Real Estate Millionaire Vs Stock Market Millionaire

Summary

TLDRIn this engaging video discussion, experts delve into various investment strategies, particularly focusing on real estate and trading. They share personal experiences and insights, emphasizing sustainable growth over quick profits. The conversation includes a hypothetical scenario where participants manage each other's investments, fostering collaboration. Key investment criteria highlighted include co-living spaces, booming Airbnb markets, and corporate land acquisitions. The speakers encourage viewer engagement through comments for future content, aiming to provide informative and entertaining perspectives on financial management and investment opportunities.

Takeaways

- 😀 Managing daily expenses is crucial for sustainability, especially when taking care of staff.

- 📉 The unpredictability of trading requires careful consideration and management of risks.

- 🏠 Real estate investments, while slower to grow, can offer more stability compared to trading.

- 💡 A unique investment challenge involves giving each person ₹1 crore to manage and tracking their growth over five years.

- 👥 Learning from others' investment strategies can enhance personal growth and decision-making.

- 🏢 Co-living spaces present a viable investment opportunity with established companies in the market.

- 🌍 The Airbnb market is booming in specific regions like Goa and Alibag, offering potential for high returns.

- 🏗️ Large corporations purchasing land for development indicates a trend worth following for future investments.

- 📈 It's essential to develop a strategic investment plan tailored to individual risk appetites and goals.

- 💬 Engaging with the audience and inviting discussions can lead to deeper insights and collaborative learning in investment strategies.

Q & A

What is the speaker's primary concern for the next six months?

-The speaker is primarily concerned about managing daily expenses and ensuring they can pay their staff.

How does the speaker view trading in comparison to real estate investments?

-The speaker prefers real estate investments for their potential for steady growth, while they express hesitation towards trading due to its risks and the possibility of rapid financial loss.

What unique investment experiment does the speaker propose?

-The speaker proposes giving someone ₹1 crore to manage and track the growth of that investment over five years to compare it with their own current investment strategies.

What specific types of properties does the speaker recommend for investment?

-The speaker recommends investing in co-living spaces, areas in the Airbnb market, and locations where large corporations are purchasing land for development.

Which regions does the speaker identify as promising for Airbnb investments?

-The speaker identifies regions like Goa and Alibag as having high demand and low supply for Airbnb investments.

What is the speaker's attitude towards making quick money in trading?

-The speaker expresses a disinterest in making quick money through trading, emphasizing a preference for sustainable growth instead.

What insights does the speaker provide about managing risk in investments?

-The speaker highlights the importance of understanding market conditions and choosing investments that have a long-term potential rather than chasing quick returns.

How does the speaker suggest engaging with the audience?

-The speaker encourages the audience to participate in the discussion by sharing their thoughts in the comments section, indicating a willingness to provide further insights.

What does the speaker say about the timeline for growth in real estate investments?

-The speaker mentions that while growth in real estate might be slower compared to other investment types, it is more reliable over the long term.

How does the speaker view the potential of co-living spaces?

-The speaker believes co-living spaces have significant investment potential due to existing contracts with international companies, which can provide stable returns.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

최고의 ETF 총정리

A Startup “Surge” Could Fuel These 5 Midwest Real Estate Markets

КОГДА УПАДЁТ СТАВКА ПО ИПОТЕКЕ И ДОЛЛАР?

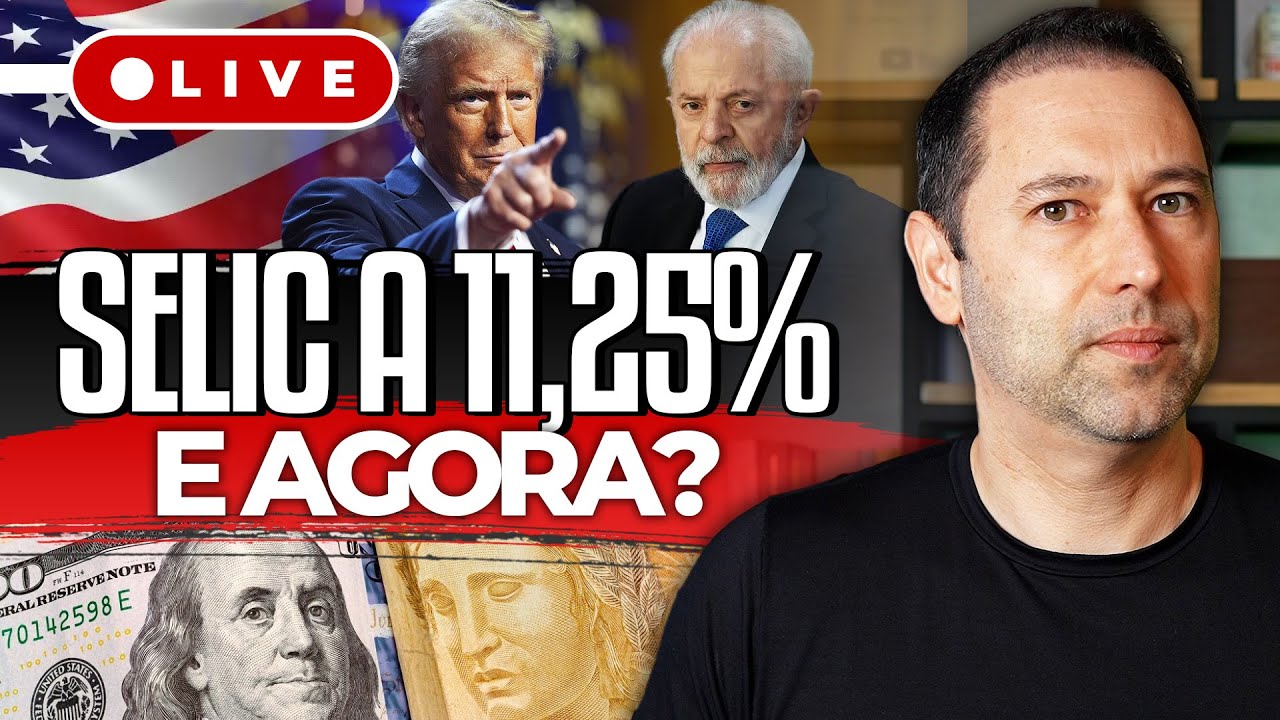

NOVA ALTA NA TAXA SELIC PARA 11,25% | COMO FICAM OS INVESTIMENTOS NO BRASIL + DONALD TRUMP ELEITO

Metaverse: The Future of the Internet? | Qatar Economic Forum

RESEARCH WORK REQUIRED BEFORE BUYING A PROPERTY

5.0 / 5 (0 votes)