The Biggest Mistakes That Stop You from Getting Wealthy

Summary

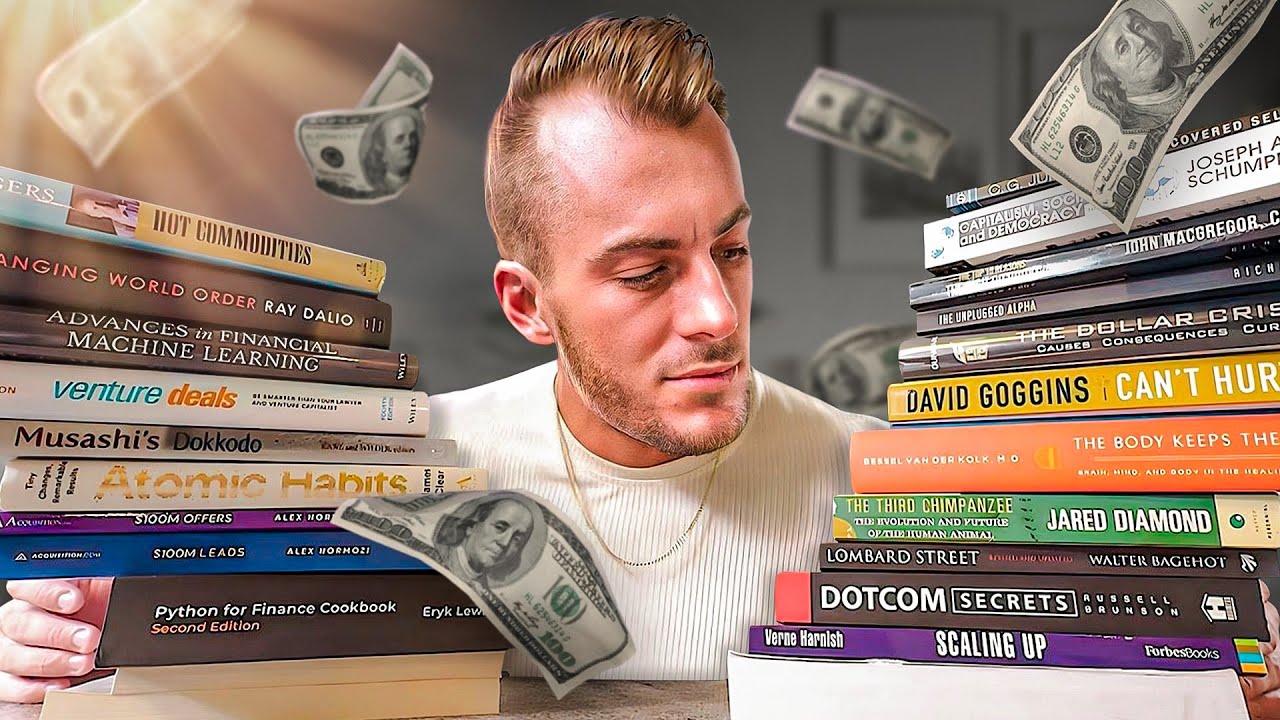

TLDRThis video reveals the key mistakes that prevent people from achieving wealth and financial independence. It highlights the importance of discipline, the dangers of poor environments, and the impact of alcohol and excessive partying on success. The video stresses the need for self-control, financial literacy, and living within one's means. By avoiding distractions and surrounding oneself with motivated individuals, you can stay focused on long-term goals. The ultimate message is that wealth is built through persistence, smart choices, and healthy habits, with the understanding that true success comes from consistent effort and self-discipline.

Takeaways

- 😀 Lack of discipline is a critical barrier to achieving wealth and financial independence. It is essential to stay committed to your goals despite challenges.

- 😀 Discipline is the foundation for success, helping you stay organized, focused, and avoid distractions on the path to wealth.

- 😀 Your environment plays a significant role in your success. Being surrounded by people with similar growth ambitions can help you stay motivated.

- 😀 Excessive partying and distractions can undermine your progress. It's important to balance socializing with focus on self-improvement and goal achievement.

- 😀 Avoiding alcohol or limiting its consumption is crucial for maintaining mental clarity, health, and productivity on your journey to financial independence.

- 😀 Living within your means is fundamental to long-term financial stability. It’s important to make financial choices based on your actual income and priorities.

- 😀 Financial literacy begins with understanding your income, expenses, and the importance of living within your means to avoid debt.

- 😀 Invest in yourself and your future by focusing on things that add long-term value, such as education, health, and savings, rather than temporary luxuries.

- 😀 Wealth building is a marathon, not a sprint. Consistent effort, discipline, and the right mindset are essential for long-term success.

- 😀 True financial independence comes from controlling your desires, making informed choices, and not trying to impress others with status symbols.

Q & A

What is the first mistake to avoid when striving for wealth?

-The first mistake is a lack of discipline. Discipline is key to sticking to your goals, plans, and commitments, especially when faced with challenges. It helps you stay focused and manage your time effectively.

How does discipline impact your path to financial independence?

-Discipline ensures that you stay on track despite temptations or distractions. It allows you to manage time, resist impulsive spending, and remain committed to long-term goals, ultimately driving you toward financial success.

What role does your environment play in achieving wealth?

-Your environment has a huge influence on your habits and mindset. Surrounding yourself with people who prioritize growth, self-improvement, and ambition will keep you focused and motivated, while spending time with those who indulge in constant entertainment can hinder your progress.

Why is it important to limit partying on the path to wealth?

-Excessive partying drains both your time and energy. Instead of spending evenings in social distractions, use that time for self-development, learning new skills, or working on projects that will bring you future income.

How can drinking alcohol negatively affect your pursuit of wealth?

-Alcohol can negatively impact your health and productivity, leading to mental fog, reduced decision-making abilities, and poor physical well-being. This can undermine your ability to work effectively and focus on achieving your goals.

What should you consider regarding alcohol consumption when pursuing financial independence?

-While moderate alcohol consumption is a personal choice, excessive drinking can undermine your health and productivity. Reducing alcohol intake, especially early in your financial journey, can lead to better focus and long-term success.

What does living within your means mean in terms of financial discipline?

-Living within your means involves understanding your income and expenses, and making conscious choices to avoid debt. It ensures that you can save and invest for things that matter most, rather than spending money on things that quickly lose value.

How can buying expensive brands hinder your financial independence?

-Purchasing luxury items to appear successful, especially when they are beyond your financial capacity, can lead to debt and financial stress. True financial independence comes from making smart financial choices, not trying to impress others with material goods.

What are the consequences of not managing your financial desires?

-Failing to manage desires and spending beyond your means can lead to financial instability, debt, and stress. Financial discipline is about controlling your impulses and making decisions based on what you can afford, not on societal pressures.

Why is financial discipline considered a foundation for long-term success?

-Financial discipline allows you to manage your finances prudently, avoid unnecessary expenses, and focus on what truly matters, such as education, health, and investments. It creates peace of mind and builds confidence in your future.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

What I Learned Reading 50 Books on Money

10 Money Habits Keeping You Broke (And How the Rich Avoid Them)

Why you care so much (and How to Stop)

CÓMO USAR UN SALARIO MÍNIMO PARA HACERSE RICO - Warren Buffett

You've Been Trained To Be POOR! (10 Shocking Money Traps)

4 Langkah Mencapai Kebebasan Finansial ala Merry Riana | Wanita Sejuta Dolar

5.0 / 5 (0 votes)