PPh Pasal 22: Pengertian, Subjek dan Objek, Pemungut, Tarif, Tata Cara Pemungutan, dan Contoh Soal

Summary

TLDRThis video discusses Indonesia's Income Tax Article 22 (PPh Pasal 22), which deals with tax collection in relation to trade activities, imports, and sales of goods. It explains the legal framework, including various ministerial regulations, and covers key aspects like taxable subjects and objects, including specific industries such as mining, luxury goods, and petroleum products. The video also outlines the tax collection mechanisms, the rates applied to different goods and transactions, and includes examples to illustrate the process of calculating and applying the tax. Additionally, exemptions and case studies are explored in detail.

Takeaways

- 📜 PPh Article 22 is a tax collection or withholding system by one party from taxpayers in connection with trade activities of goods.

- 📚 The legal basis includes Law No. 36/2008 on Income Tax and several Minister of Finance Regulations.

- 🌍 PPh Article 22 covers various transactions such as imports, exports, and sales of luxury goods like private yachts and luxury cars.

- 💼 Government entities such as central and local governments, agencies, and state-owned enterprises (BUMN) act as tax collectors for PPh Article 22.

- 🏗️ The tax applies to certain industries, including paper, steel, cement, automotive, and pharmaceutical industries.

- 🚗 Sales of luxury vehicles and fuel products are also subject to PPh Article 22 with specific tax rates for each.

- 💰 The tax is either final (cannot be credited) or non-final (can be credited toward the taxpayer’s total owed tax).

- 📦 Imports, especially of goods like minerals and metals, are also subject to PPh Article 22, with rates varying depending on whether the importer uses an API (Importer's Identification Number).

- 🔍 The tax rates vary: 0.1% for paper, 0.25% for cement, 0.3% for steel, and 0.45% for automotive products.

- 📝 The collection process involves depositing the taxes to state accounts through designated banks, and the amount is calculated based on the value of the transaction or import.

Q & A

What is PPh Article 22?

-PPh Article 22 is a tax collection mechanism where one party collects tax from a taxpayer in relation to trade activities involving goods. It applies to certain transactions like imports and sales of specific products.

What is the legal basis for PPh Article 22?

-The legal basis for PPh Article 22 includes Law No. 36 of 2008 on Income Tax, and various Minister of Finance regulations such as No. 34/PMK.010/207 and No. 92/PMK.03/209.

Who are the subjects of PPh Article 22?

-The subjects of PPh Article 22 include the government (central and regional), institutions, agencies, certain companies like those in the oil and gas industry, and individuals or entities involved in luxury goods sales.

What are the objects of PPh Article 22?

-The objects of PPh Article 22 include import and export activities involving specific goods, sales of luxury items, and transactions involving minerals, fuel, vehicles, and commodities like paper and steel.

What are the exceptions to PPh Article 22 collection?

-Exceptions include the import or delivery of goods exempt from income tax by law, items exempt from import duties, and payments for utilities like fuel, electricity, and water.

What is the difference between final and non-final PPh Article 22?

-Final PPh Article 22 means the collected tax cannot be credited against the total income tax liability at the year-end. Non-final PPh Article 22 allows the collected tax to be credited against the taxpayer's total income tax liability.

Who are the collectors (pemungut) of PPh Article 22?

-Collectors of PPh Article 22 include the Directorate General of Customs and Excise, government treasurers, and state-owned enterprises (BUMN). Private companies involved in certain industries may also act as collectors.

What are the tariff rates for PPh Article 22 on imports?

-For imports, the tariff is 2.5% for imports using a general import license (API), and 7.5% for imports without API or items not under control.

What are the tariff rates for the sale of luxury goods?

-Sales of luxury goods such as yachts or high-end vehicles are subject to a 5% tariff on the sale price, while luxury homes, apartments, and other high-value properties are taxed at 1%.

How is PPh Article 22 collected for imports and exports?

-For imports, PPh Article 22 is collected by the importers through designated perception banks. For exports, exporters pay the tax on commodities like coal or minerals through designated perception banks as well.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Pengenalan PPh Pasal 22, tarif PPh Pasal 22, dan Contoh Soal PPh Pasal 22

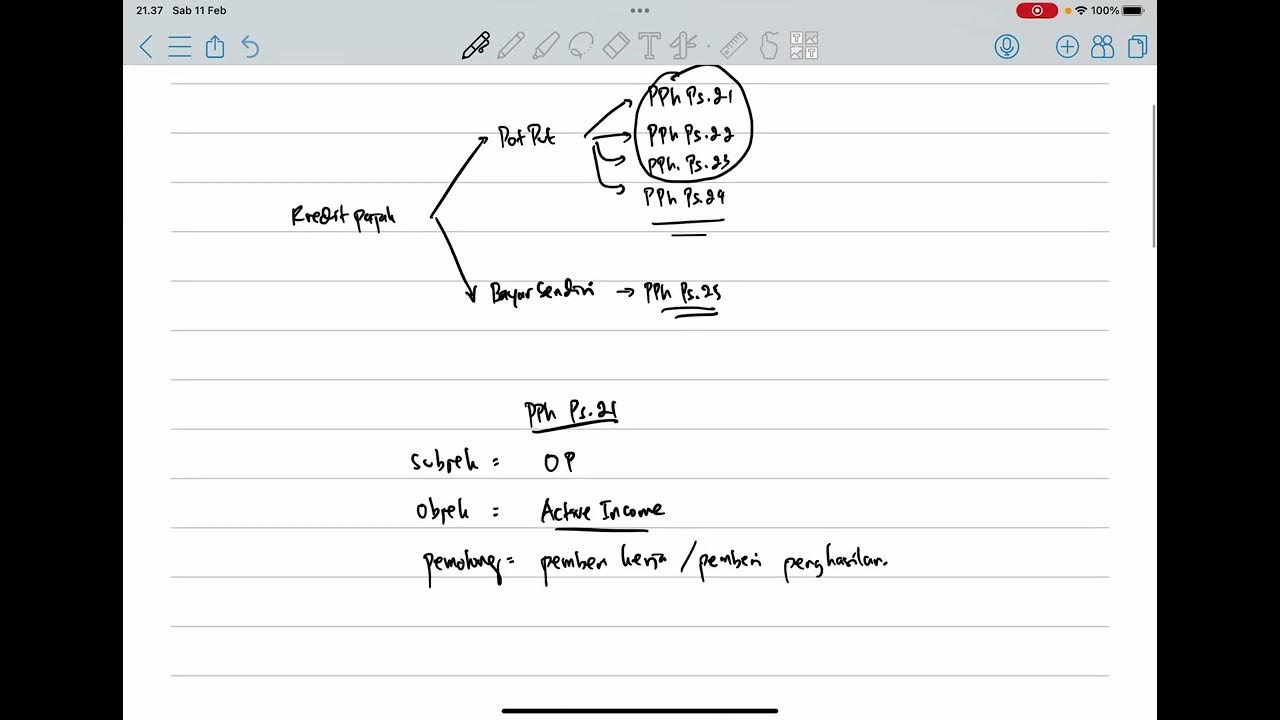

PPh Orang Pribadi (Update 2023) - 5. Kredit Pajak

Perbedaan Pemotongan & Pemungutan Pajak || Withholding Tax #tutorialpajak

Cara Mudah Memahami PPh Pasal 22

PPH PASAL 22 - PART 2

Tips memahami apa saja jenis pajak perusahaan yang harus Anda laporkan

5.0 / 5 (0 votes)