Latest AUDUSD Forecast and Technical Analysis for April 24, 2024

Summary

TLDRIn this insightful analysis, the speaker discusses the current state of the Aussie US dollar (AUD/USD) currency pair, offering a comprehensive top-down analysis from the monthly to the hourly time frame. They identify a potential 'big WXY pattern' and suggest that the most recent price action could be part of an ABC correction within Wave Y. The speaker anticipates a possible end to the correction with the current weekly candle, which could lead to an impulsive move up, indicative of a new wave sequence. On the daily chart, they note a strong impulsive move and a significant Fibonacci bounce, signaling a potential trend reversal. The four-hour chart is seen as an ongoing uptrend, with the speaker looking for long positions after the recent uptrend. Finally, on the hourly chart, they suggest the trend may not be over and that a small pullback could lead to another uptrend, confirming the higher time frame continuation. The speaker also invites viewers to join their free Discord group and check out their membership program for daily live trading sessions and swing trade setups.

Takeaways

- 📈 The speaker believes the AUD/USD currency pair is in a significant 'wxy' pattern, suggesting a potential trend change.

- 🌊 The most recent price action is considered an 'ABC' of Wave Y, which typically includes a 'Wave A' and 'Wave C'.

- 🔍 On the weekly time frame, the speaker anticipates the possibility of the end of a correction, which could signal the start of an uptrend.

- 🚀 An impulsive upward move is observed, which could represent the start of a new wave (Wave 1), followed by a corrective wave (Wave 2).

- 🎢 The daily time frame shows a strong impulsive move, with a potential 'ABCDE' pattern, indicating a possible downtrend for Wave C.

- 🎯 A significant Fibonacci level bounce is noted, which the speaker has been expecting as part of the pattern.

- ➡️ The speaker plans to go long, looking for confirmation of the trend with further price action.

- 📊 On the 4-hour time frame, an uptrend is identified, with the potential for a continuation (Wave 3) after a correction (Wave B or Wave 2).

- 🔄 The 1-hour time frame suggests the trend may not be over, with a possible 'three-way' pattern that could lead to a resumption of the uptrend.

- 📌 The speaker advises caution, with an eye on the Fibonacci retracement levels, expecting a pullback between 38% and 78% of the move up.

- 💬 The speaker invites listeners to join their free Discord group and check out their membership program for daily live trading sessions and swing trade setups.

Q & A

What is the speaker's main focus in the analysis?

-The speaker is focusing on analyzing the Aussie US dollar (AUD/USD) across different time frames, from monthly to hourly, to identify potential trading opportunities based on Elliott Wave Theory.

What is the 'wxy pattern' the speaker refers to?

-The 'wxy pattern' is a term used in Elliott Wave Theory to describe a three-wave correction that typically follows a strong five-wave impulse move. The speaker believes the AUD/USD is in such a pattern.

What does the speaker suggest could be the end of a 'correction'?

-The speaker suggests that depending on how the weekly candle closes, it could mark the end of a 'correction', which would imply the start of a new impulse wave to the upside.

What is the significance of the 'Fibonacci level' mentioned in the script?

-The 'Fibonacci level' refers to a key support or resistance level derived from the Fibonacci sequence, which is often used in technical analysis to predict potential reversal points. The speaker mentions a significant bounce at a Fibonacci level, indicating a possible reversal or continuation of a trend.

What trading bias does the speaker express towards the end of the script?

-The speaker expresses a bullish bias, suggesting that they would be looking to go long (buy) after the identified impulsive move up, and are looking for confirmation of the uptrend on higher time frames.

What is the potential trading strategy on the four-hour time frame?

-The speaker suggests that the four-hour time frame indicates an uptrend that may not be over. They propose a strategy of going long after a correction into the uptrend, which could be a wave B or a wave two, and then looking for a profit opportunity.

What does the speaker mean by 'CRUT' in the context of the one-hour time frame?

-The acronym 'CRUT' seems to be a typo or a mispronunciation. In the context, it likely refers to a 'corrective' move or a 'retracement', which is a temporary price movement opposite to the dominant trend.

What is the significance of the '3, 4, 5 save' mentioned by the speaker?

-The '3, 4, 5 save' is a reference to a potential pattern or sequence of waves in Elliott Wave Theory. The speaker suggests that the market needs to make this pattern to complete the current trend before moving on to the next phase.

What is the speaker's recommendation for traders interested in their analysis?

-The speaker recommends joining their free Discord Group and checking out their membership program, which provides access to daily live trading sessions and swing trade setups.

What is the website mentioned by the speaker for signing up to their membership program?

-The website mentioned by the speaker for signing up to their membership program is fxipcola.com.

How does the speaker conclude their analysis?

-The speaker concludes by reiterating the potential trading opportunities based on the Elliott Wave Theory analysis, and encourages traders to join their Discord Group and consider their membership program for more insights.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Latest EURUSD Forecast and Technical Analysis for November 1, 2024

How To Catch The Highest Probability Setup (FULL GUIDE)

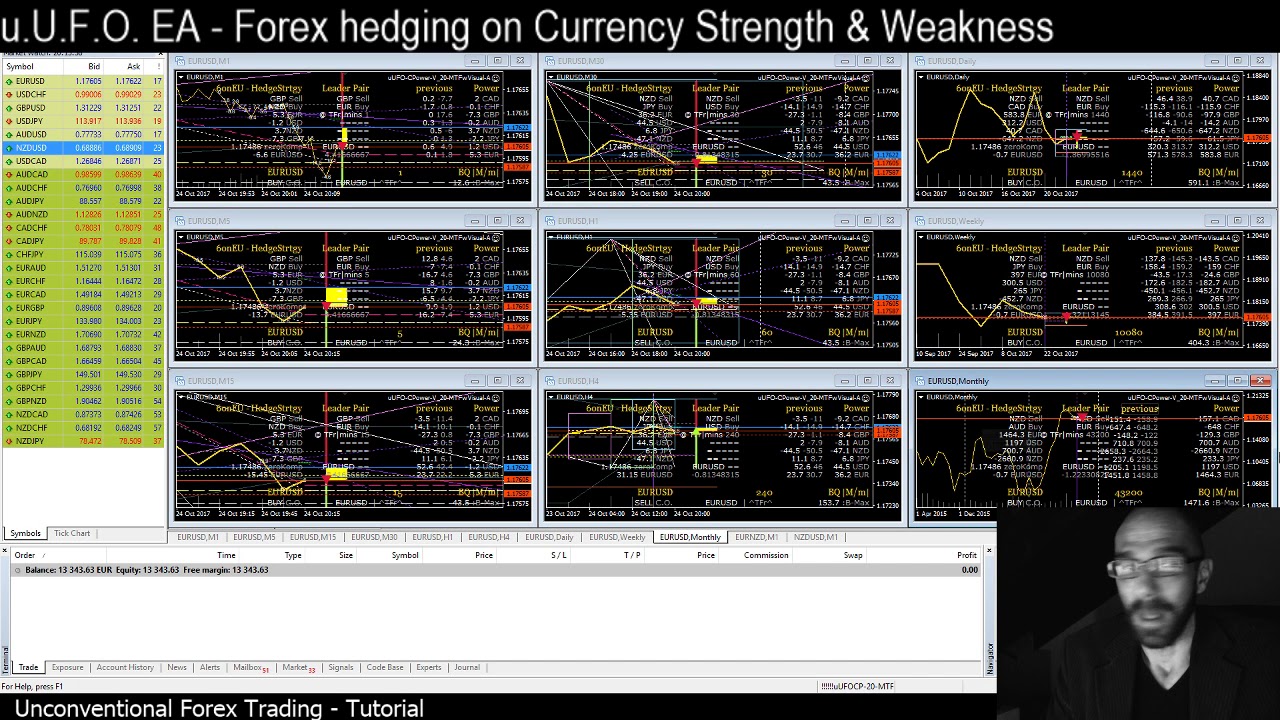

Forex math based formula application - MT4 - uUFO-EA: foreign currency hedging strategy explained.

4. Timeframes

US Dollar is not a currency - it is a weapon | How America controls the world | Abhi and Niyu

The MMXM Trader | Advanced ICT MMXM Lesson (Everything You Need To Know)

5.0 / 5 (0 votes)