Bloomberg Daybreak: Europe 04/16/2024

Summary

TLDRThis Bloomberg Daybreak Europe transcript outlines a busy day in global markets, emphasizing significant movements in currencies, stock indices, and geopolitical tensions. Key topics include a strong U.S. dollar impacting Asian markets, Federal Reserve's stance on interest rates, China's mixed economic data, and ongoing geopolitical concerns involving Israel, Iran, and Ukraine. The script also covers corporate earnings, particularly from Ericsson, and previews upcoming financial disclosures from major banks. The narrative highlights the complex interplay between economic indicators, market responses, and international politics, shaping the day's financial landscape.

Takeaways

- 📈 The surging dollar is affecting global markets, causing stocks in Asia and Europe to drop significantly.

- 🌏 Geopolitical tensions are high with Israel planning to respond to an Iranian missile and drone attack, impacting global market sentiments.

- 💹 Chinese GDP growth exceeded expectations for the first quarter, though retail sales and industrial output in March were disappointing.

- 📉 U.S. futures, including the S&P and NASDAQ, indicate further losses, reflecting global market uncertainty.

- 📊 The U.S. dollar's strength is pressuring other currencies, and Brent oil prices remain around $90 a barrel due to geopolitical risks.

- 🔍 Fintech regains its position as the UK's most funded startup sector, attracting significant investment.

- 🏦 Goldman Sachs reports a surprise profit jump, influencing the banking sector's performance expectations.

- 🌍 Severe drought in southern Africa prompts Zimbabwe to consider importing corn from Brazil, highlighting the impact of climate change on food security.

- 📚 The Bank of Japan is in focus due to potential policy changes amid market pressures from a stronger dollar and weaker yen.

- 🌐 German Chancellor Olaf Scholz discusses trade, Ukraine, and green energy in a meeting with Chinese President Xi Jinping amid growing tensions.

Q & A

What was the impact of a strong dollar on Asian currencies as mentioned in the script?

-The script highlights that a surging dollar significantly affected Asian currencies, leading to a decrease in their value against the dollar.

How did the US stock markets perform as indicated in the transcript?

-According to the transcript, the US stock markets experienced a decline, with the S&P 500 dropping by about 1.2%, indicating a rough session for stocks.

What were the geopolitical tensions mentioned in the transcript related to Israel and Iran?

-The transcript mentions that Israeli military officials declared the necessity to respond to an Iranian missile and drone attack, highlighting ongoing geopolitical tensions between Israel and Iran.

What does the Federal Reserve's stance on interest rates appear to be, based on the comments from Mary Daly?

-Mary Daly from the Fed suggested that there is no rush to start cutting rates, indicating that the Federal Reserve is likely to maintain current interest rate levels for some time.

What economic indicators from China were discussed, and what did they imply about China's economic condition?

-The script discusses China's first quarter GDP growth, which beat expectations, but also mentions disappointing retail sales and industrial output for March. This suggests that while the economy initially showed robust growth, there may be signs of an emerging slowdown.

How did the geopolitical risks affect the price of Brent crude oil as mentioned?

-Geopolitical risks, particularly involving Israel's potential response to Iran, contributed to an increase in Brent crude oil prices, which were noted to be at $90 a barrel and ticking up.

What key financial data from the UK was anticipated, and why was it significant?

-The transcript mentioned the release of wage data and Consumer Price Index (CPI) data from the UK. This information is significant as it helps gauge inflationary pressures and could influence the Bank of England's monetary policy decisions.

What trends in Ericsson's financial performance were revealed in the earnings report?

-Ericsson's financial performance indicated a significant beat in terms of first quarter adjusted earnings before interest and tax, nearly doubling the estimates. This suggests strong operational performance and possibly better-than-expected market conditions for the telecom equipment maker.

What were the market expectations for the interest rates from the major central banks?

-Market expectations included anticipations of two cuts of 25 basis points each by the Bank of England, contrasting with fewer expected rate cuts by the Federal Reserve and three by the European Central Bank.

How is the financial crisis in Southern Africa being addressed, specifically concerning food security?

-The financial crisis in Southern Africa, exacerbated by severe droughts, is being addressed by importing corn from Brazil to combat food shortages, particularly in Zimbabwe, which is considering imports for the first time since 2014.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Bloomberg Daybreak: Europe 04/08/2024

Bloomberg Daybreak: Europe 03/18/2024

TikTok Fallout, BofA's Hartnett Says AI Frenzy Gone Too Far | The Pulse with Francine Lacqua 03/14

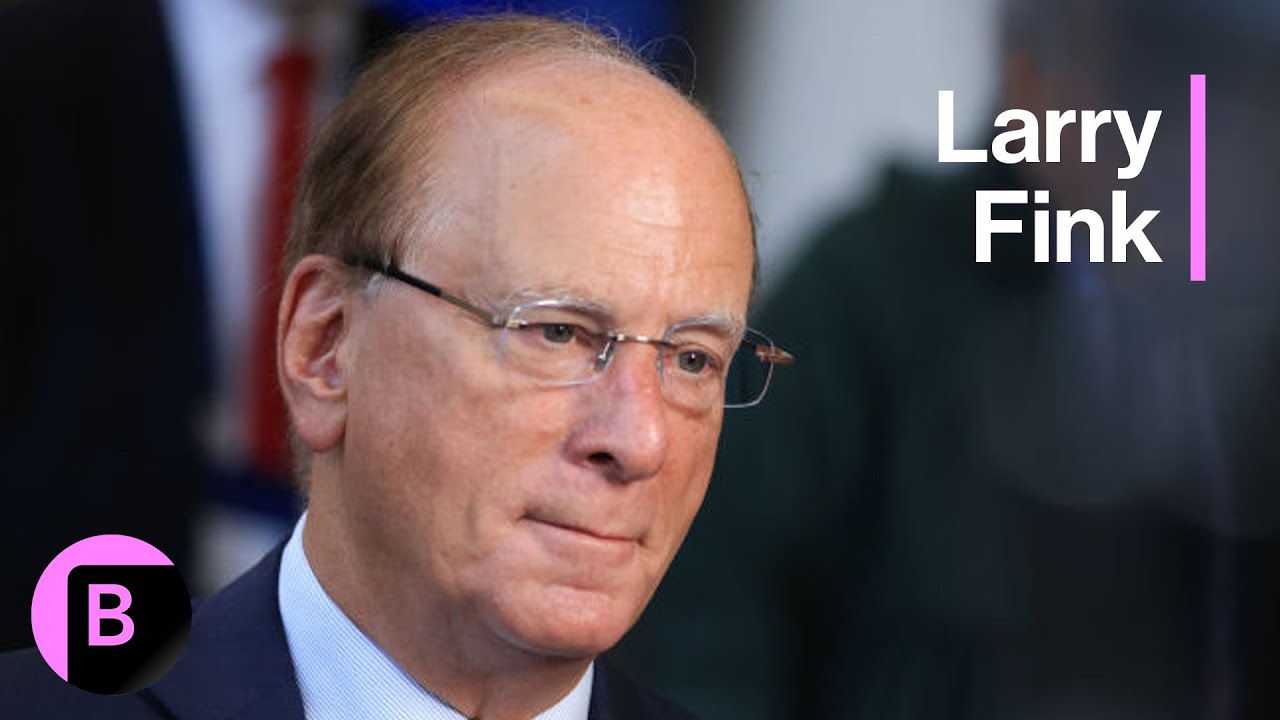

BlackRock CEO Larry Fink on US Economy, Trump Vs. Harris, Geopolitical Risks (Full Interview)

Bloomberg Daybreak: Europe 04/02/2024

Bloomberg Daybreak: Europe 04/03/3034

5.0 / 5 (0 votes)