Unit 12: Financing New Ventures

Summary

TLDRThis presentation covers the essential components of an investor-ready financial model for startups, focusing on the key financial documents required for raising capital. These include the business plan, which outlines the company’s operations and strategy; the financial model, comprising the profit and loss account, cash flow statement, and statement of financial position; and the pitch deck, a visual tool for presenting to investors. Emphasizing the importance of accurate financial projections, liquidity management, and sustainable investment, the video aims to help entrepreneurs prepare comprehensive financial models that attract funding and ensure long-term business success.

Takeaways

- 😀 A business plan is essential for securing investment, and should be concise—ideally no longer than 20 pages.

- 😀 A financial model is a critical component of the business plan, offering detailed projections for investors.

- 😀 The pitch deck summarizes the business plan and is commonly used when presenting to investors.

- 😀 The Profit and Loss (P&L) account outlines projected sales, costs, and profits, providing insight into the business's profitability.

- 😀 Gross profit is calculated by subtracting direct costs (e.g., manufacturing, shipping) from sales revenue.

- 😀 Operating profit reflects the actual profit from business operations, after deducting overhead costs like rent and salaries.

- 😀 Net profit is the final figure after accounting for interest, depreciation, and taxes, and is closely scrutinized by investors.

- 😀 The cash flow statement tracks actual cash inflows and outflows, showing the business's liquidity and financial health.

- 😀 Maintaining positive cash flow is crucial for startups, especially during early years of loss, to ensure the business can stay afloat.

- 😀 The statement of financial position (balance sheet) offers a snapshot of the company's assets and liabilities, helping investors assess financial stability.

Q & A

What are the typical documents required when a startup seeks financing?

-The typical documents required are the business plan, the financial model, and the pitch deck. The business plan outlines the founders, team, product, market, operations, and finance. The financial model provides detailed financial projections, and the pitch deck serves as a high-level overview when presenting to investors.

What is the primary focus of this presentation?

-The primary focus of this presentation is on the financial model, which is an essential document for investors and stakeholders when considering financing a startup.

What key components are included in a financial model?

-A financial model typically includes the profit and loss account, cash flow statement, and the statement of financial position (also known as the balance sheet). These documents offer insights into a startup's financial health, profitability, and cash flow management.

What does the profit and loss account show?

-The profit and loss account shows all sales and expenditures for a specific financial period, typically a year. It details revenue by product or service, gross profit, operating profit, and net profit after interest, depreciation, and taxes.

Why is gross profit an important figure in a financial model?

-Gross profit is important because it indicates how well a business is performing in terms of direct revenue generation after deducting the direct costs of production. It provides a clear view of the business's core profitability before accounting for overheads.

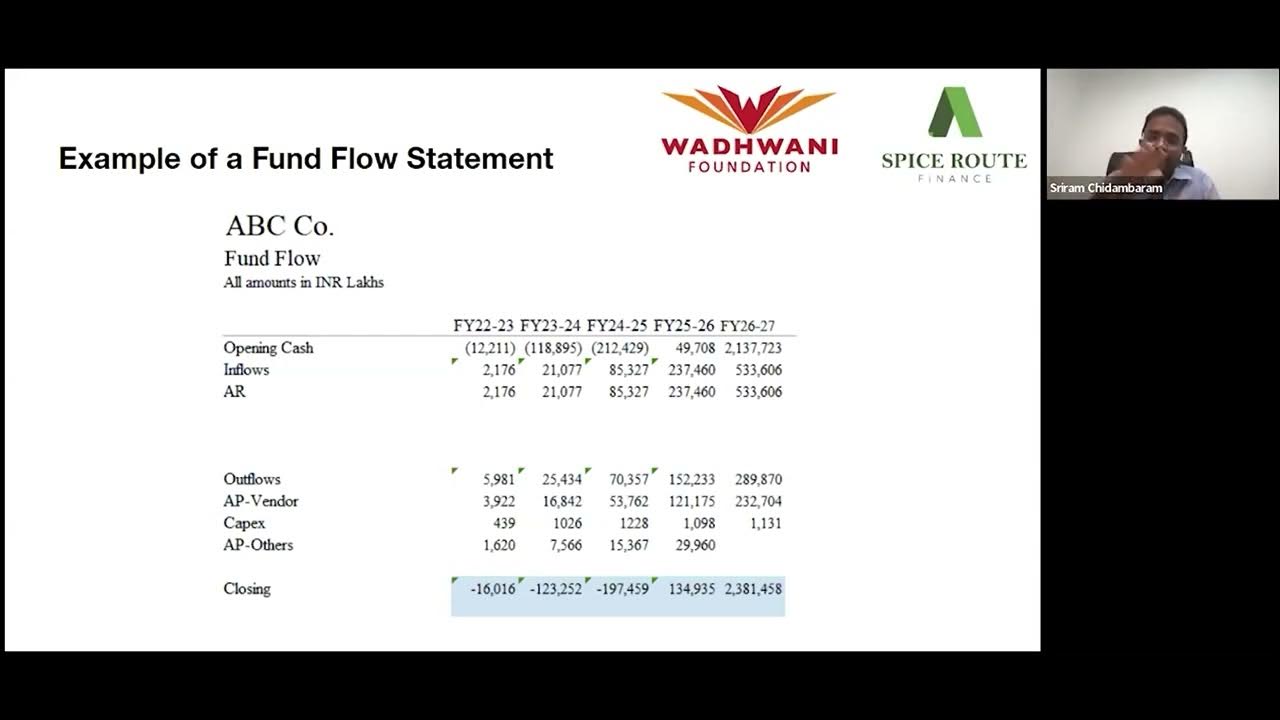

What distinguishes the cash flow statement from the profit and loss account?

-Unlike the profit and loss account, which focuses on revenue and expenses, the cash flow statement tracks actual cash receipts and expenditures. It includes investments received and capital expenditure, providing a clearer picture of a startup's liquidity and cash position.

Why is maintaining positive cash flow crucial for startups?

-Maintaining positive cash flow is crucial because most startups incur losses in their early years. Positive cash flow ensures the business can survive and reach the break-even point by having sufficient cash reserves to cover operational costs.

What is the role of equity investment in funding a startup?

-Equity investment is vital for startups as banks generally do not provide funding due to the high-risk nature of new ventures. Startups rely on equity investors to provide the necessary funds for development and scaling, which must be used wisely to ensure long-term sustainability.

What does the statement of financial position show?

-The statement of financial position, or balance sheet, provides a snapshot of the company's assets and liabilities at the end of a period. It details cash balances, amounts owed by customers (debtors), short-term creditors, and the company's overall funding structure.

Why is it important for a startup to have sufficient funds for the next 12 to 18 months?

-It's important for a startup to have enough funds to cover operations for the next 12 to 18 months to ensure the business can survive through early challenges and reach a sustainable growth phase. Investors and stakeholders often assess this financial cushion when evaluating the viability of a startup.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Can My Startup Raise Venture Capital?

What is Business Finance

Week 9 Masterclass Sriram Chidambaram Crucial Financial Insights for Startups Success

Habis Startup, Terbitlah Anti-Startup. Fenomena Apa Ini?

Type of Investors, Individual & Institutional Investor, investment Analysis and Portfolio Management

FORMATION OF A COMPANY Class 11 ONE SHOT Business studies chapter 7 | GAURAV JAIN

5.0 / 5 (0 votes)