Cara Saya Mendapatkan $150.000 dengan Teknik Scalping yang Tepat!

Summary

TLDRIn this video, the speaker discusses the importance of choosing the right time frame for scalping in Forex trading. They argue that many traders mistakenly use very short time frames like M1 and M5, which can lead to issues like spread volatility and emotional stress. Instead, they recommend using longer time frames like H1 and H4, which provide clearer price movements and more consistent profits. The speaker also emphasizes the psychological aspects of trading, urging traders to maintain discipline and emotional control. Overall, the video encourages traders to focus on strategies that lead to sustainable, consistent profits.

Takeaways

- 😀 Avoid using very short timeframes like M1 and M5 for scalping, as they can lead to higher spread costs and emotional strain.

- 😀 Trading on higher timeframes like H1 and H4 provides a clearer view of market trends and helps mitigate the impact of spread fluctuations.

- 😀 The speaker secured $150,000 in funding through consistent scalping and achieved a 9-10% profit in just 23 days of trading.

- 😀 A higher time frame (H1) helps reduce psychological stress by offering smoother price movements compared to fast-paced timeframes like M1 or M5.

- 😀 Using a higher time frame helps minimize the effect of volatility and emotional decision-making during trades.

- 😀 Understanding the spread (the difference between the bid and ask price) is crucial; smaller timeframes like M1 exaggerate the spread's effect.

- 😀 The psychology of trading plays a huge role in scalping success, and emotional control is essential to avoid fear, greed, and impulsive decisions.

- 😀 Consistency is key in scalping; relying on strategies that support repeated entries at the same price level improves the chances of profit.

- 😀 The 'Exponential Scalper' tool can automate trades based on predetermined rules, making scalping less stressful and more consistent.

- 😀 Mentorship and education programs like the 'Bootcamp Scalper' are helpful in mastering both the technical and psychological aspects of scalping.

Q & A

Why is scalping on lower time frames (like M1 and M5) considered risky?

-Scalping on very short time frames increases the visibility of spreads, which can significantly impact profitability. As the time frame gets smaller, the spread between bid and ask prices becomes more apparent, leading to greater emotional stress and risk for traders.

How does the spread affect scalping strategies on lower time frames?

-On lower time frames like M1, the spread becomes larger and more visible, which can eat into profits. In contrast, higher time frames like H1 and H4 tend to show smaller spreads, making them more suitable for scalping without the risk of frequent spread-induced losses.

What is the main advantage of using time frames like H1 and H4 for scalping?

-Using time frames like H1 and H4 for scalping allows traders to avoid the noise and stress caused by smaller spreads on M1 and M5. These time frames provide more manageable price movements and allow for more consistent and less emotionally taxing trading decisions.

What role does psychology play in successful scalping?

-Psychological factors like fear, anxiety, and greed can heavily influence trading decisions. A successful scalper must manage these emotions, avoid making impulsive decisions, and adhere to a strategy that works with higher time frames to reduce emotional pressure.

How did the speaker achieve consistent profits using scalping techniques?

-The speaker achieved consistent profits by using higher time frames (H1, H4) for scalping, focusing on key entry points and avoiding the pitfalls of low time frames. They also emphasized maintaining emotional control and sticking to a disciplined strategy.

What is the significance of the speaker's performance, such as the $150,000 in funding?

-The speaker's performance, including securing $150,000 in funding, serves as proof of the effectiveness of their scalping approach. The consistent profits over several months demonstrate that their strategy is not a fluke, but a replicable method.

Why does the speaker discourage trading on time frames like M1 or M5?

-The speaker discourages trading on M1 and M5 due to the excessive noise and the higher spread visibility on these time frames. These factors lead to emotional decision-making, quick exits from trades, and reduced profitability, making them less effective for scalping.

What is the 'Exponential Scalper' tool mentioned in the video?

-The 'Exponential Scalper' is a tool designed to automate certain aspects of scalping, allowing traders to enter multiple trades in a short amount of time based on pre-set rules. It helps reduce manual intervention and increases the efficiency of a scalping strategy.

How does the speaker suggest traders should approach scalping on higher time frames?

-The speaker suggests that traders should focus on higher time frames like H1 and H4 for scalping, entering multiple trades at key price levels within these time frames. This strategy allows for higher profitability without the emotional burden of lower time frames.

What is the main takeaway regarding time frames and scalping from the video?

-The main takeaway is that scalping on very low time frames (like M1 or M5) is generally not effective due to larger spreads and emotional stress. Using higher time frames like H1 and H4 offers a more consistent, less emotionally taxing approach, leading to better long-term results.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5 Tipe Trading YANG PALING COCOK untuk Anda

Kenapa Scalping di H1 dan H4 Lebih Menguntungkan? Ini Jawabannya!

How to Start Forex Trading as a BEGINNER in 2025 (Full Guide)

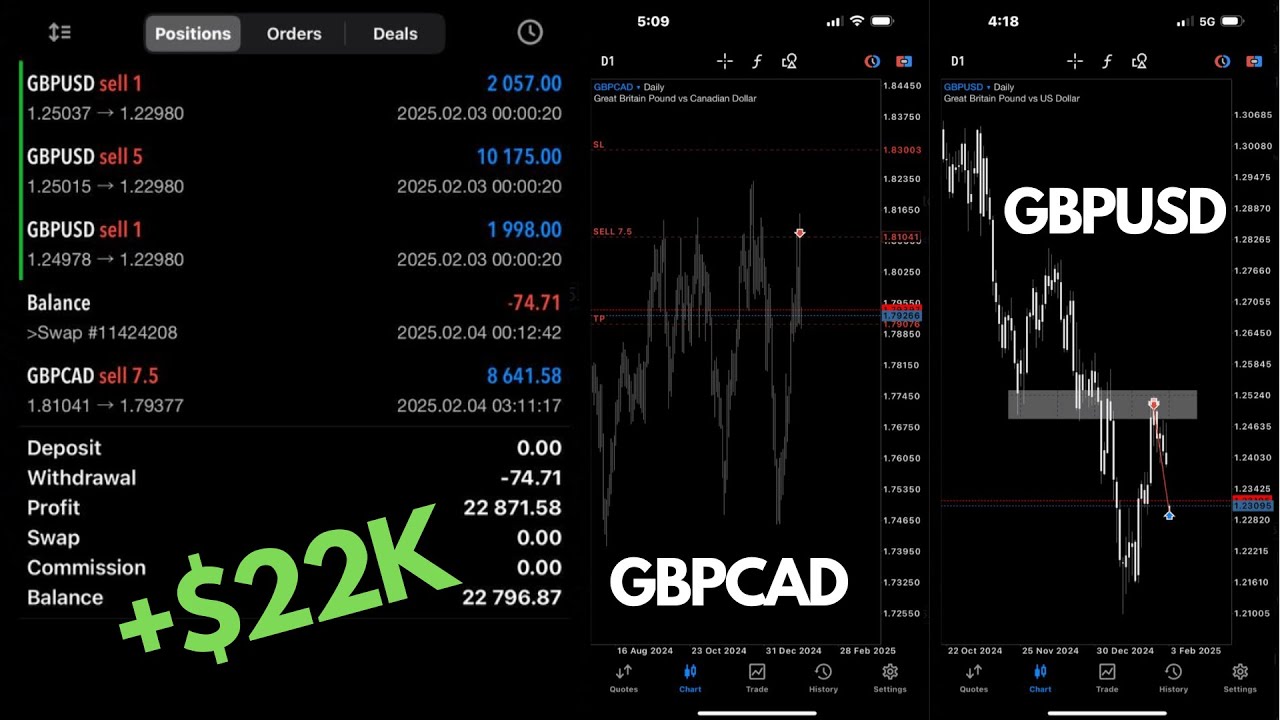

+$22,000 This Week Trading Forex (My Simple Analysis)

5 TEKNIK SCALPING TERMUDAH UNTUK MODAL KECIL

HOW to Start Trading in 2025 (Complete Beginner's Guide)

5.0 / 5 (0 votes)