What is a Group Structure for Limited Companies? Holding Companies Explained and How to Set Yours Up

Summary

TLDRIn this video, the host explains how to set up a holding company group structure to save significant amounts in taxes. A holding company allows business owners to separate trading risks from investment assets, enabling tax-free movement of funds and assets between companies. The video covers the benefits of holding companies, including tax-free dividends, capital gains, and the ability to sell businesses tax-free under certain conditions. It also walks through the process of setting up a holding company, offering practical advice for entrepreneurs and investors looking to grow their wealth efficiently.

Takeaways

- 😀 Holding companies can help you save substantial amounts in tax by allowing for tax-efficient movement of funds and asset protection.

- 😀 By setting up a holding company, you can separate your trading and investment businesses, protecting assets from trading risks.

- 😀 Dividends paid from subsidiary companies to the holding company are tax-free, making it easier to move money within the group structure.

- 😀 A group structure allows you to move capital assets (e.g., property) between companies tax-free, minimizing costs like capital gains tax and stamp duty.

- 😀 The substantial shareholders exemption can allow you to sell a business tax-free if the holding company owns more than 10% of the shares in the trading company.

- 😀 Setting up a holding company from the beginning of your business career is a cost-effective way to benefit from a group structure, especially if you plan to reinvest profits.

- 😀 While setting up a group structure early may incur higher initial costs for accountancy, it can save you money in the long run when you need to transfer funds or assets between companies.

- 😀 If you already have existing companies, you may need to go through a share-for-share exchange and get clearance from HMRC to set up a holding company structure.

- 😀 A holding company provides protection against liabilities and creditors for the subsidiary companies, especially when dealing with high-risk businesses.

- 😀 Alphabet shares can be used within a group structure for more customized dividend distribution, but this should be done with the help of an accountant.

- 😀 While not suitable for everyone, a holding company structure is ideal for property entrepreneurs or businesses with significant growth potential and the desire to reinvest profits.

Q & A

What is a holding company and how does it work?

-A holding company is a parent company that owns the majority of shares in other subsidiary companies. It doesn’t trade or carry out business activities itself, but its subsidiaries may. The holding company helps streamline management, protect assets, and offer tax advantages by consolidating ownership and controlling several businesses or investments under one umbrella.

How can a holding company structure save on taxes?

-A holding company structure can save on taxes by allowing you to move money between companies without incurring additional tax charges. Dividends paid from trading companies to the holding company are tax-free, and the holding company can then lend money to investment companies without creating taxable income or loans. Additionally, there are potential exemptions when selling shares, reducing capital gains tax exposure.

Why is it risky to buy property within a trading company?

-Buying property within a trading company can be risky because it exposes the property to the trading risks of the business. For instance, if the business is sued or faces financial issues, the property could be at risk. Mortgage lenders also typically prefer to see properties held in a separate company to avoid associating them with the business's operational risks.

What are the tax advantages of separating a trading company from an investment company?

-By separating the trading company from the investment company, you can shield the investment assets from the trading company’s risks. Additionally, this allows you to take advantage of tax exemptions such as Business Asset Disposal Relief (Entrepreneurs Relief) and other property-related tax reliefs, making the overall structure more tax-efficient.

What is the role of a holding company in managing tax liabilities between different businesses?

-The holding company allows for tax-efficient movement of funds between different businesses. For example, dividends can be paid to the holding company, which is not a trading entity, making the funds immune from trading risks. The holding company can then distribute these funds or lend them to subsidiaries, helping to avoid tax on inter-company transactions.

What is the substantial shareholder exemption?

-The substantial shareholder exemption allows you to sell shares in a trading business and receive the proceeds without incurring capital gains tax, provided the holding company owns at least 10% of the shares. This can be especially valuable during an exit, as it helps to maximize the cash you receive from the sale of a business.

How does a holding company help protect assets?

-A holding company protects assets by isolating them from the risks of the operating companies. For instance, if a trading company faces financial trouble or legal issues, the assets held under the holding company (like properties or investments) are not subject to the same risks. This ensures the long-term stability of the assets.

What are the disadvantages of setting up a holding company structure?

-One of the main disadvantages is the additional administrative costs. Setting up and maintaining multiple companies means filing separate accounts and tax returns for each. For those not ready to immediately reap the benefits of a holding company structure, the initial setup costs and ongoing compliance fees might not be worth it in the short term.

How do you set up a holding company structure?

-To set up a holding company structure, you would first create the holding company and own 100% of its shares. Then, you establish the subsidiary companies, ensuring that the holding company owns all the shares in these subsidiaries. For new businesses, this is relatively straightforward; however, for existing businesses, a more complex process involving share exchanges and statutory clearance from HMRC might be required.

Can you set up a holding company for tax efficiency even if you are just starting out in business?

-Yes, setting up a holding company at the start of your business journey can be a strategic move if you plan to scale and diversify in the future. It allows you to structure your operations for tax efficiency right from the outset and ensure that you have the flexibility to reinvest profits into separate assets or companies, maximizing long-term tax benefits.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

🇬🇧 If I Were a UK Entrepreneur, Here’s EXACTLY What I’d Do 🔥

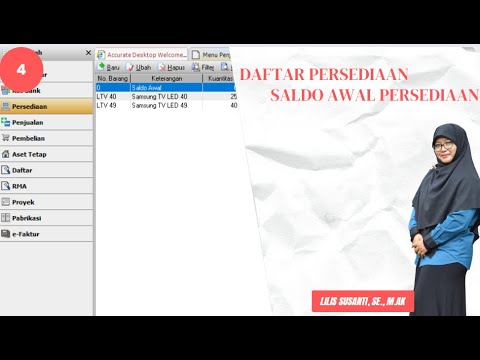

PT Cakrawala - Cara Input Persediaan Barang Dagang Menggunakan Persiapan Mahir Aplikasi Accurate

Mevduat faizleri %50'yi geçti | Koç Holding'e ne oldu? | BofA'nın büyük alımı

UD Sejuk Indonesia - Pembahasan Cara Input Data Awal Perusahaan Sampai Inventory Dengan MYOB

Kenapa Bentuk DNA Kayak Gini?

Understanding Tax-Efficient Investing: What Money Goes Where

5.0 / 5 (0 votes)