Ultimate SMART MONEY CONCEPTS Trading Course (EXPERT INSTANTLY)

Summary

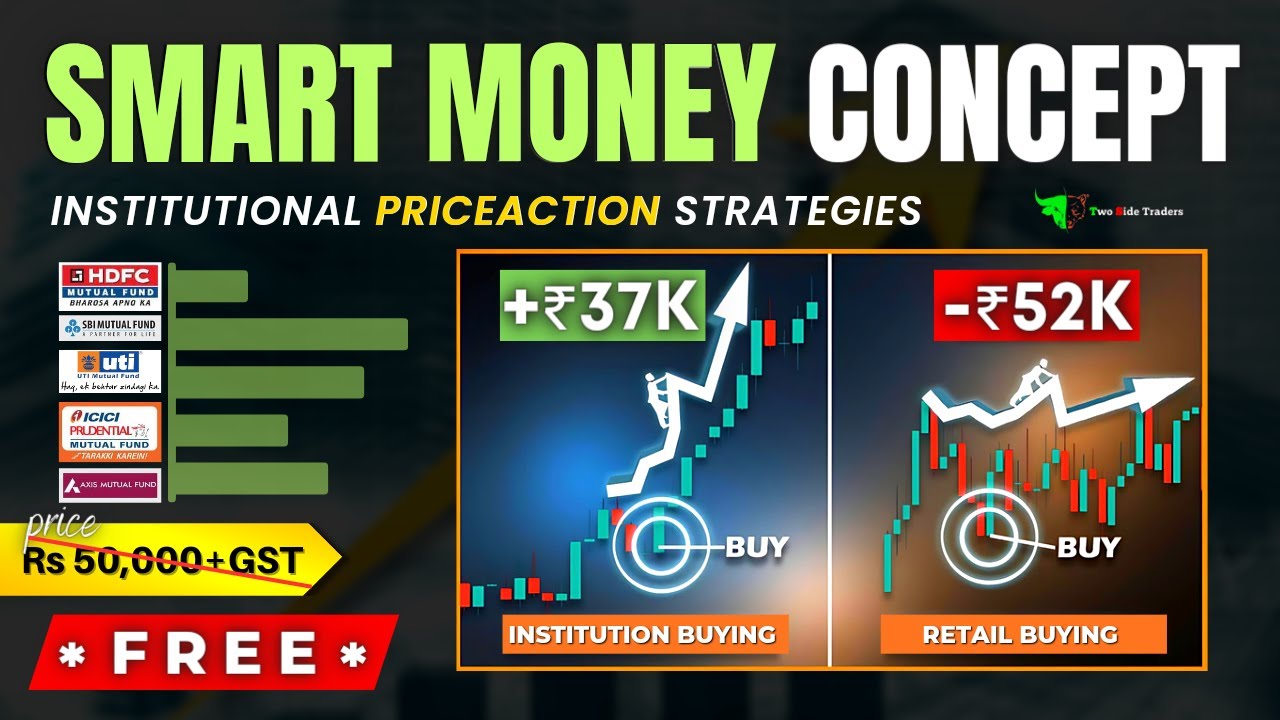

TLDRThis video demystifies 'smart money' trading concepts, making them accessible even to beginners. It introduces key strategies like break-off structures, change of character, and fair value gaps, which are crucial for identifying high-probability trading opportunities. The presenter simplifies complex trading terminologies and demonstrates how to apply these concepts using GBP/USD as an example, aiming to help viewers achieve profitable trades with a high risk-to-reward ratio.

Takeaways

- 😎 Smart money trading concepts are often considered secretive and complex, but this video aims to simplify them for better understanding.

- 📈 'Break of Structure' (BOS) is a term used to describe price movements in an uptrend, where new highs are continually made until momentum is lost.

- 📉 A 'Change of Character' (Chalk) occurs when a downtrend starts, and the price breaks below the previous higher low, indicating a potential reversal.

- 🔍 Strong areas of interest, such as supply and demand zones or order blocks, are crucial for the effectiveness of BOS and Chalk strategies.

- 📊 'Liquidity Grab' is a tactic where price fakes a breakout and then reverses, tricking traders into entering positions that get stopped out, fueling the price movement.

- 📋 'All the Blocks' are identified by strong price reversals, indicating areas where smart money and big banks enter and exit trades.

- 💹 A high win rate trading strategy involves using higher time frames, marking key levels, and looking for liquidity grabs and changes of character.

- 📌 'Fair Value Gap' is a trading entry point identified when price moves rapidly, creating an imbalance that usually corrects itself, offering a trading opportunity.

- ✅ The video demonstrates how to apply these concepts using GBP/USD as an example, showing how to identify and act on liquidity grabs, changes of character, and fair value gaps.

- 🔄 The strategy is about recognizing patterns and repeating the process, with the presenter humorously dubbing it the 'Balls and Cox' strategy for ease of recall.

Q & A

What is the main focus of the video?

-The video aims to simplify smart money trading concepts in a way that is easy to understand, even for beginners, and to reveal some of the best-kept secrets in trading.

What is a 'break-off structure' in trading?

-A 'break-off structure' refers to a pattern in an uptrend where the price makes higher highs and higher lows, and each time it breaks through a new high, it's called a bullish break of structure (BOS).

How does a 'change of character' occur in trading?

-A 'change of character' occurs when the price breaks below the previous higher low in an uptrend, signaling a potential reversal and the start of a downtrend.

What is the significance of an 'area of interest' in smart money trading?

-An 'area of interest' is a zone such as a supply or demand zone or an order block where significant price action occurs, and it's crucial for the strength of a trend and the effectiveness of trading strategies.

What is a 'liquidity grab' in the context of the video?

-A 'liquidity grab' is a false breakout where the price breaks through a recent high or low, only to reverse in the opposite direction, often causing a rapid price movement that can be exploited for trading.

How can one identify a strong supply or demand zone?

-A strong supply or demand zone can be identified by looking for areas on higher time frames where price reverses consistently, indicating significant buying or selling pressure.

What is a 'fair value gap' and how is it used in trading?

-A 'fair value gap' is a price area that is created when the market moves too quickly, leaving behind an imbalance. Traders can use this gap to identify potential re-entry points for the market to correct and reverse.

Why is it important to look for a 'change of character' after a liquidity grab?

-A 'change of character' is important because it confirms the reversal pattern, indicating that the market has lost momentum in the previous trend direction and is likely to continue in the new direction.

How does the video suggest entering a trade after identifying a fair value gap?

-The video suggests entering a trade when the price comes back down to retest the fair value gap, showing signs of rejection, which can provide a high risk-to-reward entry point.

What is the 'balls and Cox' strategy mentioned in the video?

-The 'balls and Cox' strategy is a playful term used by the presenter to describe the combination of break-off structures, change of character, and fair value gaps for trading smart money concepts.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Identifying Key Structures & Liquidity Zones

How Operator TRAPS New Traders | *FREE Advance Price Action Trading | Smart Money Concepts In Hindi

How To Trade Like Smart Money With These Easy Steps!

COMPLETE Order Blocks Course (so you can trade like banks)

How To Trade Smart Money Concepts | LuxAlgo

SMC Secrets EXPOSED With Power Of Three

5.0 / 5 (0 votes)