Introduction to Investment【Dr. Deric】

Summary

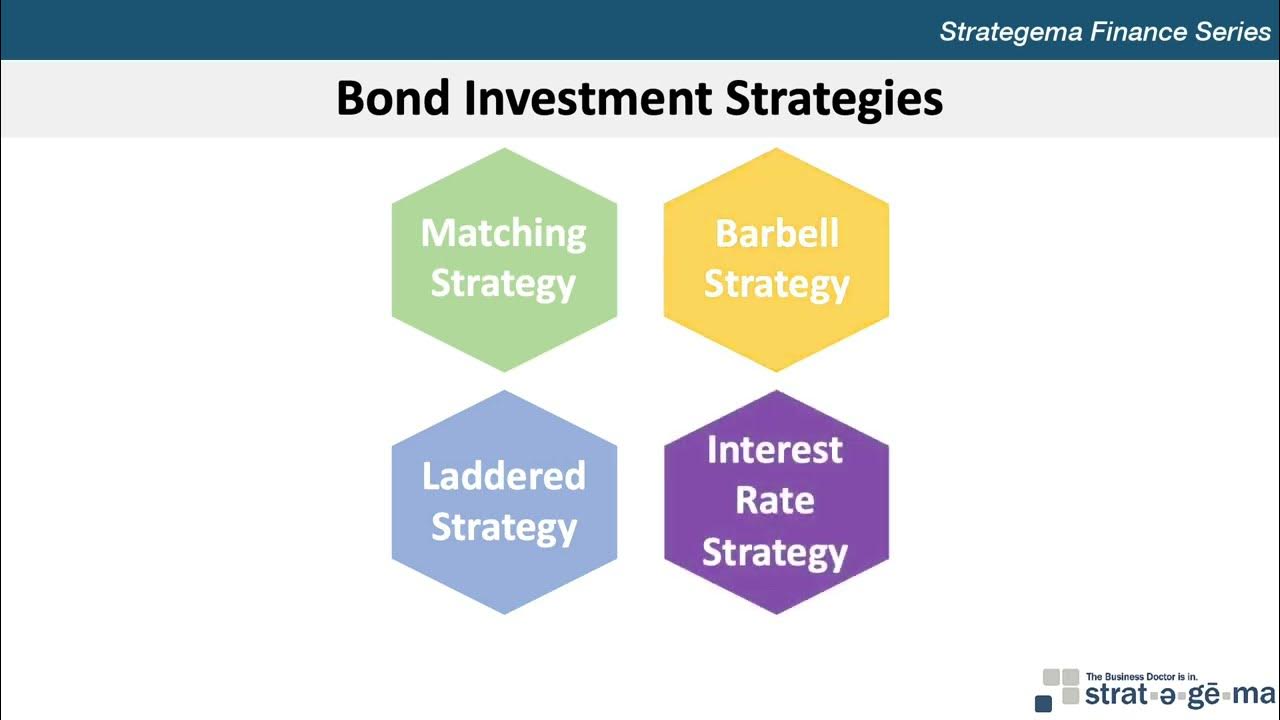

TLDRThis video provides a comprehensive overview of the bond market, explaining key concepts such as the role of interest rates in influencing returns on fixed-income securities. It highlights the inverse relationship between interest rates and bond prices—when rates rise, bond prices fall, and vice versa. The presenter also emphasizes the importance of understanding these dynamics for effective investing in bonds. By breaking down these fundamental principles, the video aims to equip viewers with essential knowledge for navigating the fixed-income market successfully.

Takeaways

- 📈 Interest rates are the most significant variable in determining returns for bonds and fixed-income securities.

- 📉 There is an inverse relationship between interest rates and bond prices.

- ⬆️ When interest rates rise, bond prices decrease.

- ⬇️ Conversely, when interest rates fall, bond prices increase.

- 🔍 Understanding this relationship is crucial for investors in the fixed-income market.

- 📊 Changes in interest rates directly impact investment strategies.

- 💡 Investors should monitor interest rate trends to optimize their bond investments.

- 🧮 The movement of interest rates affects the overall performance of a bond portfolio.

- 💵 Fixed-income securities are sensitive to fluctuations in interest rates.

- 👋 The video concludes by emphasizing the importance of these concepts for investors.

Q & A

What is the primary focus of the video?

-The primary focus of the video is to explain the relationship between interest rates and bond prices, highlighting how changes in interest rates affect the returns on bonds and other fixed-income securities.

Why are interest rates considered the most important variable for investors in fixed-income securities?

-Interest rates are deemed the most important variable because they directly impact the returns on bonds. Understanding interest rate movements is essential for investors to make informed decisions regarding their fixed-income investments.

How do interest rates and bond prices relate to each other?

-Interest rates and bond prices move in opposite directions: when interest rates increase, bond prices decrease, and when interest rates decrease, bond prices increase.

What happens to bond prices when interest rates rise?

-When interest rates rise, bond prices fall, leading to lower returns for investors holding those bonds.

What effect does a decrease in interest rates have on bond prices?

-A decrease in interest rates leads to an increase in bond prices, which benefits investors as the value of their bonds rises.

Why is understanding the movement of interest rates important for bond investors?

-Understanding interest rate movements is crucial for bond investors because it helps them anticipate changes in bond prices and manage their investment strategies accordingly.

Can you summarize the main takeaway from the video?

-The main takeaway from the video is that interest rates are pivotal in determining the performance of bonds and that investors should pay close attention to interest rate trends to optimize their fixed-income investments.

What is the significance of fixed-income securities in an investment portfolio?

-Fixed-income securities, like bonds, provide a stable income stream and are generally considered less risky compared to equities, making them an essential component of a diversified investment portfolio.

What are some factors that can influence interest rates?

-Factors that can influence interest rates include central bank policies, inflation rates, economic growth, and market demand for credit.

How can investors prepare for changes in interest rates?

-Investors can prepare for changes in interest rates by diversifying their portfolios, considering bond durations, and staying informed about economic indicators that might signal interest rate shifts.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

GUIA BÁSICO PRA INVESTIR EM RENDA FIXA | TUDO que você PRECISA SABER antes de investir em RENDA FIXA

Kurva LM, Keseimbangan Pasar Uang

Bond Valuation and Risk

The Term Structure of Interest Rates Spot, Par, and Forward Curves (2024 CFA® Level I Exam – FI 9)

IPCA +10,8%: NÃO CAIA NESSA ARMADILHA do IPCA+

GUIA DA RENDA FIXA PARA INVESTIDORES INICIANTES | O que é CDB, CDI, SELIC, LCA, LCI, LC, CRI, CRA?

5.0 / 5 (0 votes)