Manajemen Risiko: Transfer Risiko

Summary

TLDRThis presentation by students from Universitas Pamulang explains the concept of risk transfer in businesses. It covers the various types of risks, including human and property risks, and highlights methods of risk transfer such as insurance, subcontracting, and contract amendments. The script also outlines the objectives of using insurance for risk management, like cost reduction, protection, and investment. Additionally, the presentation discusses the importance of risk transfer for companies, the challenges faced in its implementation, and the role of culture and management in adopting these strategies. The video concludes with an invitation for questions and further engagement.

Takeaways

- 😀 Risk is the uncertainty of events that may cause harm or loss to a business or individual.

- 😀 Risk transfer is a method of managing risk by shifting the consequences to another party, such as an insurance company.

- 😀 The three main strategies for handling risk are: Risk Transfer, Risk Acceptance, and Risk Avoidance.

- 😀 Risk transfer involves moving the risk from a company to another entity that can better manage it.

- 😀 Common risk transfer products include insurance for life, health, vehicles, education, disasters, accidents, retirement, and others.

- 😀 Subcontracting is another method of risk transfer, where specialized tasks are delegated to third-party contractors who assume the related risks.

- 😀 Modifying contract clauses allows companies to shift risk exposure to other parties by renegotiating terms in a contract.

- 😀 The main objectives of risk transfer are to provide protection, financial security, efficiency, and to cover potential losses.

- 😀 Insurance can help businesses reduce the financial impact of risks and offer security for unforeseen events.

- 😀 Challenges in risk transfer include incomplete risk coverage, cultural resistance within companies, high costs of protection, and choosing the right risk transfer method.

- 😀 While risk transfer does not eliminate all risks, it is an essential tool for businesses to manage uncertainty and safeguard against significant losses.

Q & A

What is the definition of risk in the context of the script?

-Risk is defined as uncertainty regarding the occurrence of an event that may result in a loss. It is a potential hazard that can negatively impact a company.

What are the three main approaches to handling risk mentioned in the script?

-The three main approaches are: 1) Risk Transfer, which involves shifting the risk to another party; 2) Risk Acceptance, where the company chooses to bear the risk; and 3) Risk Avoidance, which means taking steps to prevent the risk from occurring.

How does risk transfer work?

-Risk transfer is a strategy where a company shifts the responsibility of managing risk to another entity, typically an organization with more expertise in handling such risks.

What is the role of insurance in transferring risk?

-Insurance is used as a tool for transferring risk, allowing companies to protect themselves from potential losses by paying premiums to an insurance company, which assumes the financial responsibility in case the risk occurs.

What types of insurance are mentioned as useful for transferring risk?

-The script mentions various types of insurance, including life insurance, health insurance, vehicle insurance, education insurance, disaster insurance, accident insurance, retirement insurance, and others.

What are the primary benefits of using insurance for risk transfer?

-The primary benefits include reducing potential losses, providing financial protection, enabling businesses to avoid large out-of-pocket expenses, ensuring compensation for losses, and offering security for loans and credits.

What is the significance of risk transfer for a company?

-Risk transfer is important because it helps reduce the volatility of a company’s income and performance. By shifting risk to a third party, companies can focus on core operations without the added uncertainty of potential financial losses.

What are some of the challenges companies face when implementing risk transfer?

-Challenges include the fact that risk transfer does not completely eliminate risk, the company's cultural resistance to change, reluctance from management to incur additional costs, and the potential for choosing an inappropriate risk transfer product.

How does subcontracting contribute to risk transfer?

-Subcontracting allows a company to delegate specialized tasks and associated risks to subcontractors who are better equipped to manage those risks, thereby reducing the company’s exposure to potential losses.

What is the purpose of renegotiating contract clauses in risk transfer?

-Renegotiating contract clauses helps ensure that the allocation of risk is fair and balanced. If a clause places undue risk on one party, it can be amended to prevent project failure or financial strain.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Sambutan Ketua LKA (Lembaga Kealumnian dan Kemahasiswaan) Unpam

KETUA YAYASAN SASMITA JAYA | PKKMB 2024/2025 Genap

ECOTOURISM • Ekowisata Di Dunia

UJAR SISTEM INFORMASI MANAJEMEN PERTEMUAN 2 KONSEP DASAR DAN RUANG LINGKUP SISTEM INFORMASI MANAJEME

Contoh Video Presentasi Menarik Kelompok 7 | Sistem Informasi Manajemen

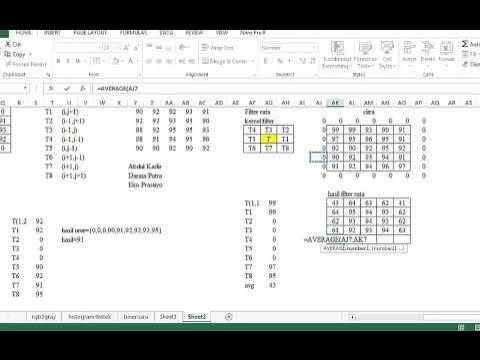

Materi Pengolahan Citra Digital|Filterin Rata|Filter Rata|Filter Rata di Matlab|nayavadaacademic.com

5.0 / 5 (0 votes)