🌟4/12(金)米株NEWS🌟市場は買いたくて仕方なかった?APPLEとNVIDIAが+4%超え!ナスダック最高値!

Summary

TLDRThis video script covers a comprehensive review of U.S. stock and global economic news, highlighting key developments that could be beneficial for new strategies. It discusses the stock market's shift from a CPI-induced downturn to an upswing, with notable gains by companies like NVIDIA, Apple, and Amazon reaching record highs. The script also touches on economic indicators such as PPI, which show an 11-month high increase, and the mixed reactions in the market following the data release. It further delves into topics like Bitcoin's price surge, driven by the upcoming halving event and ETFs, and the potential peak in 2024 or 2025. The video also covers company-specific news, including Apple's AI advancements and Amazon's operational improvements and financial performance. Lastly, it mentions the European Central Bank's interest rate decision contrasting with the U.S. Federal Reserve's approach and the impact on currency exchange rates.

Takeaways

- 📈 U.S. stock market experienced a significant rise after a dip due to CPI (Consumer Price Index) figures, with NASDAQ reaching a new high.

- 🚀 Tech giants like NVIDIA, Apple, and Amazon saw substantial stock price increases, contributing to the overall market upswing.

- 📊 Despite initial declines, PPI (Producer Price Index) numbers indicated a worrying upward trend, suggesting inflationary pressures are still present.

- 💹 Interest rates fluctuated, with a temporary dip following PPI news, but eventually rising again, indicating ongoing market volatility.

- 🌐 IMF (International Monetary Fund) expressed concerns about the high-interest rates in the U.S., suggesting they could have negative impacts on other countries' economies.

- 🤖 There is growing anticipation for AI enhancements in technology, particularly for Apple's upcoming products, potentially driving market interest.

- 💼 Amazon continues to impress with its operational efficiency and financial performance, including improvements in operating margins and strong growth in its AWS cloud business.

- 🏦 Banking and financial sectors are facing scrutiny with reports of loan defaults and credit card delinquencies, hinting at potential risks in the economy.

- 🏠 The real estate market is showing signs of strain with increased foreclosures and difficulties in refinancing due to high-interest rates.

- 🔑 Bitcoin and other cryptocurrencies are mentioned, with Bitcoin's price remaining strong despite some fluctuations, and discussions about its potential to reach $250,000.

- 📊 Overall market sentiment is a mix of fear and greed, with the 'Fear & Greed Index' showing an increase from the previous day, suggesting market optimism.

Q & A

What was the significant change in the stock market after the CPI release?

-The stock market experienced a dramatic shift from a 'hell' scenario to a 'paradise' as the stock prices rose, with NASDAQ reaching a new all-time high.

Which companies performed well in terms of stock price increase?

-NVIDIA saw a 4.1% increase, Apple rose by 4.33%, and Amazon also reached a new all-time high, indicating strong performances.

What was the context behind the PPI announcement and its impact on the market?

-The PPI, a leading indicator of inflation, showed a significant increase after 11 months, which generally had a negative sentiment; however, the market seemed to react positively despite this, with stocks like DraftKings, NVIDIA, Alphabet, and others turning positive.

How did the market react to the discrepancy in gas prices reported in the PPI announcement?

-There was an issue with the reported gas prices in the PPI announcement, where the labor statistics bureau seasonally adjusted a 6.3% increase to a -3.6% decrease, causing some concern about the reliability of the data.

What was the situation with the 10-year interest rates and how did it affect the market?

-The 10-year interest rates were volatile, with a temporary push towards 4.6%, indicating a strong market reaction to the rates, despite concerns that high rates could negatively impact stock prices.

What was the IMF's stance on the sustained high interest rates in the US?

-The IMF expressed concern about the sustained high interest rates in the US, suggesting that other countries might not be able to benefit from America's rising interest rates due to the increased investment in the US and capital inflow.

What was the news about Bitcoin and its potential price prediction?

-Bitcoin experienced a slight decrease but remained above $70,000. There's speculation that Bitcoin could reach $250,000 by the end of the year, influenced by factors such as the upcoming halving event and increased demand as a digital gold.

What are the expectations for Apple's stock and its AI-related developments?

-Apple's stock rose significantly, with expectations of AI enhancements driving investment. JP Morgan has upgraded its investment rating, anticipating new AI features in upcoming iPhone models, which could drive sales as these features are not available in current models.

What updates were mentioned about Amazon's business and its financial performance?

-Amazon continues to set new highs in its stock price. CEO Andy Jassy reported improvements in the company's operational efficiency, particularly in reducing the time from order to shipment in metropolitan areas. Additionally, Amazon's AWS cloud business saw a 13% increase, contributing to the company's strong financial performance.

What was the European Central Bank's stance on interest rates compared to the US?

-In contrast to the US Federal Reserve's actions, the European Central Bank announced a 4% interest rate hike and indicated a willingness to lower rates in the future, showing a divergent monetary policy approach.

What challenges are being faced by the real estate market due to high interest rates?

-High interest rates have made refinancing difficult for property owners, leading to a significant increase in commercial real estate foreclosures in California and a potential shock to the real estate market.

How did the market sentiment and indices perform on the day of the script?

-Despite the challenges, the market sentiment index rose to 59, indicating a mix of fear and greed. The strong wind index decreased, and the interest rates saw a slight increase. The stock market, particularly the NASDAQ and S&P 500, showed gains, while the Dow was negative.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

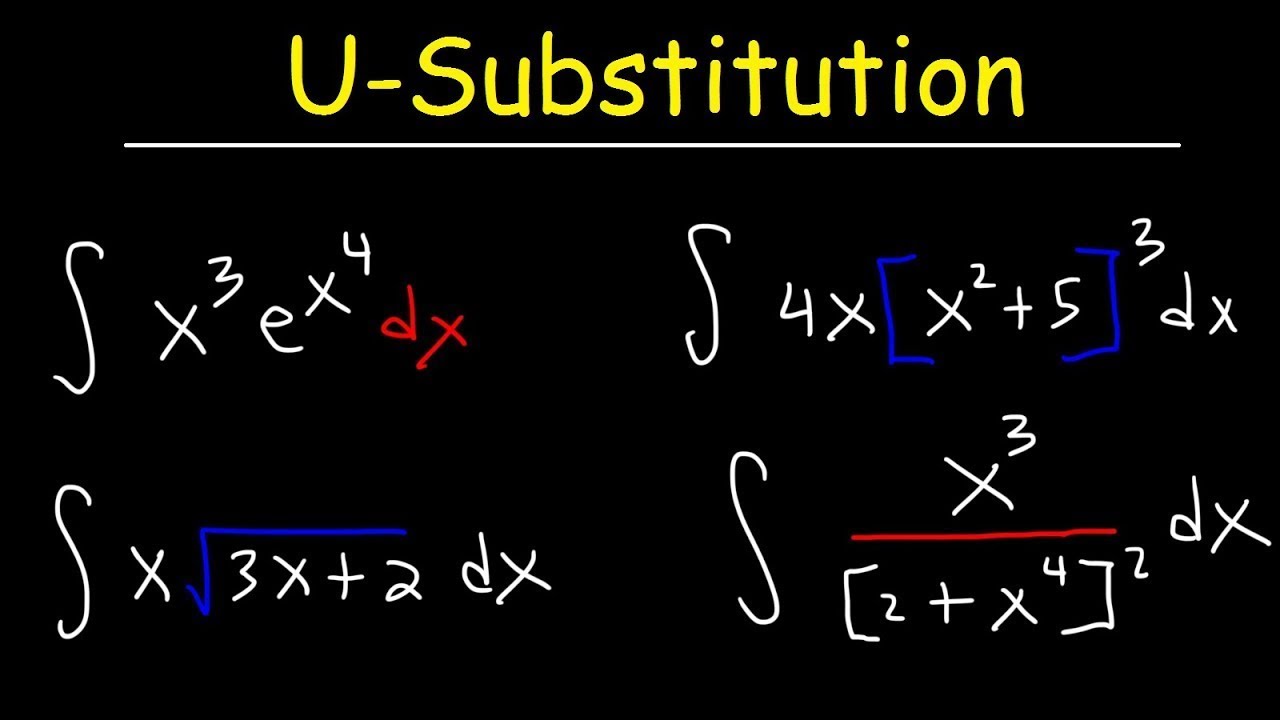

How To Integrate Using U-Substitution

How would you go about solving this? Limit of x/sqrt(x^2+1) as x goes to infinity. Reddit inf/inf

Top 3 Best Creatine Monohydrate Under 300 | Best Creatine for Muscle Gain?

How to Diagnose and Replace Universal Joints (ULTIMATE Guide)

LearningTools: Reading Syringes

Complements of Sets

ISTQB FOUNDATION 4.0 | Tutorial 25 | Early Feedback | Review Process | Roles & Responsibility | CTFL

5.0 / 5 (0 votes)