Difference between Futures and Options Contract - HDFC Securities

Summary

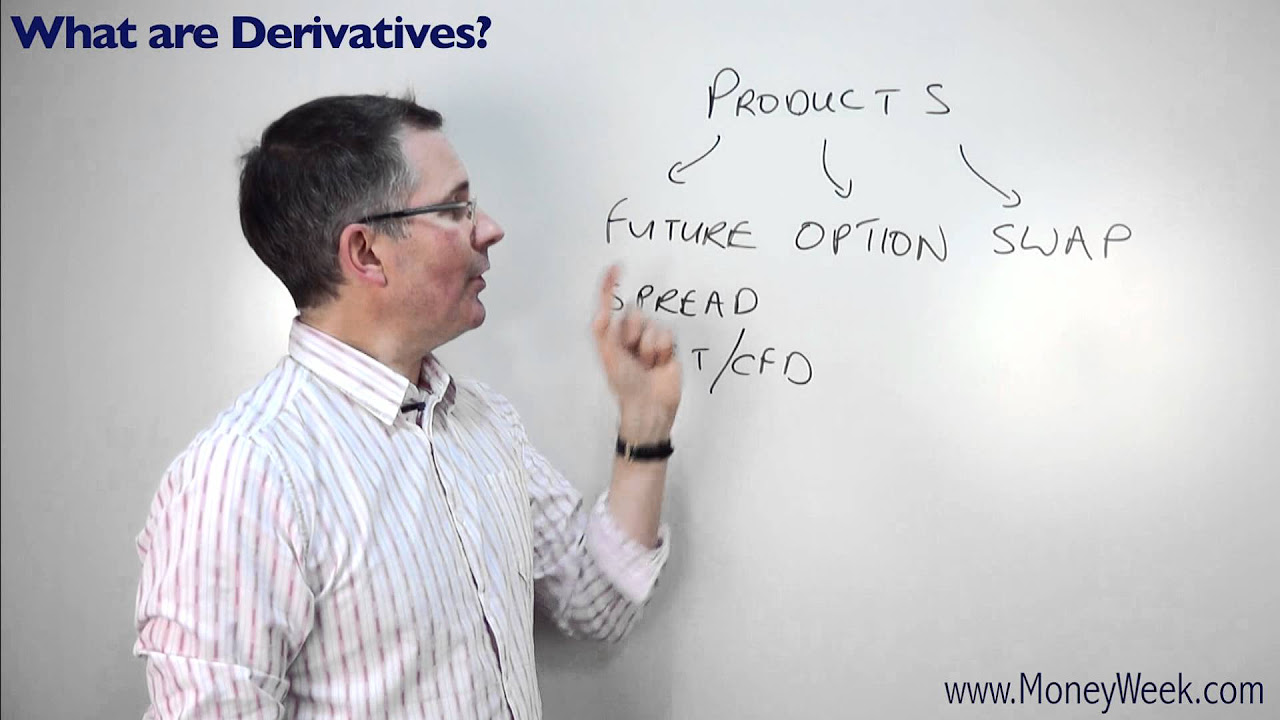

TLDRThis video explains the fundamentals of futures and options as derivatives, emphasizing how their values are derived from underlying markets. It outlines the key differences between the two: futures contracts impose obligations to buy or sell at a future date, while options provide rights without obligations. The discussion covers the payment structures, risk levels, and execution timelines associated with each. Options carry limited risk, with potential losses capped at the premium paid, while futures involve higher risk. Viewers are advised to carefully consider market risks before investing in securities.

Takeaways

- 📈 Futures and options are derivatives that derive their value from an underlying market.

- 🔄 A futures contract creates an obligation to buy or sell physical goods at a future date.

- ✅ Options contracts provide a right, but not an obligation, to buy or sell an asset.

- 📊 Options involve purchasing rights for a premium, whereas futures require a down payment.

- ⚖️ The risk level in futures is high, while options carry limited risk.

- 💵 The maximum loss when buying options is limited to the initial premium paid.

- 🗓️ Futures contracts are executed on a predetermined date, while options can be exercised any time before expiration.

- 🔍 Understanding the differences in risk levels is crucial for effective trading.

- 📉 Options trading is considered more complex and advanced than futures trading.

- ⚠️ Investors should be aware of market risks and read related documents carefully before investing.

Q & A

What are derivatives, and why are futures and options classified as such?

-Derivatives are financial instruments whose value is derived from an underlying asset or market. Futures and options are classified as derivatives because their values depend on the price movements of these underlying assets.

What is a futures contract?

-A futures contract is an agreement to buy or sell a physical good at a predetermined future date. It creates an obligation for the buyer to purchase and the seller to sell the asset.

How does an options contract differ from a futures contract?

-An options contract provides the buyer with the right, but not the obligation, to buy or sell an asset at a specified price before a certain date, unlike a futures contract which creates a mandatory obligation.

What are call and put options?

-Call options give the holder the right to buy an asset, while put options give the holder the right to sell an asset. These options allow traders to speculate on market movements.

What is the risk level associated with futures contracts compared to options?

-Futures contracts generally involve higher risk as they require fulfillment of the contract on a specified date, while options carry limited risk, as the maximum loss is restricted to the premium paid for the option.

What is a premium in the context of options trading?

-A premium is the price paid for the right to buy or sell an asset under an options contract. It represents the cost of acquiring the option.

When is the execution of a futures contract required?

-Execution of a futures contract must occur on the pre-decided date specified in the contract.

When can options contracts be exercised?

-Options contracts can be exercised at any time before the expiration date, providing more flexibility than futures contracts.

What should investors consider regarding market risks?

-Investors should understand that both futures and options are subject to market risks, and they should read all related documents carefully before investing.

Why might a trader choose to use options over futures?

-A trader might choose options over futures due to the limited risk exposure, as the maximum loss is confined to the premium paid for the option, making them potentially safer for speculative strategies.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)