1 APA ITU INVESTASI DAN PASAR MODAL ??

Summary

TLDRIn this lecture on Investment Management and Portfolio, Professor Eka Yulianti introduces key concepts, including investment theory, asset types (real and financial), and investment processes like risk and return. The lecture outlines the syllabus, covering topics like portfolio performance evaluation, market efficiency, and investment decision-making. She highlights essential textbooks (Tandelilin and Jogiyanto) and tasks students with creating a mind map summarizing the topics. Professor Yulianti emphasizes understanding through textbooks and not solely relying on handouts. The lecture concludes with a discussion on the differences between primary and secondary markets and practical tips for succeeding in the course.

Takeaways

- 📚 The course being discussed is 'Investment Management and Portfolio', taught by Eka Yulianti for the semester.

- 📖 The main textbooks for this course are by authors Tandelilin and Jogiyanto, with Tandelilin's book being the most frequently used.

- 📝 The course is structured into four learning units (L1 to L4), with specific topics assigned to each unit, covering a total of five main topics.

- 💼 The course will focus on investment theories, including capital markets, Markowitz's theory, portfolio performance evaluations like Sharpe, Treynor, and Jensen models, as well as market equilibrium and efficiency.

- 📊 The core of the course revolves around understanding the relationship between return and risk, with higher returns generally meaning higher risks.

- 💸 Investment can be made in real assets like land, gold, and buildings or in financial assets like stocks, bonds, and options.

- 👥 There are two types of investors: individual (like someone buying stocks personally) and institutional (such as a university investing in corporate stocks).

- 📈 The concept of return includes expected return (what an investor hopes to gain) and actual return (what is actually earned), while risk is the difference between these two.

- 🏦 The capital market plays an intermediation role, connecting surplus parties (those with excess funds) with deficit parties (those needing funds).

- 📝 As part of the coursework, students are required to create a mind map summarizing key concepts such as investments in real and financial assets.

Q & A

What is the main subject of the course?

-The main subject of the course is Investment and Portfolio Management.

Who is the instructor for this course?

-The instructor for this course is Eka Yulianti.

What are the two main textbooks recommended for the course?

-The two main textbooks recommended are 'Tandelilin' and 'Jogiyanto'. The instructor primarily uses 'Tandelilin'.

What are the five key topics covered during the course?

-The five key topics are: 1) Investment Theory and Capital Markets, 2) Markowitz Model and Single Index Model, 3) Portfolio Performance Evaluation, 4) Equilibrium Models and Market Efficiency, and 5) Event Studies.

What is the definition of investment in the context of this course?

-Investment is defined as the commitment of funds or other resources with the goal of earning a return in the future.

What are the two types of assets that investments can be made in?

-Investments can be made in real assets (e.g., land, gold, buildings) and financial assets (e.g., stocks, bonds, options).

Who are the two types of investors discussed?

-The two types of investors discussed are individual investors (e.g., a person buying shares) and institutional investors (e.g., a company investing in shares).

What is the relationship between return and risk in investment decisions?

-The relationship between return and risk is direct and linear: the higher the expected return, the higher the risk that must be considered.

What is the difference between expected return and actual return?

-Expected return is the return anticipated by the investor for the future, while actual return is the return realized from past investments.

What is the purpose of creating a 'mind mapping' as an assignment in this course?

-The purpose of the 'mind mapping' assignment is to create a visual summary of the course material in an organized and creative way, highlighting key concepts such as types of assets and investment processes.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Dr. Jiang Investment: Risk and Return

SESI 14 MANAJEMEN PORTOFOLIO

Sharpe ratio, Treynor Ratio, M Squared and Jensens Alpha - Portfolio Risk and Return : Part Two

Risk Return Trade off Concept | Financial Investment Techniques & Theory | MBA | M.Com | B.Com | BBA

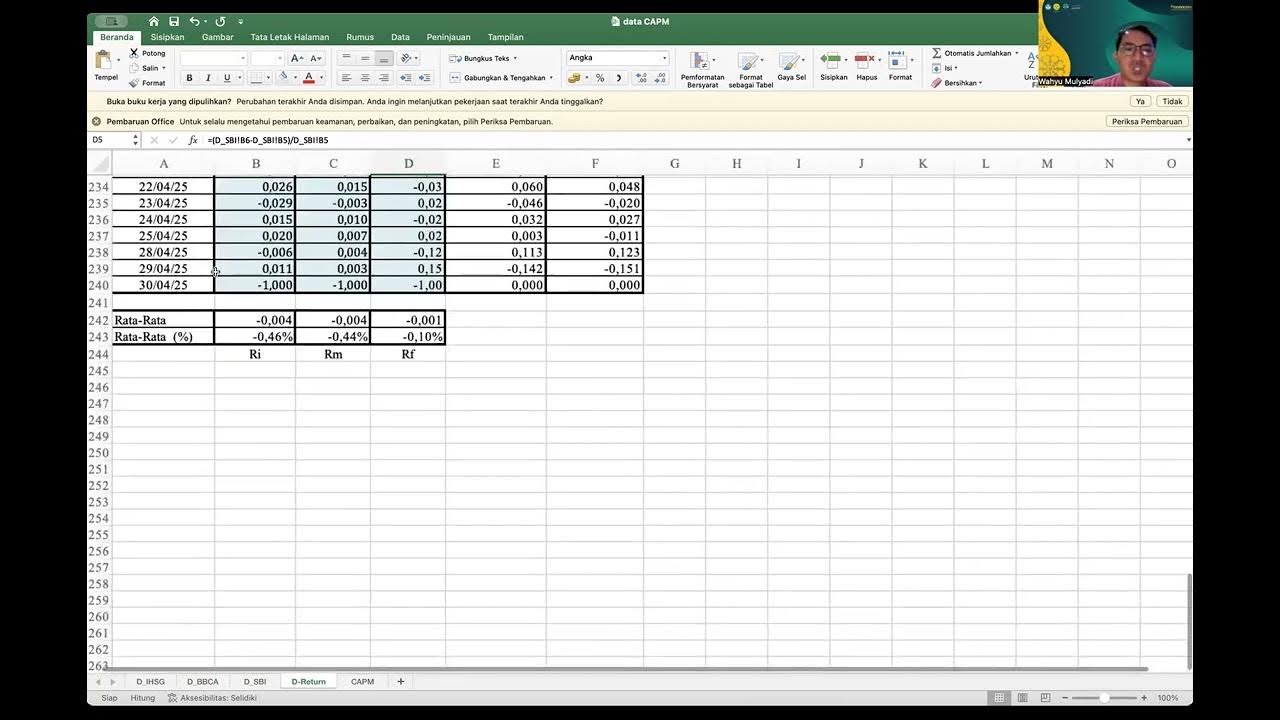

Teori Portofolio dan Analisis Investasi sesi 12 ( Menghitung Capital Aset Pricing Model)

Markowitz Model and Modern Portfolio Theory - Explained

5.0 / 5 (0 votes)