China is Bailing Out Their ENTIRE Banking System

Summary

TLDRThe video discusses the worsening situation of China's banking system, marked by a significant deterioration in credit conditions. The Chinese government recently announced a trillion yuan recapitalization plan for its six largest banks, confirming fears of hidden financial instability. While Chinese and Hong Kong stock markets react with volatile optimism driven by stimulus hopes, the underlying economic conditions remain grim. The focus is on the potential credit crisis, the impact on China's broader economy, and the skepticism surrounding the effectiveness of these stimulus measures in resolving the deeper systemic issues.

Takeaways

- 💣 China's banking system is in serious trouble, with significant deterioration in credit conditions.

- 🏦 A recapitalization plan for China's six largest banks has been quietly announced, potentially amounting to 1 trillion yuan.

- 📉 The ongoing crisis is not yet a liquidity crisis but is shaping up to be a major credit crisis.

- 📈 Chinese and Hong Kong stocks are extremely volatile, driven by stimulus hopes, but the reality of failed stimulus could quickly follow.

- 🤫 There has been a near-total silence from officials regarding the banking recapitalization plan, adding to concerns about the severity of the situation.

- 💰 China's biggest state-owned banks could receive injections of 100 billion yuan each to support the struggling economy, funded by new special sovereign bonds.

- ⚠️ Hidden losses, particularly non-performing loans, are likely much larger than what is being disclosed by China's banks.

- 📉 Chinese banks have been pulling back on lending all year, indicating they are balance-sheet constrained due to hidden losses.

- 🔄 The recapitalization plan echoes China's past strategies, such as during the 1998 financial crisis, where the government bailed out banks with special government bonds.

- 📉 Stock markets in China and Hong Kong react wildly to stimulus announcements, but underlying economic issues, like the banking crisis, continue to hinder real recovery.

Q & A

What is the main issue with China's banking system according to the transcript?

-The main issue with China's banking system is a serious deterioration in credit conditions, leading to a potential credit crisis. The government has announced a recapitalization plan for China's six largest banks, which signals the severity of the situation.

How has the Chinese government responded to the banking crisis?

-The Chinese government has responded by announcing a recapitalization plan, potentially injecting up to 1 trillion Yuan into China's six largest banks. This includes special sovereign bonds to strengthen their capital base and support the struggling economy.

Why does the transcript suggest that China's economy is in bad shape?

-The economy is described as deteriorating due to several factors, including the banking crisis, shrinking bank profits, the real estate bust, and ineffective stimulus measures. The banking system's struggles to generate credit are worsening the overall economic situation.

What role has the stock market played in the current economic environment in China?

-The stock market has been highly volatile, with shares rising rapidly in response to stimulus announcements, only to decline again when the reality of failed stimulus measures becomes apparent. This reflects speculative behavior, with investors hoping for short-term gains.

What is the significance of the recapitalization plan mentioned in the transcript?

-The recapitalization plan is significant because it confirms that China's banking system is under severe stress. It suggests that the banks have hidden losses, particularly related to non-performing loans, and that the government is stepping in to prevent a deeper crisis.

What is the potential impact of the recapitalization on China's economy?

-While the recapitalization may temporarily stabilize the banking system, it is unlikely to solve the underlying economic problems. The banking system's balance sheet constraints and the broader economic downturn suggest that this is only a short-term fix.

How does the transcript compare the current situation to past financial crises in China?

-The transcript compares the current recapitalization plan to similar efforts in 1998 and during the global financial crisis, where the government used special bonds to bail out banks. It suggests that this approach is being repeated because of the hidden, long-standing problems in the banking system.

What are non-performing loans, and why are they a concern in China's banking system?

-Non-performing loans (NPLs) are loans on which the borrower is not making interest or principal payments as scheduled. In China's banking system, NPLs are a major concern because their increasing levels indicate deeper financial instability, especially in the real estate sector.

Why does the transcript mention 'hidden losses' in the Chinese banking system?

-The 'hidden losses' refer to the bad loans or non-performing loans that are not fully disclosed or recognized on the banks' balance sheets. These undisclosed losses make the banking system more vulnerable and are a key reason behind the recapitalization plan.

What does the transcript suggest about the effectiveness of China's stimulus measures?

-The transcript suggests that China's stimulus measures are largely ineffective. While they may temporarily boost stock market performance, they fail to address the deeper structural issues in the economy, such as the banking crisis and real estate sector problems.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

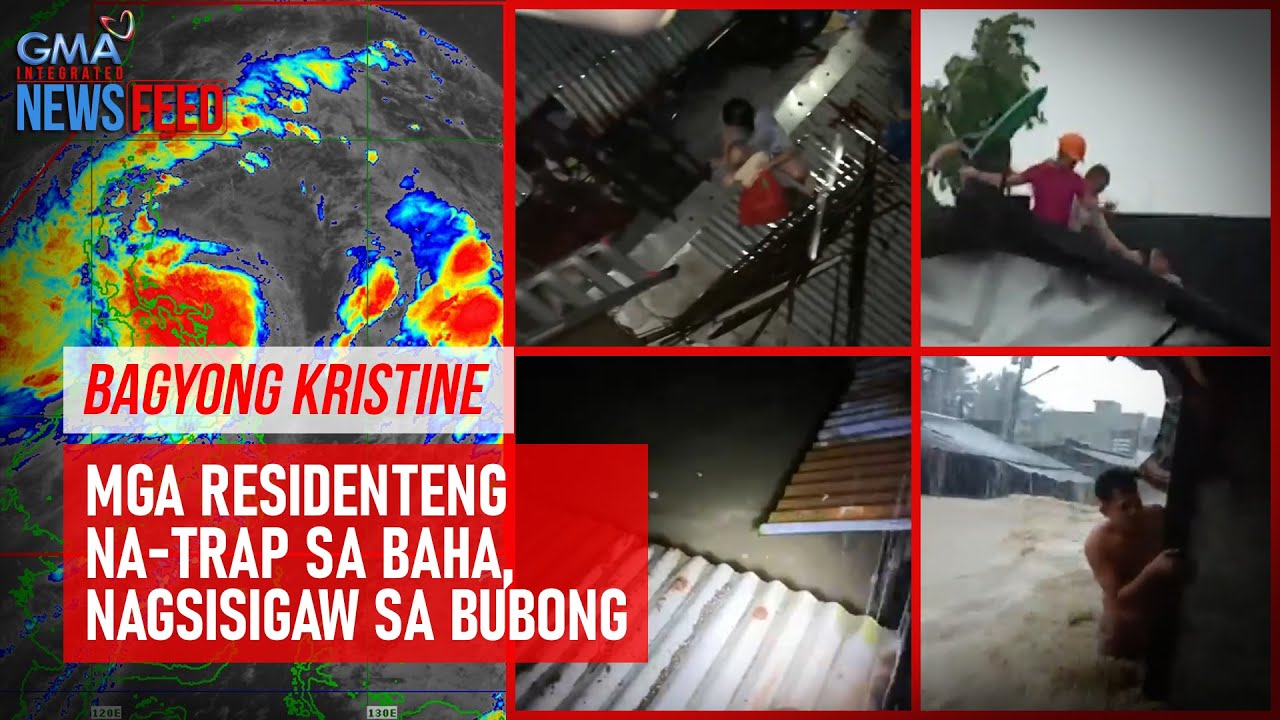

Bagyong Kristine – Mga residenteng na-trap sa baha, nagsisigaw sa bubong | GMA Integrated Newsfeed

Hukum Perbankan 3 - Kredit dan Analisa Kredit - Devi Yustisia, SH., M.Kn FH UNUD

Why are So Many Chinese Banks Disappearing?

What's wrong with Chinese Economy?

China’s Next Financial Crisis: Shadow Banking

Major Banking Crisis in China, Rights Protests Abound, Widespread Resistance

5.0 / 5 (0 votes)