Inequality: Why are the rich getting richer?

Summary

TLDRThis video exposes the myth of wealth 'trickling down' from the richest to the rest of us. It explains how money in the economy is largely created by banks when they issue loans, leading to a massive amount of debt that disproportionately burdens the bottom 90% of the population. The video argues that this system shifts wealth to the top 10% while trapping most people in debt. The solution proposed is creating money through a public body, which would reduce debt, close the wealth gap, and reduce the burden of interest payments. The video encourages viewers to join the campaign for a fairer financial system.

Takeaways

- 😀 The gap between the very richest and the rest of society is growing.

- 😀 A common belief that wealth will trickle down from the richest to the rest is a myth.

- 😀 In reality, wealth is being sucked up from the majority to a very small group of people.

- 😀 Most money in the economy is created by banks when they issue loans, not by lending out others' savings.

- 😀 Banks create new money electronically when loans are made, and 97% of money in the economy is created this way.

- 😀 Our economy relies on the money created through loans, meaning we depend on debt for money circulation.

- 😀 If no one went into debt, there would be very little money in the economy.

- 😀 The interest on debt is paid to banks, transferring wealth from the bottom 90% of the population to the top 10%.

- 😀 The daily interest paid to banks in the UK alone is £192 million, contributing to the growing wealth gap.

- 😀 As long as we rely on loans from banks, the wealth gap between the richest and the rest will continue to increase.

- 😀 A potential solution is to create money through a public body, not through private bank loans, to reduce debt and inequality.

Q & A

What is the common belief about wealth distribution in society?

-The common belief is that it's good for everyone if a small group of people earns a large amount of money because their wealth will trickle down to the rest of society.

Why is the belief about wealth distribution a myth?

-The belief is a myth because, in reality, wealth is not trickling down. Instead, it is being sucked up from the majority of people into the pockets of a very small group of the richest individuals.

How is money created in the economy today?

-Almost all of the money in the economy is created by banks when they issue loans. This money is created electronically by typing numbers into a borrower's account.

What is the common misconception about loans and money creation?

-A common misconception is that when banks give loans, they are lending out someone else's savings. In reality, banks create new money when they lend.

What percentage of money in the economy is created through loans?

-97% of all money in the economy is created when people take out loans from banks.

What would happen if no one went into debt in the economy?

-If nobody went into debt, there would be almost no money in the economy. Our economy relies on money created through loans.

How does the system of money creation benefit the wealthiest individuals?

-The system benefits the wealthiest individuals because the interest on the loans, which is a large burden on the bottom 90% of the population, is transferred to the top 10%, which holds most of the wealth.

How much interest do people in the UK pay to banks every day?

-People in the UK collectively pay £192 million in interest to banks every single day.

Why does the gap between the richest and the rest of society continue to grow?

-The gap continues to grow because the system forces people to rent money from banks by borrowing. This results in high interest payments that transfer wealth from the majority of people to the wealthiest.

What alternative to the current system of money creation is being proposed?

-The proposal is to create money through a public body that would inject it directly into the economy, so people wouldn’t have to borrow money from banks and go into debt. This could reduce overall debt and help prevent the gap between the rich and the rest from widening.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

The African tyrant living in luxury while his people starve | 60 Minutes Australia

How Hong Kong became one of the world’s most unequal cities

Andrew Carnegie

The Richest Man In Babylon // 10 Timeless Wealth Lessons

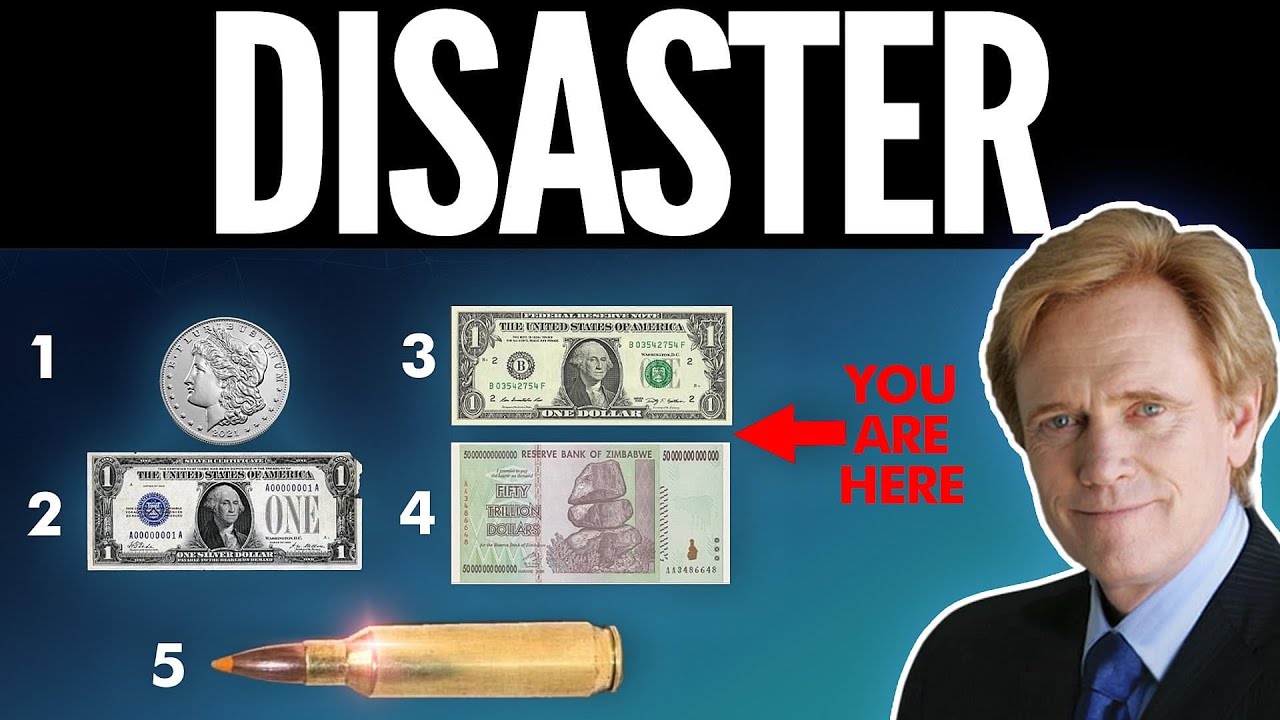

Silver vs Fiat: The Fall of Minimum Wage in Real Terms | Mike Maloney

Income Inequality and Wealth Inequality I A Level and IB Economics

5.0 / 5 (0 votes)