2 Pengertian Manajemen Investasi dan Fungsi dari manajer investasi

Summary

TLDRThe video discusses investment management, emphasizing its role in building diverse portfolios of stocks and bonds with clear goals. It highlights the importance of professional investment managers who analyze market trends and provide tailored advice. Viewers learn when to seek investment management services, the distinction between fixed and liquid assets, and insights into leading investment firms in Indonesia. The content encourages financial literacy, urging investors to monitor financial statements and choose investments wisely, ultimately fostering a proactive approach to wealth-building in a dynamic financial landscape.

Takeaways

- 😀 Investment management is the process of building a diverse portfolio of stocks, bonds, and other financial instruments to achieve specific financial goals.

- 📈 An investment manager analyzes market trends and forecasts to provide strategic investment advice to clients.

- 🤝 Hiring a professional investment manager can help new investors navigate the complexities of investing and provide peace of mind.

- ⚖️ Understanding the balance between risk and return is crucial; higher returns typically come with higher risks.

- 💼 Investment managers are responsible for providing tailored strategies that align with their clients' financial objectives.

- 🔍 New investors should be aware of when to seek help from investment management services, especially when feeling uncertain about their decisions.

- 📊 Regular monitoring and analysis of your investment portfolio are vital to assess performance and make informed decisions.

- 🏆 Top investment management firms in Indonesia include Manulife, Sinarmas Asset Management, and Bahana TCW Investment Management.

- 📉 Investors should focus on understanding financial statements, particularly profit and loss reports, to evaluate the health of their investments.

- 💡 Continuous learning and openness to new information are essential for successful investing in a rapidly changing financial market.

Q & A

What is investment management?

-Investment management is the process of building and managing a portfolio of assets such as stocks, bonds, and other investment instruments to achieve specific financial goals.

Why might someone hire an investment manager?

-Individuals might hire an investment manager for professional guidance in selecting investments, managing their portfolio, and implementing strategies to optimize returns while managing risk.

What are the primary responsibilities of an investment manager?

-Investment managers analyze market trends, make predictions about stock performance, provide investment strategies, and manage client portfolios to meet their financial objectives.

How can a beginner assess the safety of an investment?

-Beginners can assess the safety of an investment by understanding the fundamentals of the asset, reviewing financial statements, and consulting with a professional investment manager for advice.

What factors should be considered when deciding to use investment management services?

-Consider using investment management services if you lack confidence in making investment decisions, need professional advice for managing your portfolio, or face complex financial situations.

What types of assets are included in investment management?

-Investment management includes various assets such as stocks, bonds, real estate, mutual funds, and other securities.

What are some of the top investment management firms in Indonesia mentioned in the transcript?

-The top investment management firms in Indonesia mentioned include Manulife, Sinarmas Asset Management, and Bahana TCW Investment Management.

What is the significance of reading financial reports in investment management?

-Reading financial reports, such as profit and loss statements, is crucial for evaluating a company's performance, assessing its profitability, and making informed investment decisions.

What should investors focus on to maximize their returns?

-Investors should focus on identifying companies with consistent profit growth and low debt levels, as these factors often indicate a company's strong financial health and potential for high returns.

What is the relationship between risk and return in investing?

-In investing, higher potential returns usually come with higher risks. Investors must carefully assess their risk tolerance and investment objectives to find an appropriate balance.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

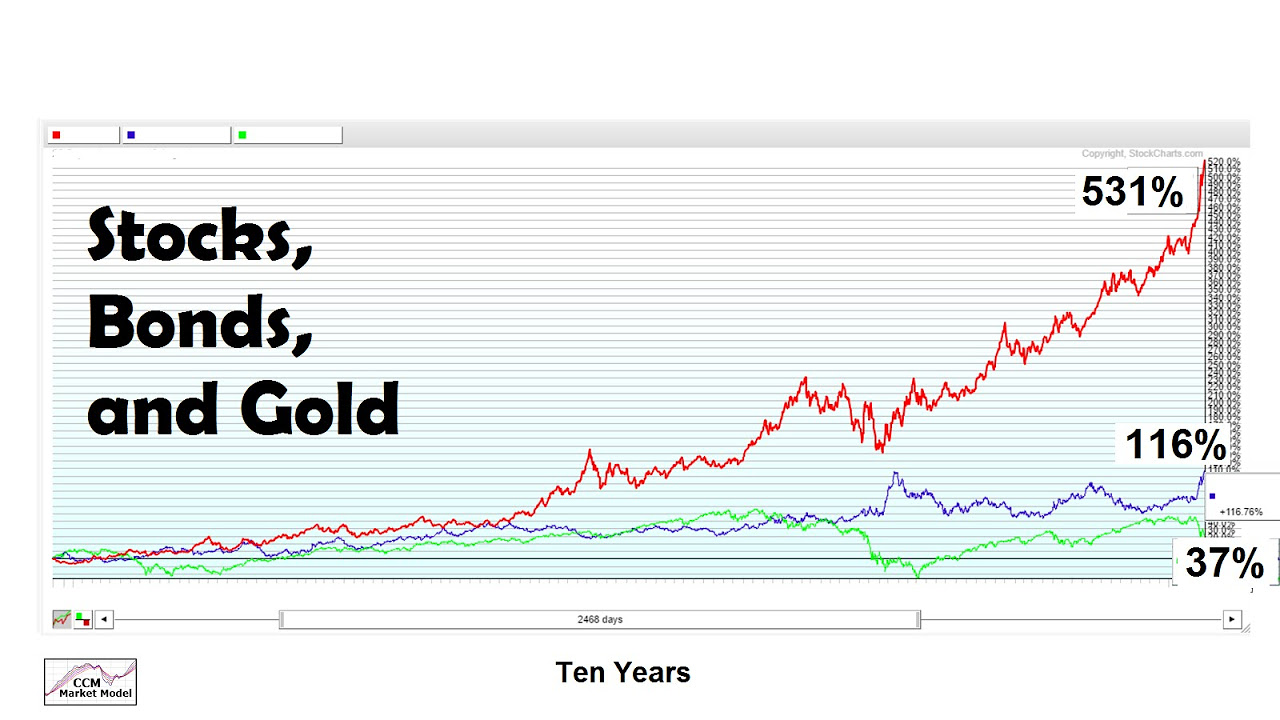

Is Gold a Good Investment?

Gold Can Add Value To A Stock/Bond Portfolio

Learn About Investing #6: Stocks vs Bonds | Stock Market

ch 22 demand for money part 4 of 5 Friedman modern Quantity theory of Money

Investasi Jenis Apa yang Cocok untuk Kamu? | feat. Mercy Widjaja

Kenapa Orang Kaya Menaruh Uang di Obligasi?

5.0 / 5 (0 votes)