一口气了解银行游戏规则 中美银行体系

Summary

TLDRThe video script discusses the recent U.S. bank collapses, focusing on the systemic failures within banks and the economic climate that contributed to the crisis. It highlights the rapid response of regulatory bodies, particularly the SBIC, in stabilizing confidence among depositors. The acquisition of First Republic Bank by J.P. Morgan is scrutinized for potential violations of the Dodd-Frank Act, raising concerns about monopolistic practices. Additionally, comparisons are drawn with banking systems in Japan and Switzerland, emphasizing the need for diverse regulatory approaches. The speaker advocates for a broader understanding of the financial system to address emerging challenges.

Takeaways

- 🏦 Banks have evolved significantly over the past centuries, impacting economies worldwide.

- 💰 The primary function of banks is to act as intermediaries that facilitate loans, which stimulate economic growth.

- 📈 There is a positive correlation between personal debt levels and GDP per capita in various countries.

- 🇨🇳 China's banking system is characterized by state-owned banks that operate under government directives and policies.

- 🇺🇸 The US banking system is highly market-oriented, allowing significant private sector influence and capital mobility.

- 📝 Modern banks can 'create' money by issuing loans, effectively expanding the money supply in the economy.

- ⚖️ Regulatory frameworks, such as the Dodd-Frank Act in the US, aim to manage risks in the banking industry but have faced challenges.

- 🚨 Recent bank failures in the US highlight systemic risks and the need for immediate government intervention to stabilize confidence.

- 📊 The Big Four banks in China dominate the banking landscape, accounting for a large portion of the financial system's assets.

- 🌍 Different countries adopt unique regulatory approaches to banking, influenced by their historical and economic contexts.

Q & A

What are the main factors contributing to the recent bank collapses in the U.S.?

-The recent bank collapses are attributed to internal problems within the banks and a crisis of confidence in small and medium-sized banks, particularly during economic downturns.

How has the U.S. government historically responded to banking crises?

-The U.S. government has learned from historical bank runs and crises, emphasizing the need for rapid and decisive actions to stabilize confidence in the banking system.

What steps were taken by the U.S. government in response to the recent bank failures?

-In response to the recent bank failures, the government acted swiftly to protect depositors and ensured that banks were taken over rapidly to maintain stability.

What was the significance of J.P. Morgan's acquisition of First Republic Bank?

-J.P. Morgan's acquisition of First Republic Bank was significant because it violated the Dodd-Frank Act by allowing one bank to hold more than 10% of the country's total deposits, raising concerns about monopoly power.

What is the Dodd-Frank Act, and why is it relevant in this context?

-The Dodd-Frank Act is a regulation enacted after the 2008 financial crisis to prevent too-big-to-fail banks. Its relevance lies in its restrictions on bank deposit concentrations, which were violated in the recent acquisition.

How do banking regulations differ between the U.S. and China?

-The U.S. banking system is market-oriented, focusing on loosening and tightening regulations based on market conditions, while China uses policy-driven approaches to regulate loans and the banking system.

What challenges arise when credit expansion exceeds certain limits?

-Excessive credit expansion can lead to diminishing returns on marginal effects, which can result in systemic problems within the banking and financial systems.

Why is public confidence important in the banking sector?

-Public confidence is crucial in the banking sector because a loss of trust can lead to bank runs and systemic failures, prompting the need for urgent government intervention.

What lessons has the U.S. government learned from past banking crises?

-The U.S. government has learned the importance of rapid response and decisive action to restore public confidence during banking crises, drawing from experiences in the 19th and 20th centuries.

What does the speaker hope to achieve by discussing the banking system in a broader context?

-The speaker aims to provide a more comprehensive understanding of the banking system by exploring its connections to the entire financial system, emphasizing the complexity of financial regulation.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

FEDERALES TENIAN EN LA MIRA A CDOBLETA

BIG New Nintendo Switch 2 Leaks Just Appeared!

Nitish ने ली CM पद की शपथ, तेजस्वी कैसे कर सकते हैं 'Check Mate', सुनिए Sukesh का राजनीतिक विश्लेषण

TIMNAS INDONESIA U17 KALAH SEGALANYA DARI KORUT DAN TERSINGKIR DARI PIALA ASIA!

बिहार में एंट्री करते ही राहुल ने कर दिया खेला, प्रेसिडेंट ने दिया इस्तीफा फंस गए नीतीश!

How would you go about solving this? Limit of x/sqrt(x^2+1) as x goes to infinity. Reddit inf/inf

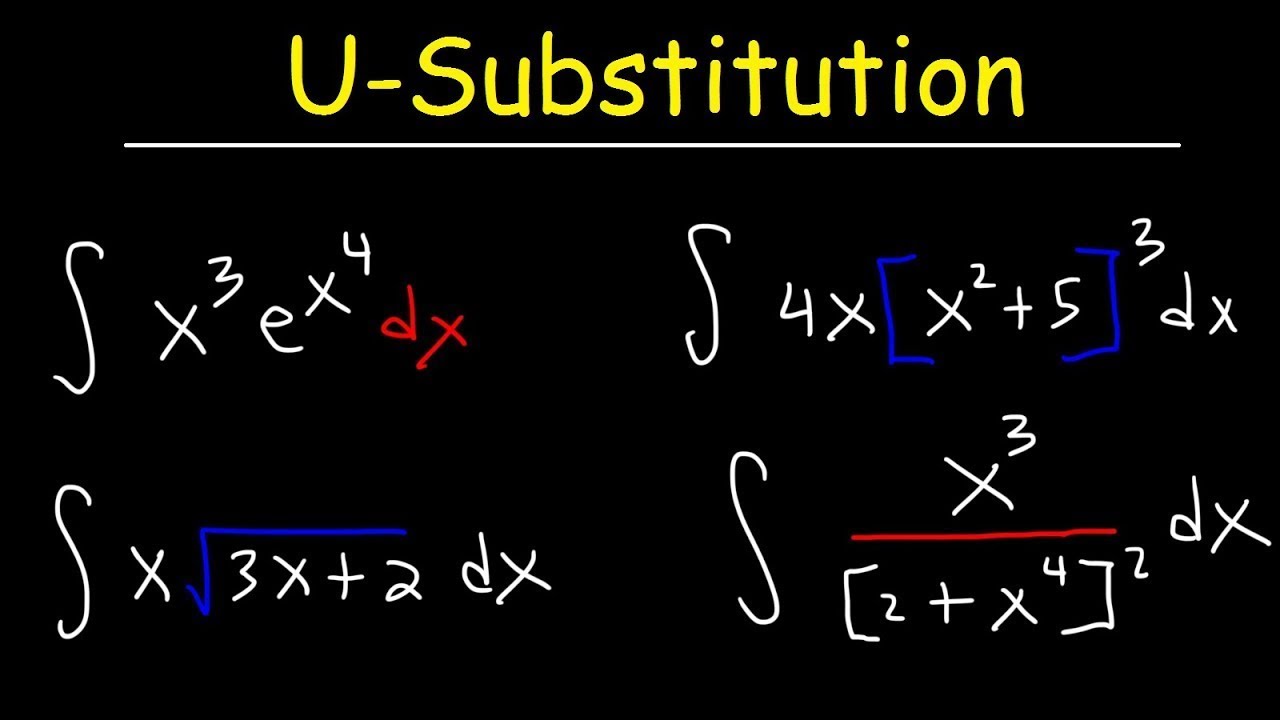

How To Integrate Using U-Substitution

5.0 / 5 (0 votes)