Financial Terms Explained as Simply as Possible

Summary

TLDRThis video simplifies 26 key financial terms, providing quick, clear explanations for each. Terms like balance sheets, liquidity, GAAP, and net income are broken down to their essentials, making complex financial concepts accessible. The script covers everything from capital gains, amortization, and bonds, to stock options, ROI, and cash flow. It also touches on personal finance topics like credit scores, net worth, and term life insurance. Whether you're new to finance or looking for a refresher, this video serves as an easy guide to understanding essential financial terminology.

Takeaways

- 😀 A balance sheet summarizes a company’s assets, liabilities, and equity, with the equation: Assets = Liabilities + Equity.

- 😀 Liquidity refers to how quickly an asset can be converted into cash, with cash being the most liquid asset.

- 😀 GAAP (Generally Accepted Accounting Principles) ensures consistency and transparency in financial reporting across companies.

- 😀 Capital gains are the profits from selling an asset for more than its purchase price, and are taxed when realized.

- 😀 Net income is the amount of profit left after all expenses are subtracted from total revenue.

- 😀 Equity is the value of an asset after subtracting any debts owed, and can be positive or negative.

- 😀 Depreciation is the reduction in an asset's value over time, with most physical assets depreciating except for real estate.

- 😀 Earnings Per Share (EPS) is a key indicator of a company’s profitability, calculated by dividing net income by the number of shares.

- 😀 Net worth is the total value of everything you own, minus what you owe, indicating your financial health.

- 😀 Amortization spreads the cost of intangible assets, like patents or trademarks, over a set period of time.

Q & A

What is a balance sheet and how does it work?

-A balance sheet is a financial statement that summarizes a company’s assets, liabilities, and equity. It works with the equation: Assets = Liabilities + Equity, showing a snapshot of the company’s financial position.

What does liquidity mean in finance?

-Liquidity refers to how easily an asset can be converted into cash. Cash is the most liquid asset, while assets like real estate are less liquid because they can take time to sell.

What is GAAP and why is it important?

-GAAP (Generally Accepted Accounting Principles) is a set of rules and conventions that standardize how companies report their financial statements, ensuring consistency and comparability.

What is the difference between realized and unrealized capital gains?

-Realized capital gains are profits from selling an asset for more than its purchase price, while unrealized gains are paper profits on assets that haven’t been sold yet.

How is net income calculated?

-Net income is calculated by subtracting a company’s expenses from its total revenue, showing the company's profitability.

What does negative equity mean?

-Negative equity occurs when the value of an asset is less than the amount owed on it. This is common with items like cars or homes if the owner owes more than the asset is worth.

What is the significance of Earnings Per Share (EPS)?

-EPS represents a company’s profitability by showing the portion of a company’s profit allocated to each outstanding share of common stock. It’s calculated by dividing net income minus dividends by the number of shares.

What is the purpose of amortization?

-Amortization is the process of spreading the cost of an intangible asset (like patents or trademarks) over its useful life, helping to account for its gradual reduction in value.

What is EBITDA and what does it represent?

-EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It measures a company’s cash flow from operations, providing an indication of its profitability before non-operating expenses.

How are bonds and stocks different?

-Bonds are loans made to companies or governments that pay interest over time and can be traded, while stocks represent ownership in a company and can be bought or sold based on the company's performance.

What is the role of a FICO score in financial decisions?

-A FICO score is a credit score that ranges from 300 to 850, used to evaluate an individual's creditworthiness. It influences loan approvals, interest rates, and overall borrowing conditions.

What does the term 'working capital' refer to?

-Working capital is the difference between a company’s current assets and current liabilities. It represents the cash available to cover day-to-day operations and indicates a company’s short-term financial health.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

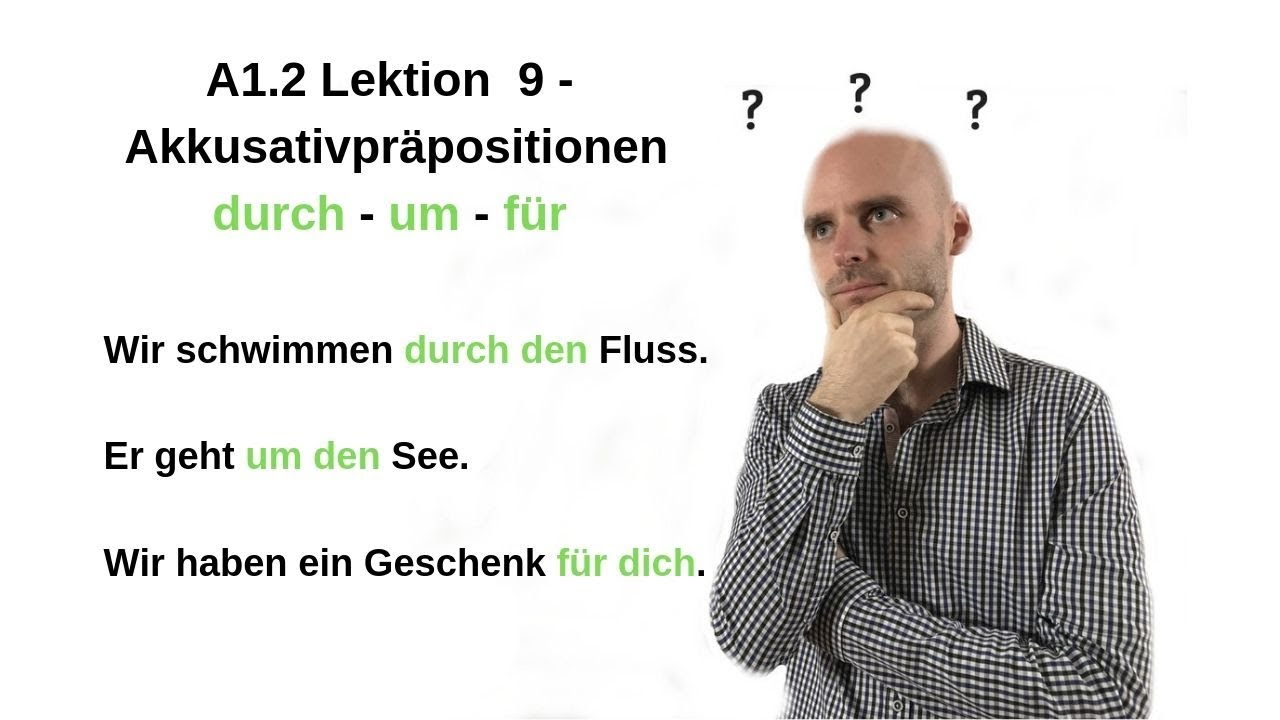

Deutschkurs A1.2 Lektion 9 - Akkusativpräpositionen durch - um - für

Multiplication of Binomials using FOIL method and Vertical Form | Grade 8 | Q1 | Revised K-12 |

50 Definitions Every Programmer Should Know

Introdução à Anatomia: posição anatômica e termos de relação | Anatomia etc

[CPNS&PPPK 2023/2024] 10 SOAL TIU YG TIPENYA SRING MUNCUL: HITUNG CEPAT,ALJABAR,ARITMATIKA,DLL #cpns

KOMBINASI Peluang Mudah Banget

5.0 / 5 (0 votes)