5 steps to : Transaction costs- why do firms exist? by: Ismail Jeilani

Summary

TLDRThis video explores Ronald Coase's theory on why firms exist in terms of reducing transaction costs. The speaker explains that while markets are efficient, firms are necessary to handle the costs associated with finding business partners, negotiating prices, and enforcing contracts. Employment contracts help minimize these costs by offering flexibility in directing employees' work. The video also touches on Oliver Williamson's ideas about bounded rationality and opportunism, discussing how firms solve problems like the holdup issue through strategies like vertical integration.

Takeaways

- 🤔 Ronald Coase, a notable economist, explained why firms exist using transaction cost theory.

- 📊 The market is considered efficient, but firms exist to reduce transaction costs.

- ⏳ Transaction costs include the time spent finding business partners, negotiating prices, and enforcing contracts.

- 🔄 Firms simplify transactions by employing people under flexible employment contracts, reducing the need for constant renegotiations.

- 💡 Firms will only form when their total transaction costs are lower than market transaction costs.

- 📜 Oliver Williamson expanded on Coase’s ideas, introducing concepts like bounded rationality and opportunism.

- 🛠 Asset specificity refers to products that are tailor-made for specific companies, leading to potential risks for suppliers.

- 😨 The holdup problem occurs when suppliers fear that a company like Apple could exploit them by lowering prices after investments are made.

- 🧩 Vertical integration, where companies buy out suppliers, can reduce the holdup problem and transaction costs.

- 🏭 In summary, firms help reduce transaction costs by centralizing decision-making and avoiding the inefficiencies of constant market negotiations.

Q & A

Who is Ronald Coase, and why is he important in the context of firms and transaction costs?

-Ronald Coase was an economist known for his explanation of why firms exist, despite the efficiency of free markets. He argued that firms exist to reduce transaction costs, which are the costs associated with making exchanges in the market.

What are transaction costs, and why do they matter?

-Transaction costs are the costs incurred during the exchange of goods or services between parties. These costs can include finding a business partner, negotiating prices, and enforcing contracts. They matter because they can make transactions in the market more expensive or inefficient.

Why do firms exist if the free market is considered efficient?

-Firms exist to reduce transaction costs. While the market is efficient in theory, the costs of finding partners, negotiating, and enforcing contracts can be high. Firms streamline these processes through employment contracts and hierarchical structures, reducing the need for repeated negotiations.

What are some examples of transaction costs in the market?

-Examples of transaction costs include the time and effort spent finding someone to do business with, negotiating prices, enforcing contracts, and adjusting to economic changes that require renegotiation of contracts.

How do firms reduce transaction costs?

-Firms reduce transaction costs by using employment contracts that specify general terms, allowing them to direct employees without needing to renegotiate contracts for each task. This structure reduces the need for constant negotiation and enforcement.

What is bounded rationality, and how does it affect firms and contracts?

-Bounded rationality refers to the limited ability of people to predict the future or have complete information. This limitation makes contracts inherently incomplete, as they cannot cover every possible future event or scenario, leading to potential exploitation or opportunism.

What is opportunism, and why is it a concern for firms?

-Opportunism is the act of exploiting gaps in contracts for personal gain, even if it harms others. It is a concern for firms because incomplete contracts can leave room for opportunistic behavior, which can lead to inefficiencies or conflicts.

What is asset specificity, and how does it relate to firms like Apple?

-Asset specificity refers to investments that are tailored for a specific purpose or company, such as a supplier producing a custom part for Apple. This creates a risk for the supplier because if Apple decides to lower prices or stop buying, the supplier may be left with costly assets that are difficult to repurpose.

What is the holdup problem, and how does it affect suppliers?

-The holdup problem occurs when one party, like Apple, has significant bargaining power over a supplier that has made specific investments. The supplier fears that Apple could renegotiate for lower prices after the investment, leaving them with high sunk costs and no alternative buyers.

What is vertical integration, and how does it solve the holdup problem?

-Vertical integration occurs when a firm acquires or merges with a supplier to reduce the risk of the holdup problem. By bringing the supplier under its control, the firm can ensure more stability in its supply chain and reduce transaction costs.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Teoria da Firma / Parte 02

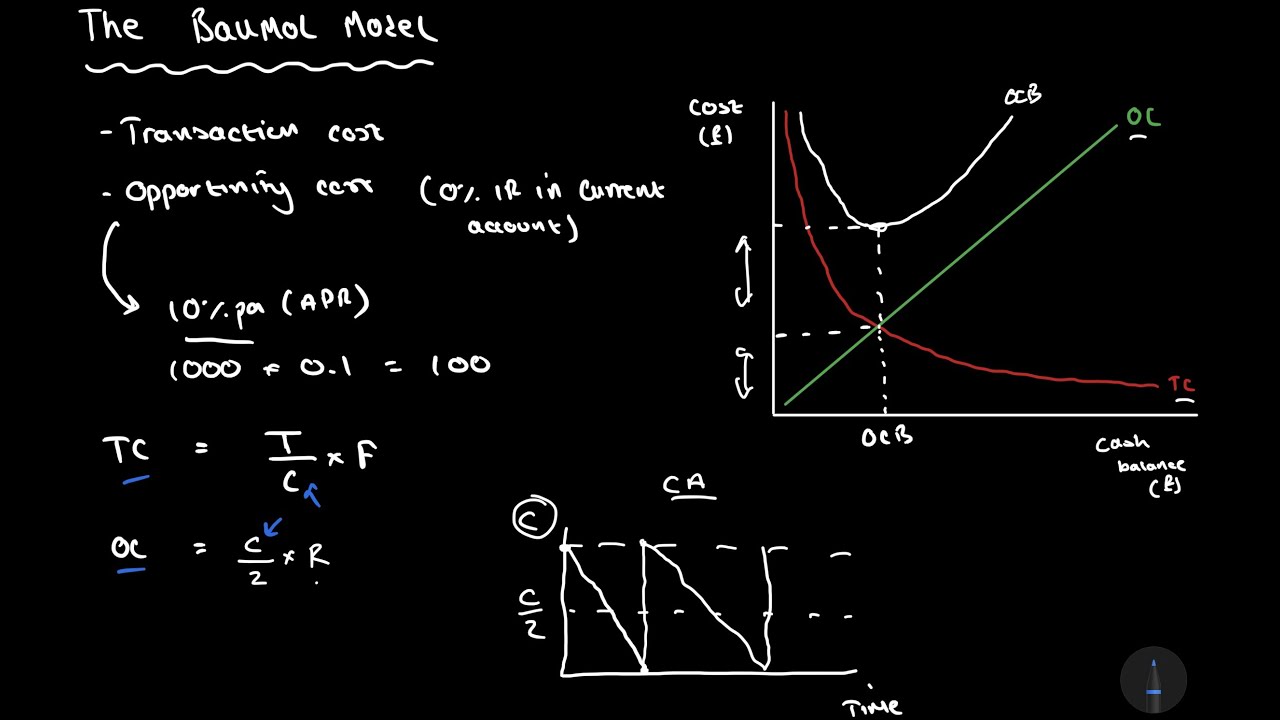

Deriving The Baumol Model of Cash Management | Corporate Finance

Bitcoin Fees and Unconfirmed Transactions - Complete Beginner's Guide

Monopoly vs. Oligopoly vs. Competition: Monopolies and Oligopolies Defined, Explained and Compared

Y2/IB 23) Oligopoly - Kinked Demand

Returns to Scale in Long Run Production I A Level and IB Economics

5.0 / 5 (0 votes)