Lecture 02: Impairment of Loans Receivable. Receivable Accounting. [Intermediate Accounting]

Summary

TLDRThe transcript discusses the risk associated with financial instruments, highlighting how one party's failure to fulfill obligations can lead to financial loss for another. It elaborates on loan impairment accounting, defining it as the difference between the carrying amount and the present value of future cash flows, discounted at the original effective rate. The concept of estimated future cash flows is crucial, and the discussion touches on using the direct method for calculating impairment losses and assessing expected credit loss over a 12-month period, particularly when there is a significant increase in credit risk.

Takeaways

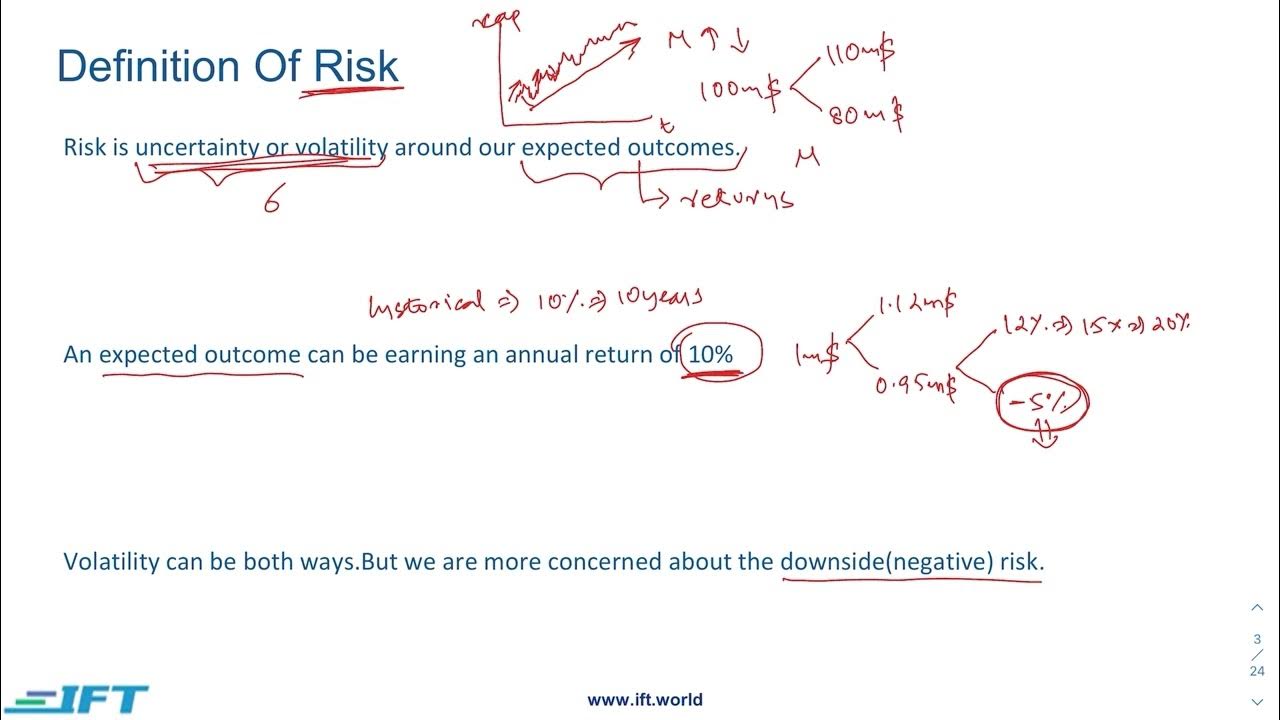

- 😀 Financial instruments carry the risk of one party causing financial loss to another by failing to meet obligations.

- 😀 Loan impairment is assessed based on observable data indicating a decrease in estimated future cash flows.

- 😀 Accounting for loan impairment involves measuring the difference between the carrying amount and the present value of future cash flows.

- 😀 The present value of estimated future cash flows is discounted at the original effective interest rate.

- 😀 Impairment is recorded based on its current value and future estimates.

- 😀 The comparison of carrying amount and present value of cash flows is crucial in assessing loan impairment.

- 😀 Using the direct method, impairment loss is automatically debited when assessing expected credit loss.

- 😀 The 12-month expected credit loss model is used for estimating potential impairment.

- 😀 A significant increase in credit risk triggers specific accounting measures for loan impairment.

- 😀 Monitoring changes in credit risk is essential for accurate financial reporting and impairment evaluation.

Q & A

What is the primary risk discussed in the transcript?

-The primary risk is that one party to a financial instrument may cause a financial loss to the other party by failing to fulfill their obligations.

What does the term 'impairment' refer to in this context?

-Impairment refers to a measurable decrease in the estimated future cash flows associated with a financial instrument.

How do we measure loan impairment?

-Loan impairment is measured as the difference between the carrying amount and the present value of estimated future cash flows, which are discounted at the original effective interest rate.

What does the impairment value represent?

-The impairment value represents the current estimated value of future cash flows, reflecting what is expected to happen rather than historical values.

What method is mentioned for comparing carrying amounts and cash flows?

-The direct method is mentioned for comparing carrying amounts and present value of estimated cash flows.

What is debited when using the direct method in accounting for impairments?

-When using the direct method, impairment losses are debited.

What is the expected credit loss mentioned in the transcript?

-The expected credit loss mentioned is the 12-month expected credit loss, which is used to assess credit risk.

What indicates a significant increase in credit risk?

-A significant increase in credit risk is indicated by observable data that reflects changes in expected future cash flows.

Why is the original effective rate used for discounting cash flows?

-The original effective rate is used for discounting cash flows to ensure that the measurement reflects the rate at which the loan was originally made.

What role does observable data play in assessing impairment?

-Observable data plays a crucial role in determining whether there is a measurable decrease in estimated future cash flows, impacting the assessment of impairment.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

1. Options, Futures and Other Derivatives Ch1: Introduction Part 1

IAS 32 Financial Instruments Presentation | IFRS Lectures | ACCA Exam | International Accounting

FRM Part 1 Book 1 Chapter 1 – Lecture 1

Contacts

OJK Cabut Izin Kantor Akuntan Public Akibat Kasus Gagal Bayar

Resiko Reputasi | Manajemen Risiko Bank

5.0 / 5 (0 votes)