Why You Choose the Wrong Liquidity ICT Concepts | SIMPLE 3 Step ICT Strategy

Summary

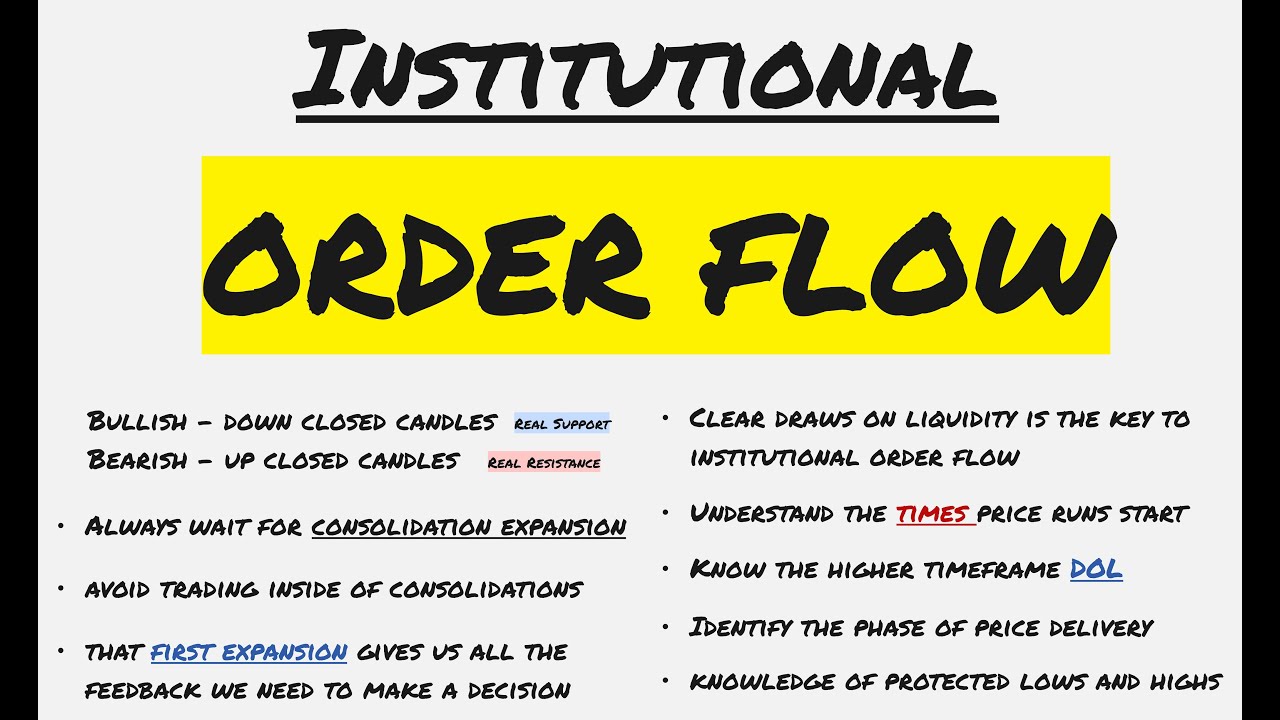

TLDRThe video script emphasizes the importance of selecting the right liquidity levels in trading to avoid getting stopped out or hesitating. The speaker shares a successful strategy they've used to achieve funding and make significant withdrawals from the markets. The strategy involves a three-step plan that focuses on identifying time-based liquidity levels, such as daily, weekly, and quarterly highs and lows, and waiting for the second or third quarter of a trading session to act on these levels. The script provides clear instructions on marking out these levels, waiting for a balanced price range or market structure shift for confirmation, and targeting the first opposing time-based liquidity level with at least a 2:1 risk-to-reward ratio. The speaker encourages traders to ask questions, like and subscribe for more content, and stresses the significance of time in trading, suggesting that focusing on time-based liquidity can significantly improve trading outcomes.

Takeaways

- 📈 Focus on choosing the right liquidity levels to enter trades, which is crucial for avoiding getting stopped out and improving trade quality.

- ⏰ Importance of timing: Wait for the second or third quarter of your trading session to identify valid liquidity points.

- 📊 Mark out time-based liquidity levels such as previous weekly, daily, and quarterly highs and lows to identify potential trade entry points.

- 🌐 Use the New York session times as a reference for marking liquidity levels, ensuring you are aligned with market activity.

- 🔍 After identifying a liquidity level, wait for a market structure shift or a balanced price range for confirmation before entering a trade.

- 🎯 Target the first opposing time-based liquidity level for your trade entry with at least a 2:1 risk-to-reward ratio.

- 📉 In the case of taking out time-based liquidity levels, look for a reversal and wait for a market structure shift or balanced price range to enter.

- 🚫 If there is no action at the marked liquidity levels, do not make a trade as it indicates an invalid setup.

- 📌 Use higher time frame targets for extended trades but always recommend taking profit at the first time-based liquidity level.

- 📈 Understanding daily bias and trading with higher time frames can help in setting extended targets and improving trading strategy.

- 💡 Emphasize the importance of time as much as price in trading, which can lead to more refined and less speculative trading approaches.

Q & A

What is the main issue that traders face when trying to identify liquidity for trading?

-The main issue traders face is not knowing which high or low to use as liquidity to enter a trade, leading to hesitation, getting stopped out, or choosing the wrong levels to trade from.

What is the significance of waiting for the second or third quarter of a trading session to look for liquidity?

-Waiting for the second or third quarter of a session allows traders to observe how the market interacts with previously identified time-based liquidity levels, providing a clearer signal for potential trade entries.

How does marking out time-based liquidity help in trading?

-Marking out time-based liquidity, such as previous weekly, daily, or quarterly highs and lows, provides a structured approach to identifying key levels where the market may react, thus improving trade entries and exits.

What is the recommended approach for setting a stop loss in a trade?

-The recommended approach is to place the stop loss under the lowest low if being conservative, or under the displacement that gave the market structure shift if being aggressive.

Why is it important to wait for a market structure shift or a balanced price range after identifying liquidity?

-Waiting for a market structure shift or a balanced price range provides confirmation that the market is ready for a potential reversal, increasing the probability of a successful trade.

What is the concept of 'scaling out' in trades?

-Scaling out refers to taking profits at different levels during a trade, starting with at least a 2:1 risk-to-reward ratio at the first time-based liquidity level, and then potentially taking more profits at extended targets if the trader understands daily bias and is trading with higher time frames.

How can understanding daily bias improve a trader's strategy?

-Understanding daily bias allows a trader to align their trades with the overall market direction for the day, which can improve the timing and positioning of trades and potentially lead to more successful outcomes.

What is the significance of the 6 p.m. to midnight range for the Asia session in marking liquidity?

-The 6 p.m. to midnight range for the Asia session is significant because it represents a key time frame during which liquidity levels are established for that particular session, which can influence trading decisions.

Why is it crucial to focus on the previous highs or lows during a trading session?

-Focusing on previous highs or lows is crucial because these levels have historically shown to be areas of significant market reaction. They act as potential entry or exit points for trades based on how the market interacts with these levels.

What does the speaker mean by 'if you can't see the liquidity, you are the liquidity'?

-The phrase implies that if a trader is unable to identify liquidity levels in the market, they may end up becoming part of the market's liquidity by entering trades without a clear understanding of market structure, potentially leading to undesired outcomes.

How does the speaker suggest improving the quality of trades?

-The speaker suggests improving trade quality by focusing on time-based liquidity, waiting for confirmation through market structure shifts or balanced price ranges, and targeting trades with at least a 2:1 risk-to-reward ratio.

What is the importance of patience in trading according to the video?

-Patience is important in trading because it allows traders to wait for the right liquidity levels to form and for market confirmations before entering a trade, which can lead to higher win rates and reduced stress.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)