🚀 Réserve Nationale de Bitcoin 🇺🇸 : À L'Aube d'un Bull Run Historique ? 😱

Summary

TLDRThis video explores the potential for the U.S. government to create a strategic reserve in Bitcoin, with the possibility of purchasing up to 1 million Bitcoin over the next 5 years. It discusses the implications of such a move, particularly in relation to the U.S. national debt, the role of Bitcoin as an alternative asset to gold, and the influence this could have on the global crypto market. The video also examines the political landscape surrounding the proposal, with notable figures like Donald Trump and Senator Cynthia Lummis pushing for Bitcoin adoption, suggesting a significant shift in U.S. economic policy. It raises important questions about the decentralization of Bitcoin and the future of crypto regulation.

Takeaways

- 😀 Trump becomes the 47th president of the United States and pushes cryptocurrency policies as part of his agenda.

- 😀 Trump’s victory has sparked renewed optimism for Bitcoin, with its value soaring before his official inauguration.

- 😀 The concept of a 'strategic reserve' in Bitcoin is introduced, suggesting the U.S. government could hold Bitcoin in its reserves alongside gold.

- 😀 The U.S. government currently holds a large amount of Special Drawing Rights (SDRs) instead of tangible assets like gold, and Bitcoin could be seen as an alternative to these SDRs.

- 😀 Bitcoin is considered superior to gold by many, and its adoption as a reserve asset could strengthen the U.S. financial system.

- 😀 Senator Cynthia Lummis proposes a Bitcoin Act to purchase up to 1 million Bitcoin over five years, controlling 8% of the total supply.

- 😀 The U.S. government could sell some of its gold reserves to purchase Bitcoin, potentially stabilizing the country’s finances.

- 😀 RFK Jr. has also advocated for the creation of a strategic Bitcoin reserve, proposing the government purchase 550 Bitcoin daily for five years.

- 😀 Despite the push for Bitcoin adoption, there are concerns that a large government-backed reserve could compromise Bitcoin's decentralization and independence.

- 😀 The political landscape may evolve, and while the concept of a Bitcoin reserve could thrive under Trump's administration, it could face challenges from anti-crypto forces in future administrations.

Q & A

What is the concept of a strategic reserve in the context of Bitcoin?

-A strategic reserve refers to the storage of a product, such as Bitcoin, by a government for financial preparedness during unexpected events. Its primary purpose is to act as a backup in times of crisis or economic downturn.

Why is Bitcoin considered a better asset than gold for a strategic reserve?

-Bitcoin is considered a better asset than gold due to its exceptional performance and adaptability in the digital age. Unlike gold, Bitcoin's value is not dependent on physical storage and is more aligned with modern financial systems, offering a potential hedge against inflation and monetary manipulation.

What is the significance of the U.S. government's potential accumulation of Bitcoin in its reserves?

-If the U.S. government begins accumulating Bitcoin, it would significantly reduce the available supply of Bitcoin in the market, leading to potential price increases. Moreover, it would also represent a shift in global financial policy, potentially signaling the adoption of Bitcoin as a reserve asset in other nations.

What is the Bitcoin Act proposed by Senator Cynthia Lummis?

-The Bitcoin Act, proposed by Senator Cynthia Lummis, suggests creating a federal program to purchase Bitcoin, with the U.S. government acquiring up to 1 million Bitcoin over the next 5 years. This would result in the U.S. controlling a substantial portion of Bitcoin's total supply, around 8%.

How does the U.S. currently manage its reserves, and how could Bitcoin be integrated into this system?

-The U.S. currently manages its reserves, which are worth around $242 billion, with a majority in Special Drawing Rights (SDRs) and a smaller portion in gold. By integrating Bitcoin into this system, the government could diversify its reserves, possibly by converting some of its gold certificates into Bitcoin.

What are the potential benefits and risks of a Bitcoin-backed strategic reserve?

-The benefits include providing the U.S. government with a more secure and independent financial asset, reducing reliance on traditional fiat currencies and central banking systems. However, the risks include market volatility, potential loss of value, and the influence of government control over Bitcoin's decentralized nature.

How would the proposed Bitcoin strategic reserve impact global financial markets?

-The creation of a Bitcoin strategic reserve by the U.S. could drastically affect global financial markets by increasing demand for Bitcoin, thereby pushing its price higher. Other countries might follow suit, further integrating Bitcoin into the global financial system and reducing reliance on traditional currencies.

What are the challenges in implementing the Bitcoin strategic reserve in the U.S.?

-The challenges include political resistance, potential legal hurdles, and the volatility of Bitcoin's price. Additionally, there is the risk that a future administration could reverse the policy, causing market instability.

What role could a crypto council play in shaping Bitcoin-related policies in the U.S.?

-A crypto council, consisting of experts in the field, could advise the U.S. government on Bitcoin-related policies, including the creation of a strategic reserve. It would likely help ensure that any decisions made are informed by a comprehensive understanding of the cryptocurrency market.

How might the idea of a Bitcoin reserve affect the decentralization of the cryptocurrency?

-While Bitcoin's decentralization relies on a distributed network of users, government accumulation of Bitcoin could centralize control over a significant portion of its supply, leading to greater market influence and potentially reducing the decentralized nature of Bitcoin.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Apresiasi Usai Timnas Juara Piala AFF U-19 2024 - iNews Pagi 01/08

For Oom Piet - Poem Analysis

Embedded Linux | Introduction To U-Boot | Beginners

How would you go about solving this? Limit of x/sqrt(x^2+1) as x goes to infinity. Reddit inf/inf

How to Diagnose and Replace Universal Joints (ULTIMATE Guide)

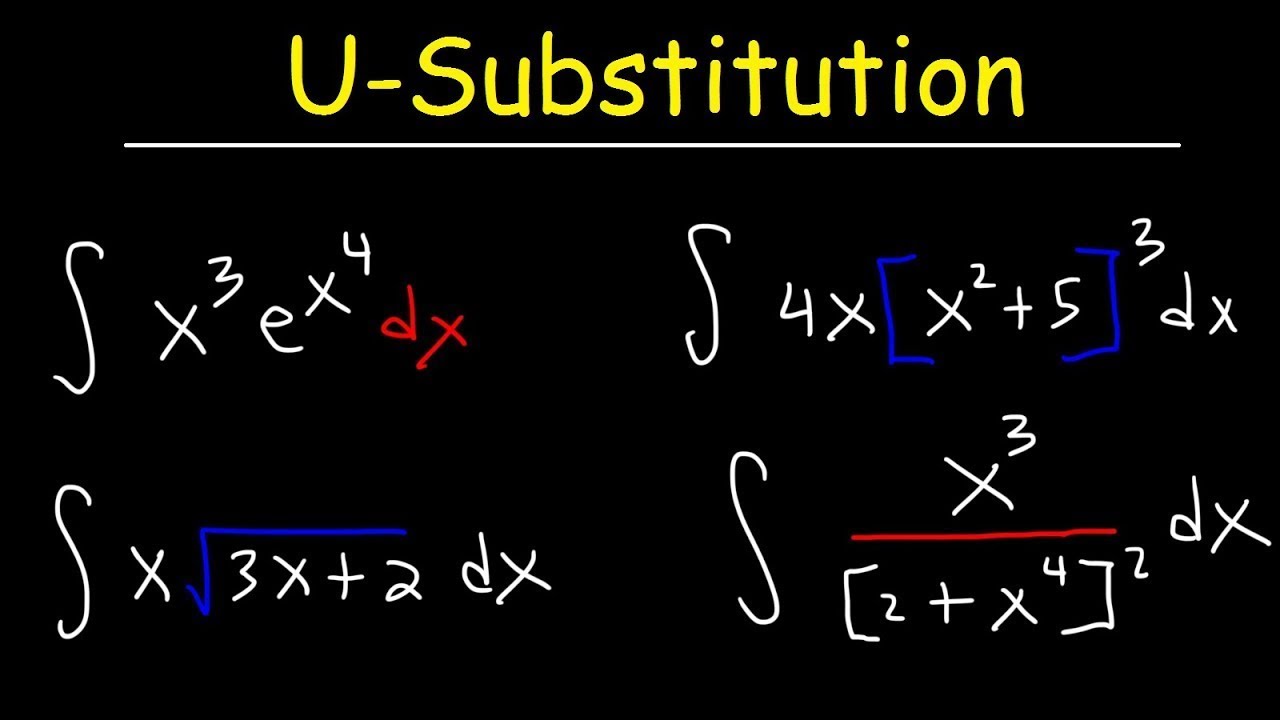

How To Integrate Using U-Substitution

E' LA FINE DEI NOSTRI DRONI? E' arrivato U-space in Italia

5.0 / 5 (0 votes)