Mark The Calander, Dan Ives Says This Dirt-Cheap Stock Will Surpass Nvidia In 1 Year Max. Get In Now

Summary

TLDRTesla is poised for significant growth as it expands into AI, with its highly anticipated Robo taxi service set to disrupt the ride-hailing industry. Analysts predict Tesla's AI push, including its FSD program and cortex supercomputer, could unlock a multi-trillion-dollar opportunity. Despite stock underperformance in 2024, positive Q2 results and advancements in AI position Tesla for a strong finish, with the potential for a short squeeze and increased demand as interest rates drop.

Takeaways

- 🚗 Tesla's conversations are shifting from traditional metrics like deliveries and price cuts to AI advancements and the potential of FSD (Full Self-Driving).

- 🌟 FSD is considered a significant use case for AI and could be the biggest form of AI penetration for Tesla's install base, which is expected to grow to 10 million vehicles.

- 🚖 Tesla is anticipated to unveil its 'hyper cab', a revolutionary autonomous ride-sharing vehicle, which could be a game-changer for the company.

- 🚀 The Robo taxi service is expected to disrupt the ride-hailing industry by offering a more affordable and efficient alternative without the need for human drivers.

- 💹 Analysts predict that Tesla's Robo taxi service could represent an $8 to 10 trillion global revenue opportunity if it captures a significant market share.

- 💻 Tesla's investment in AI is aggressive, with plans to spend $10 billion on AI-related expenditures in 2024 alone, highlighting its commitment to leading the AI revolution.

- 🔋 Tesla's supercomputer cluster, Cortex, is powered by Nvidia's advanced chips, which will be crucial for training neural networks for autonomous driving.

- 📈 Despite challenges, Tesla's core EV business remains strong, with the company reclaiming its position as the global EV market leader in 2024.

- 📊 Tesla's financials are stabilizing, with improved operating margins and a record $30 billion in cash reserves, providing a strong foundation for future investments.

- 📉 Tesla's stock performance has been underwhelming in 2024, partly due to valuation adjustments, declining operating margins, and leadership changes, but there are signs of stabilization and potential for improvement.

- 📈 Interest rate cuts could boost Tesla's stock performance, as lower rates make it easier for consumers to finance electric vehicles, and Tesla is one of the most shorted stocks, creating potential for a short squeeze.

Q & A

What is the current focus of discussions about Tesla?

-The discussions about Tesla have shifted from traditional topics like deliveries, unit sales, and price cuts in China to the company's advancements in AI, particularly its Full Self-Driving (FSD) technology and the upcoming Robo taxi service.

What is the projected timeline for Tesla's vehicle fleet size?

-Tesla currently has around 6 million vehicles on the road and is expected to grow to 8 million next year, with a potential to reach up to 10 million vehicles in the future.

What is the significance of Tesla's Robo taxi service?

-The Robo taxi service is anticipated to be a disruptive innovation in the ride-hailing industry by eliminating the need for human drivers, which could significantly reduce operating costs and make Tesla a dominant player in the autonomous ride-sharing market.

How does Tesla's AI push align with its financial performance?

-Tesla's aggressive investment in AI and its focus on FSD and Robo taxis are seen as long-term strategies that could transform the company into a leader in autonomous technology, potentially unlocking multi-trillion-dollar opportunities and boosting its stock price.

What is the role of Tesla's supercomputer cluster Cortex in its AI strategy?

-The Cortex supercomputer cluster, powered by Nvidia's H100 and H200 chips, is crucial for Tesla's full self-driving program as it can handle the vast amounts of data needed to train neural networks for autonomous driving.

What is the potential global revenue opportunity for Tesla's Robo taxi service according to Kathy Wood?

-Kathy Wood predicts that Tesla's Robo taxi service represents an $8 to 10 trillion global revenue opportunity, suggesting that if Tesla captures just 50% of the global autonomous ride-sharing market, it could become a massive revenue driver.

How has Tesla's EV business performed in 2024?

-In 2024, Tesla reclaimed its position as the leader in the global EV market after briefly losing it to BYD in 2023. In Q2 2024, Tesla delivered 443,000 EVs, driven by strong demand in markets like China.

What financial milestone did Tesla achieve in Q2 2024?

-Tesla surpassed $30 billion in cash reserves for the first time in Q2 2024, which allows the company to weather economic uncertainties and invest heavily in its AI and energy businesses.

What are the reasons behind Tesla's stock underperformance in 2024?

-Tesla's stock underperformance in 2024 is attributed to factors such as valuation adjustments, declining operating margins due to increased competition and aggressive pricing strategies, and leadership changes that have rattled some investors.

What is the potential impact of interest rate cuts on Tesla's stock performance?

-Interest rate cuts could reignite Tesla's stock performance as they make it easier for consumers to finance big-ticket items like electric vehicles, increasing demand and potentially leading to a short squeeze due to Tesla being one of the most shorted stocks on Wall Street.

How does the upcoming Robo taxi event fit into Tesla's broader strategy?

-The upcoming Robo taxi event is seen as the beginning of Tesla's broader strategy to transition into an AI company, which could create new high-margin revenue streams and accelerate Tesla's earnings growth, significantly boosting its stock price.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Elon Musk unveils Cybercab at Tesla robotaxi event | BBC News

Launch Event For NEW Tesla LEAKED | Here's What's Coming

Tasha: "This Tesla FSD Development Will DESTROY the Industry"

Peluang dan Ancaman Taksi Vietnam Xanh SM di Indonesia

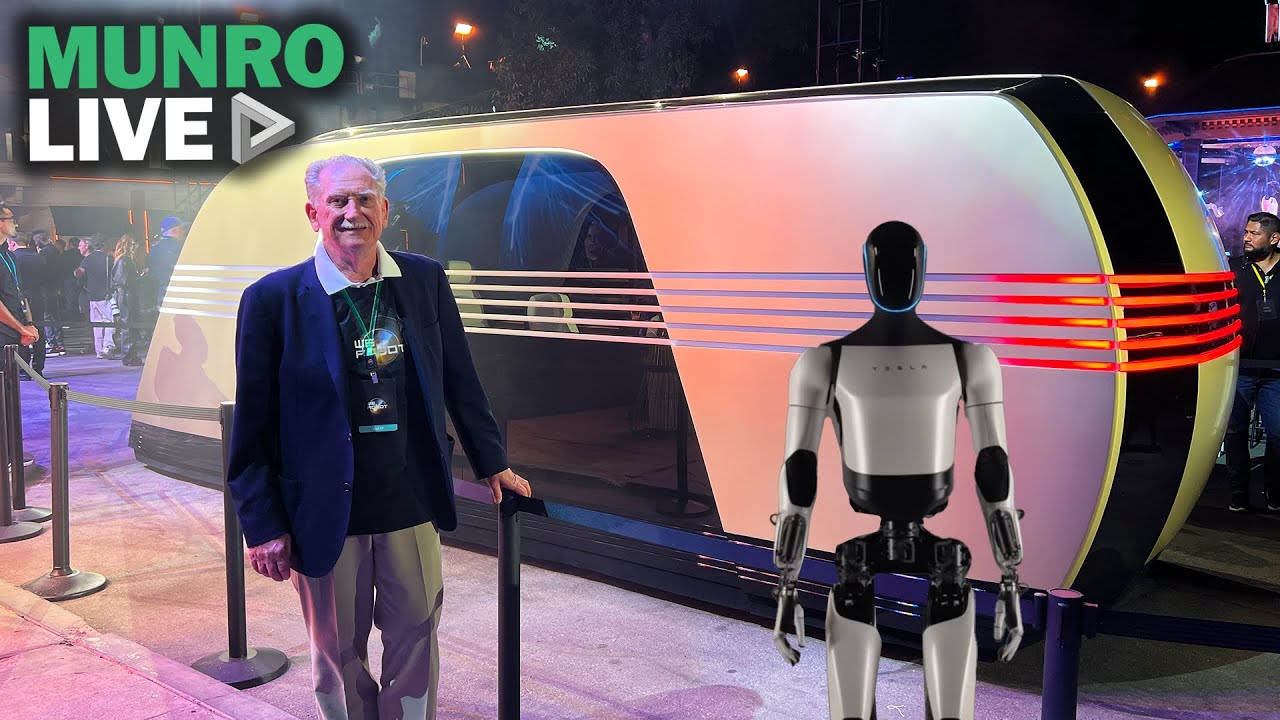

Tesla’s Vision for an Autonomous Future - We Robot Event Recap

NEW Tesla Quietly Released | You Can Buy It Now

5.0 / 5 (0 votes)