STOP! Why You Shouldn't Do a Roth Conversion

Summary

TLDRThis video dives into the nuances of Roth conversions, tax brackets, and how they affect retirement planning, particularly in relation to Medicare's IRMA surcharge and Social Security taxation. It explains the importance of timing Roth conversions, considering future tax brackets, and avoiding pitfalls like the 'Social Security tax torpedo.' The discussion emphasizes proactive planning to manage taxes efficiently during retirement, particularly before Required Minimum Distributions (RMDs) or Social Security kick in. The key takeaway is to ensure strategies are customized to individual financial circumstances to maximize tax savings and avoid unnecessary costs.

Takeaways

- 😀 Roth conversions can be a tax-saving strategy, but they require careful consideration of future income and tax brackets to avoid paying unnecessary taxes.

- 😀 Medicare surcharges (IRMAA) apply when your Modified Adjusted Gross Income (MAGI) exceeds certain thresholds, and they can increase your overall retirement healthcare costs.

- 😀 The IRMAA surcharge starts at $83 per month for Part B and Part D premiums when your income exceeds $206,000 for married couples ($103,000 for single filers).

- 😀 Roth conversions might trigger higher Medicare premiums, so it's important to account for IRMAA when planning conversions to avoid costly surprises.

- 😀 Social Security benefits are taxed based on your provisional income, and doing Roth conversions could inadvertently increase your taxable income, resulting in more of your Social Security being taxed.

- 😀 It's important to plan Roth conversions carefully to avoid the Social Security 'tax torpedo,' where you end up paying more than expected due to higher income thresholds.

- 😀 Qualified Charitable Distributions (QCDs) allow retirees to donate up to $100,000 directly from an IRA to a charity, reducing taxable income after age 70½.

- 😀 Required Minimum Distributions (RMDs) start at age 73 (or 75, depending on birth year), and strategic Roth conversions before then can help reduce future RMDs.

- 😀 The IRS allows for proactive adjustments to IRMAA surcharges, such as filing form SSA-44 to adjust for income fluctuations from previous years to avoid unnecessary premium hikes.

- 😀 Roth conversions are a great tool for some, but they may not be beneficial for everyone. For some, converting too much too early can result in unnecessary tax burdens in the long run.

- 😀 Effective tax planning is key to retirement, and working with a tax professional can help you optimize your conversion strategy to avoid pitfalls like the tax torpedo and IRMAA surcharges.

Q & A

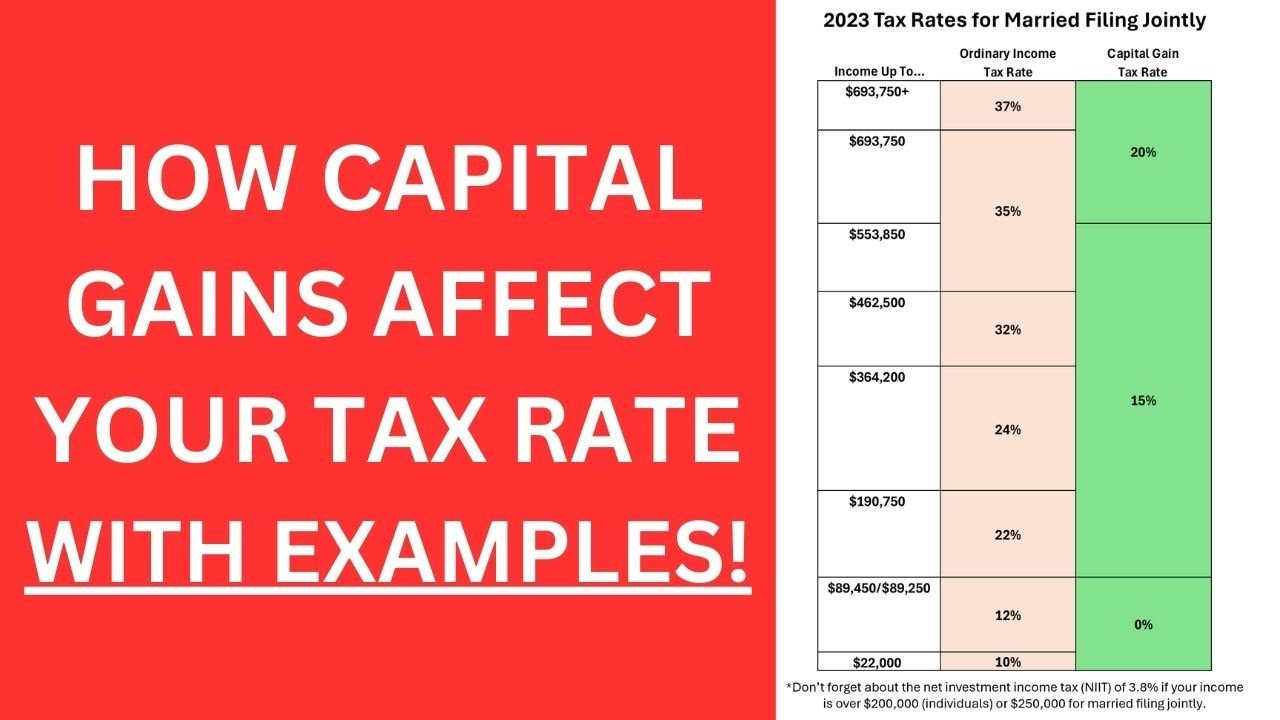

What is the importance of understanding your marginal tax bracket when planning Roth conversions?

-Understanding your marginal tax bracket helps determine how much you can convert into Roth IRAs without pushing yourself into higher tax rates. The goal is to fill up lower tax brackets before jumping into higher ones, which can save you money over the long term.

How can Roth conversions impact your future tax situation?

-Roth conversions allow you to pay taxes on converted funds now, rather than in retirement. By converting assets to a Roth IRA in years when you're in a lower tax bracket, you can potentially reduce your overall tax burden in the future when you're drawing from those funds tax-free.

What is the IRMAA (Income-Related Monthly Adjustment Amount) and how does it affect Medicare premiums?

-IRMAA is an additional charge on Medicare Part B and Part D premiums, triggered when your Modified Adjusted Gross Income (MAGI) exceeds certain thresholds. The higher your income, the higher your Medicare premiums, and Roth conversions could push you into these higher income brackets, triggering IRMAA charges.

What thresholds determine the IRMAA surcharge for Medicare premiums?

-For 2024, the IRMAA surcharge kicks in if you're married and have a MAGI above $206,000 (half that for single filers). This surcharge increases as your income rises, adding an additional $70 for Part B and $13 for Part D premiums per month.

Can you perform a Roth conversion if you are not working?

-Yes, Roth conversions can be done at any time, even if you're not working. The key factor is that Roth conversions are not dependent on earned income, unlike Roth IRA contributions, which do require earned income.

How does Social Security income interact with Roth conversions?

-Roth conversions can increase your taxable income, which may cause more of your Social Security benefits to become taxable. This is known as the 'Social Security tax torpedo,' where your benefits are taxed at higher rates due to the increase in provisional income from Roth conversions.

What is the Social Security tax torpedo and how does it affect tax planning?

-The Social Security tax torpedo refers to the phenomenon where higher taxable income, resulting from Roth conversions, can push more of your Social Security benefits into taxable income. This could effectively increase your tax rate on Social Security, making it more costly than it initially appears.

When should you start doing Qualified Charitable Distributions (QCDs)?

-QCDs can be made starting at age 70.5. These distributions allow you to donate directly from your IRA to charity, potentially lowering your taxable income. QCDs can also help offset required minimum distributions (RMDs), which begin at age 73 or 75, depending on your birth year.

How can a Roth conversion impact your future tax planning strategy?

-Roth conversions can be a powerful tool for tax planning in retirement. By converting assets during years when your tax rate is lower, you can minimize taxes over time. However, overdoing it can lead to unnecessary tax costs, so it's important to balance conversions with other retirement income sources.

What should you consider before deciding to do a Roth conversion?

-Before doing a Roth conversion, you should evaluate your current and future tax brackets, your expected income sources in retirement, and potential Medicare surcharges like IRMAA. Over-converting might push you into higher tax brackets, potentially resulting in higher costs than anticipated.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Will My 401(k) and IRA Work Abroad? Complete Guide for Expat Retirees

NEW! - Can Capital Gains Push Me Into a Higher Tax Bracket?

Práticas #29 - Legislaçõe Trabalhista x previdenciaria

Roth IRA Explained Simply for Beginners

Ed Slott: The Case for Roth IRA Contributions

FINANCIAL ADVISOR Explains: Retirement Plans for Beginners (401k, IRA, Roth 401k/IRA, 403b) 2024

5.0 / 5 (0 votes)