Chapter 7 Part 3: Estimating Demand for a Price-Setting Firm

Summary

TLDRThis video covers Chapter 7, Part 3, focusing on estimating demand for price-setting firms, like restaurants in monopolistically competitive markets. The example of Netflix's price increase is discussed, showing how firms analyze sales impact before changing prices. The video explains how to specify a firm's demand function, collect data, estimate demand, and calculate elasticities. A case study on Checkers Pizza demonstrates interpreting regression results, calculating price, income, and cross-price elasticities, and understanding demand changes based on price shifts. This analysis helps firms predict sales impact when adjusting prices.

Takeaways

- 🍽️ The video discusses estimating demand for a price-setting firm, using a restaurant as an example in a monopolistically competitive market.

- 💰 The firm sets prices and is not in perfect competition. For example, Netflix raised its price by less than 20%, and sales impact analysis is essential before doing so.

- 📊 To estimate demand, the firm needs to define its demand function, gather relevant data, estimate the demand, and calculate price elasticities.

- 🍕 The video uses an example of Checkers Pizza's demand function, where price, income, and prices of substitutes (like Big Mac and Al's Pizza) are variables.

- 📉 A price increase of $1 for Checkers Pizza would decrease sales by 213 units, making it price-sensitive (inelastic).

- 📈 The relationship between income and pizza sales shows that with a $1 income increase, pizza sales rise, indicating a normal good.

- 🔄 Al's Pizza and Checkers Pizza are good substitutes, as an increase in Al's Pizza price leads to higher sales for Checkers.

- 🍔 Big Mac is a weaker substitute; its price increase results in a smaller rise in Checkers' pizza sales.

- 🧮 Calculating demand elasticity reveals that if Checkers increases prices by 10%, sales will fall by 6.94%, indicating inelastic demand.

- 📖 The video emphasizes the importance of understanding demand elasticities and cross-price elasticities to predict how sales will respond to price and income changes.

Q & A

What type of market is the restaurant in, according to the script?

-The restaurant operates in a monopolistically competitive market, where firms are price setters rather than price takers.

How does the script describe Netflix's recent price increase?

-Netflix increased their prices by three dollars, which was less than a 20% increase. This serves as an example of a price-setting firm considering the effect of price changes on demand.

What is the first step in estimating demand for a price-setting firm?

-The first step is to specify the price-setting firm's demand function.

What are the variables used in the demand function for Checkers Pizza?

-The variables include the quantity of pizza sold (Q), the price of the pizza (P), income in the area (M), the price of a substitute (Al’s Pizza), and the price of another weaker substitute (Big Mac).

How does the price of Al’s Pizza affect the sales of Checkers Pizza?

-If the price of Al’s Pizza goes up, sales of Checkers Pizza increase by 101 units, indicating that they are good substitutes.

What does a negative value of B-hat (-213) represent in the demand function?

-A negative B-hat means that for every $1 increase in the price of pizza, the sales decrease by 213 units, showing an inverse relationship between price and quantity sold.

What is the significance of income elasticity in the demand function?

-Income elasticity measures how the quantity demanded changes with income. If income goes up by 1%, sales of pizza increase by 0.871%, indicating that pizza is a normal good.

How can you calculate the price elasticity of demand based on the provided data?

-The price elasticity of demand is calculated as the B-hat (price coefficient) times the price divided by the quantity. In this case, using the values provided, the elasticity is -0.694, indicating inelastic demand.

What does an elasticity of -0.694 mean for a price-setting firm?

-It means that the demand is inelastic. A 1% increase in price will result in a 0.694% decrease in quantity sold, suggesting that raising prices may not significantly reduce sales.

What happens to Checkers Pizza sales if Al’s Pizza increases its price by 10%?

-If Al’s Pizza increases its price by 10%, sales of Checkers Pizza will increase by 3.68%, indicating a strong substitute relationship.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

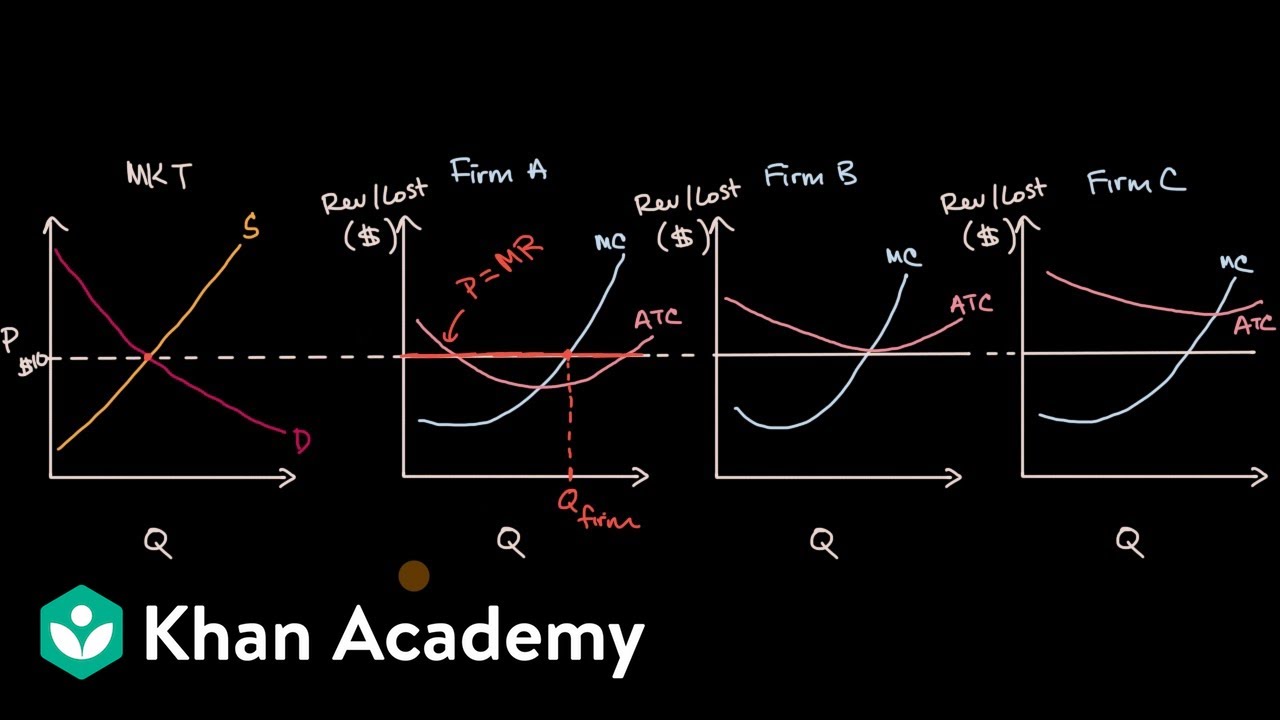

Micro: Unit 4.7 -- Monopolistic Competition

Y2/IB 23) Oligopoly - Kinked Demand

Long run supply curve in constant cost perfectly competitive markets | Microeconomics | Khan Academy

Ekonomi Mikro - Struktur Pasar Lainnya

Economic profit for firms in perfectly competitive markets | Microeconomics | Khan Academy

Pert-9. Permintaan Input Pasar Tenaga Kerja dan Pasar Lahan

5.0 / 5 (0 votes)