantitative finance, such as mathematical, statistical, and computational methods, and their application to real-world financial problems like portfolio optimization, risk management, and derivative pricing.

What are the two main components of the course syllabus?

-The syllabus is divided into two major components: 1) Quantitative Techniques, which include mathematical, statistical, and computational tools; 2) Financial Applications, which focus on how these tools are applied to areas like portfolio analysis, risk management, and pricing of financial derivatives.

What type of risk management concepts will be covered in the course?

-The course will cover several types of risk management concepts, including the use of **copulas** for multivariate risk modeling, **conditional value-at-risk (CVaR)**, and the analysis of different types of financial risks such as market risk and operational risk.

What are some of the mathematical and computational techniques mentioned in the syllabus?

-The syllabus includes techniques such as **stochastic processes**, **Monte Carlo simulations**, **stochastic programming**, **dynamic programming**, and methods like the **Newton-Raphson** and **Lagrangian** approaches for optimization.

How does the course approach the teaching of quantitative finance tools?

-The course will use a combination of PowerPoint-based lectures, case studies, and practical examples. In addition, external resources such as websites with real-world financial data will be introduced to help students learn how to apply these techniques in real financial situations.

Will the course include practical applications, and if so, which areas of finance will be covered?

-Yes, the course will include practical applications in areas such as **portfolio optimization**, **derivative pricing** (including options, futures, and forwards), and **stock price forecasting**. It will emphasize using tools to solve real-world financial problems.

What are the key topics in portfolio optimization covered in the course?

-The course will cover portfolio optimization techniques including the **mean-variance optimization** (Markowitz), the **Capital Asset Pricing Model (CAPM)**, and the **Efficient Frontier**, which helps to find the optimal balance of risk and return in a portfolio.

What is the role of time series analysis in this course?

-Time series analysis will be used to model and forecast financial data, such as stock prices and interest rates. Techniques like **ARIMA models** and **GARCH models** will be introduced to help predict market trends and optimize portfolios based on historical data.

What is the primary difference between this course and a stock market investment course?

-This course focuses on **quantitative finance techniques** and their application to **portfolio optimization**, **risk management**, and financial modeling, rather than stock market strategies based on **fundamental** or **technical analysis**. It is not aimed at individual stock picking or trading.

What textbooks or resources are recommended for students taking this course?

-Recommended textbooks include works by **Prasanna Chandra** on financial markets, **David G. Luenberger** on operations research, **John C. Hull** on options and futures, and **Stephen Blythe** and **David Ruppert** on quantitative finance and statistics. Students are also encouraged to explore online resources for further learning.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Machine Learning And Deep Learning - Fundamentals And Applications [Introduction Video]

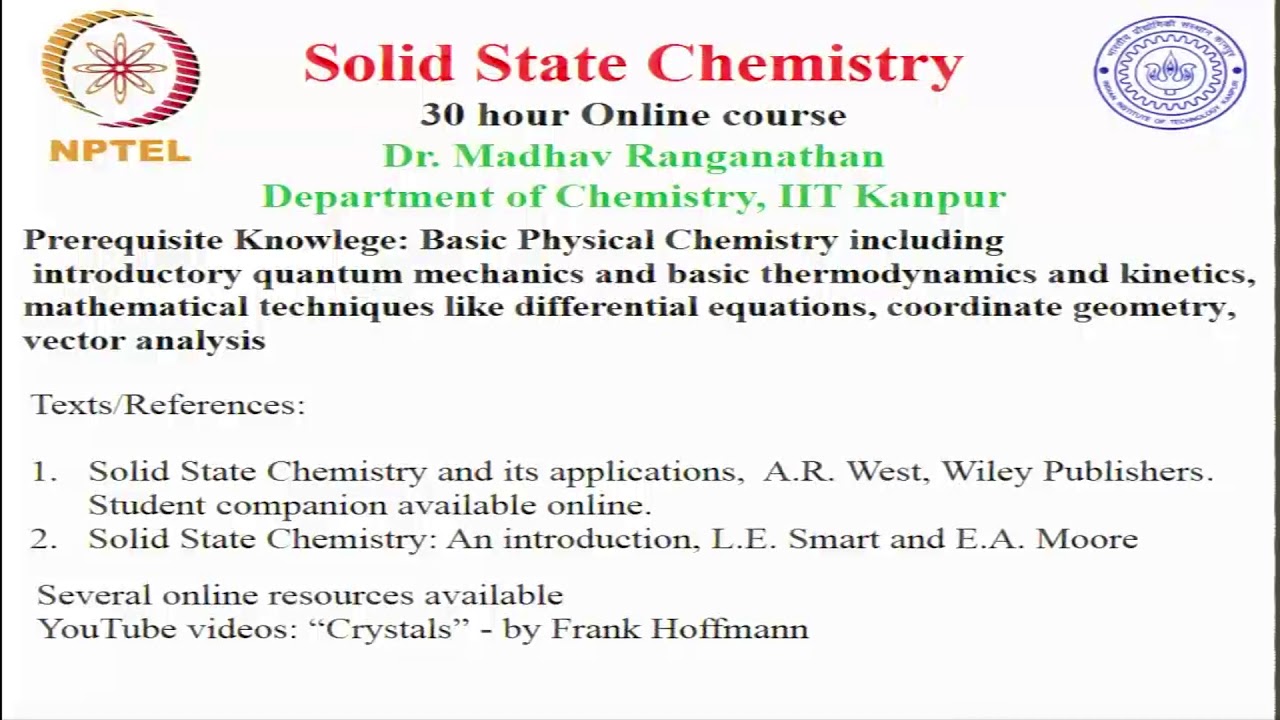

noc19-cy16-Introduction-Solid State Chemistry

Undergrad Courses and Books to Prepare for Quant Masters

Intro - Corrosion Failures And Analysis

PR2 - Introduction to Quantitative Research: Definition of Quantitative Research

Lecture Series on Quantum Mechanics - Beginner to Advanced ❤️

5.0 / 5 (0 votes)