Assertions, Evidence, & Audit Procedures

Summary

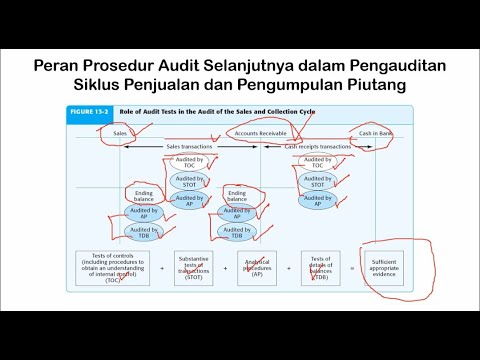

TLDRThe script discusses auditing procedures, focusing on linking assertions to evidence and audit processes. It explains the importance of testing asset existence and occurrence of transactions, using examples like inspecting inventory and confirming accounts receivable. The script highlights why auditors trace sales journal entries to shipping documents to prevent overstatement of sales, rather than starting with shipping documents to check for understatement. It also touches on rights and obligations, emphasizing third-party confirmations as evidence and the need for clear presentation and disclosure in financial statements.

Takeaways

- 🔍 Audit assertions are tied to evidence and audit procedures to verify the accuracy of financial statements.

- 🏢 Existence assertion ensures that recorded assets truly exist, like physical inventory or confirmed accounts receivable.

- 📦 Occurrence assertion checks if recorded transactions actually took place, such as sales transactions backed by shipping documents.

- 🔄 The auditor's concern is with overstatement, hence the procedure starts with the sales journal to trace back to shipping documents, not the other way around.

- 📄 Completeness is about ensuring all transactions that should be recorded are indeed recorded, which is why auditors trace from shipping documents to sales journal.

- 🤝 Rights and obligations assertion verifies that the entity owns the assets and has identified legal responsibilities.

- 📑 Third-party confirmations are crucial for verifying ownership and existence of assets and liabilities.

- 📊 Presentation and disclosure assertion ensures that financial statements are understandable to users, including the format and related disclosures.

- 📋 Audit evidence includes management-prepared financial statements, which auditors review for accuracy and compliance with presentation standards.

- 🔎 Inquiry is a part of gathering audit evidence to understand the context and details of financial statement presentations and disclosures.

Q & A

What is the main focus of the transcript?

-The transcript focuses on explaining the relationship between audit assertions, evidence, and procedures, particularly in the context of financial statements.

What does the term 'existence' refer to in audit assertions?

-In audit assertions, 'existence' refers to the confirmation that the recorded assets truly exist, such as physical inventory or tangible property, plant, and equipment.

How does an auditor confirm the existence of accounts receivable?

-An auditor confirms the existence of accounts receivable by obtaining evidence such as confirmation from customers or analyzing aging reports.

What is the auditor's concern when testing the occurrence of sales transactions?

-The auditor's concern is to ensure that all recorded sales transactions have actually occurred and are not overstated.

Why does the auditor trace sales from the sales journal back to shipping documents?

-The auditor traces sales from the sales journal back to shipping documents to ensure that every recorded sale in the journal is supported by a corresponding shipping document, thus confirming the occurrence of the sale.

Why is it not appropriate to start with shipping documents to test for overstatement?

-Starting with shipping documents to test for overstatement is not appropriate because it would only confirm completeness, not overstatement. The auditor is more concerned with ensuring that all recorded sales are valid and not fictitious.

What is the significance of third-party audit evidence?

-Third-party audit evidence, such as confirmations from banks or legal counsel, is significant because it provides an independent verification of the existence of assets or liabilities.

What is the auditor's approach to testing the completeness of sales transactions?

-The auditor's approach to testing the completeness of sales transactions involves starting with shipping documents and ensuring they are properly reflected in the sales journal, indicating that all sales have been recorded.

What is the auditor's concern regarding the presentation and disclosure of financial statements?

-The auditor's concern is to ensure that the presentation and disclosure of financial statements are understandable to users and accurately reflect the amounts recorded in the financial statements.

How does the auditor verify the assertion of rights and obligations?

-The auditor verifies the assertion of rights and obligations by obtaining evidence such as legal documents, contracts, or third-party confirmations that confirm the entity's ownership of assets and identification of legal responsibilities.

What is the role of management in the preparation of financial statements?

-Management is responsible for preparing the financial statements, and auditors review these statements, including the presentation, format, and related disclosures, to ensure they meet the standards for understandability and accuracy.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)